python中建模分析零息票收益率曲線--複利和連續複利

阿新 • • 發佈:2018-11-08

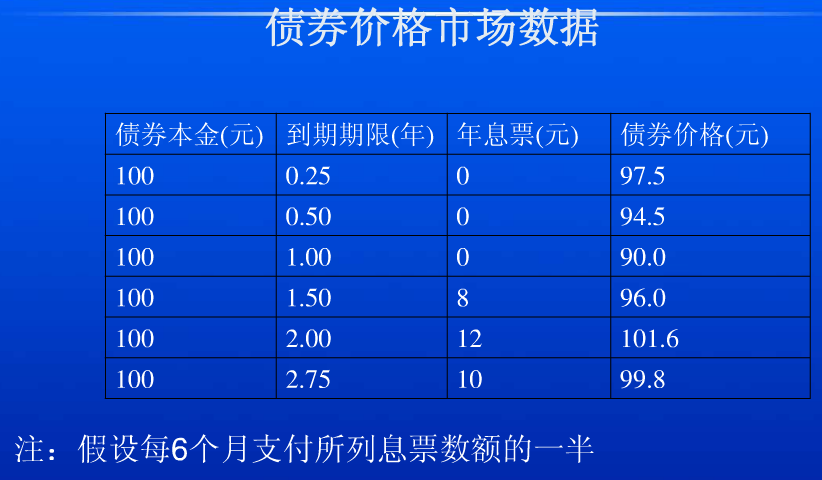

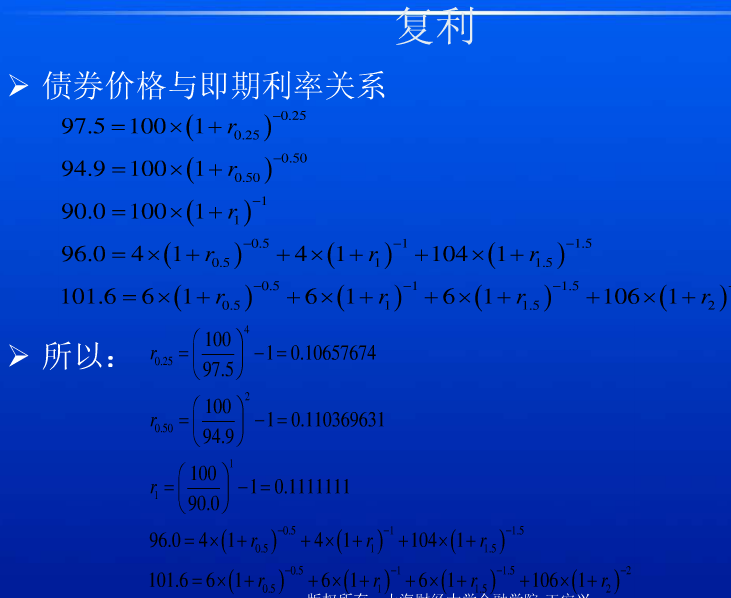

收益率曲線(Yield Curve)是顯示一組貨幣和信貸風險均相同,但期限不同的債券或其他金融工具收益率的圖表。縱軸代表收益率,橫軸則是距離到期的時間。在此用python建模分析零息票收益率曲線,輸出圖表並製圖。

首先要理解收益率的計算方法,然後計算出連續複利和複利。再根據計算步驟在python中編寫程式碼建模

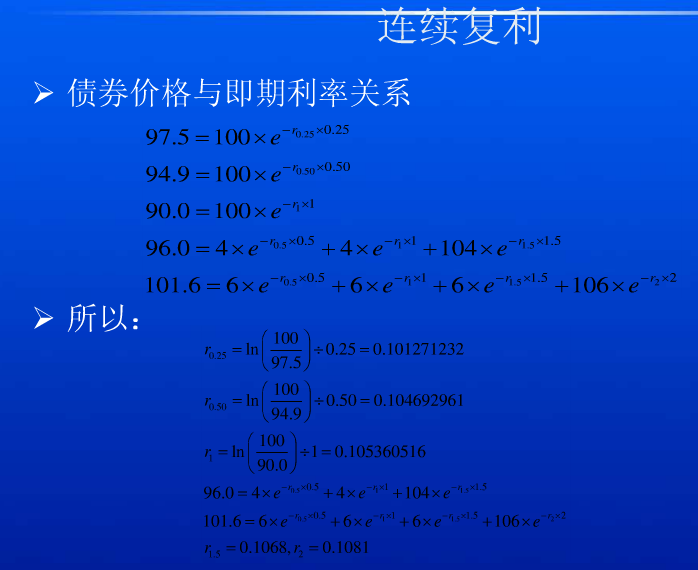

此為連續複利的計算

1 # 沒有年息票的一年期以內的零息票年收益率YTM=(log(面值/價格))/期限 2 r1 = np.log(100/97.5)/0.25 3r2 = np.log(100/94.9)/0.5 4 r3 = np.log(100/90)/1 5 print('第0.25年年息票收益率:',round(r1,5)) 6 print('第0.5年年息票收益率:',round(r2,5)) 7 print('第1年年息票收益率:',round(r3,5))

1 #每半年付息一次的有年息票的零息票年收益率YTM:零息票年收益率=[log((年息票/2+面值)/(債券價格-年息票/2*(前期價格/面值)))]/期限 2 #價格=(年息票/2)*e^(-r2*0.5)+(年息票/2)*e^(-r3*1)+(年息票/2+面值)*e^(-r4*1.5) 3 # r4=[log(104/(94-(94.9+90)/100)]/1.54 #超過一年期的零息票年收益率YTM=(面值/價格)開期限n的次方根減1 5 rate2 = math.pow(100 / 84.99, float(1) / float(3))-1 6 print(rate2) 7 # 96=4*(1+0.5*r2)^-1+4*(1+r3)^-1+104*(1+r4)^-1.5 8 r4 = np.log(104/88.604)/1.5 9 print('第1.5年年息票收益率:',round(r4,5)) 10 11 r5 = np.log(106/(101.6-(1.849*6+88.604/104*6)))/2#np.log(106/85.394)/2 12 print('第2年年息票收益率:',round(r5,5))

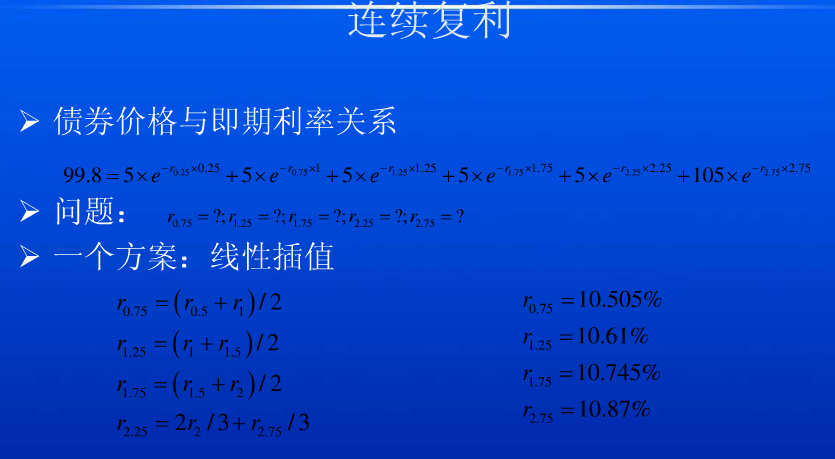

1 #線性插值 2 #第0.75年年息票收益率: 3 r6 = (r2+r3)/2 4 print('第0.75年年息票收益率:',round(r6,5)) 5 #第1.25年年息票收益率: 6 r7 = (r3+r4)/2 7 print('第1.25年年息票收益率:',round(r7,5)) 8 #第1.75年年息票收益率: 9 r8 = (r4+r5)/2 10 print('第1.75年年息票收益率:',round(r8,5)) 11 #第2.25年年息票收益率: 12 # r9 = 2(r5)/3 +(r'第2.75年年息票收益率')/3 13 # print('第2.25年年息票收益率:',round(r9,5))

1.我們需要在python中載入相應的模組來進行開發調式

1 import pandas as pd 2 import numpy as np 3 import matplotlib.pyplot as plt 4 import math 5 import os 6 import operator 7 import sys#實現從程式外部向程式傳遞引數。 8 import xlrd

2.確定輸入及輸出的檔案路徑,讀取檔案

1 InputPath=sys.argv[1]#輸入路徑 2 OutputPath=sys.argv[2]#輸出路徑 3 filePath = InputPath#處理的檔案為在輸入路徑中讀取的檔案

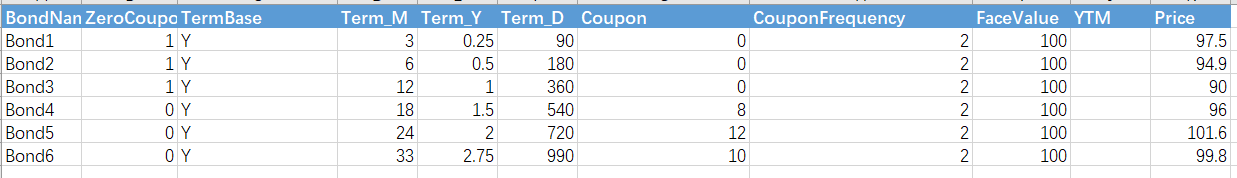

3.明確表中的欄位,定義兩個空字典輸出計算的數值

上表為輸入表,根據表中的欄位來計算收益率,Period為付息頻率,我們需要取CouponFrequency中的最大值來進行計算

1 df = pd.read_excel(filePath) 2 bondsCount = df.shape[0] 3 4 dicE4Calc = {}#定義一個空的價格比計算表。價格/面值 5 dicResult = {}#定義一個空的結果表 6 7 Period = 1 / df['CouponFrequency'].max()#步長為0.5

4.定義一個價格合計,根據這個合計來進行迭代計算

1 def getPreSum(pCoupon, targetTerm, startTerm):#前期價格合計 2 sum = 0 3 p = startTerm 4 while (p < targetTerm):#要小於目標的期限 5 sum += dicE4Calc[str(p)] * pCoupon 6 p += Period#期限以0.5遞增 7 8 return sum#返回的是新計算出來的價格

5.定義線性插值法計算,利用前後兩期資料可以求出中間的值

1 def LinearInterpolation(pCoupon, targetTerm, interval):#線性插值法利用中位數求利率 2 sum = 0 3 p = interval 4 while p < targetTerm: 5 if str(p) not in dicResult:#結果表中沒有的資料,left為前面一期,right為後面一期 6 r_Left = str(p - interval) 7 r_Right = str(p + interval) 8 9 if r_Left in dicResult and r_Right in dicResult:#結果表中有前後的資料就用插值法計算 10 r = (dicResult[r_Left] + dicResult[r_Right]) / 2 11 12 elif r_Left in dicResult and r_Right not in dicResult:#有前面的資料沒有後面的資料 13 r_Left2 = str(p - interval - interval)#left為前2期 14 r = dicResult[r_Left2] + (dicResult[r_Left] - dicResult[r_Left2]) / (interval) * (p - float(r_Left2)) 15 16 17 dicResult[str(p)] = r 18 dicE4Calc[str(p)] = pow(math.e, -r * p)#e的(-r*p)次方 19 20 p += interval

6.讀取表格

df['Coupon']=df['Coupon'].fillna(0)#若Coupon為空值則填充為0 for i in range(bondsCount):#讀取表格中對應的列 FaceValue = df.loc[i, 'FaceValue'] Price = df.loc[i, 'Price'] Term = df.loc[i, 'Term_Y'] Coupon = df.loc[i, 'Coupon'] CouponFrequency = df.loc[i, 'CouponFrequency'] YTM = 0 e4Calc = 0

7.計算有年息和無年息的收益率

1 if Coupon == 0: 2 3 e4Calc = Price / FaceValue 4 5 YTM = math.log(FaceValue / Price) / Term 6 7 else:#有息票的計算 8 PeriodCoupon = Coupon * Period#年息票的0.5 9 10 11 if Term % Period == 0:#從0.5年開始 12 LinearInterpolation(PeriodCoupon, Term, Period) 13 e4Calc = (Price - getPreSum(PeriodCoupon, Term, Period)) / (FaceValue + PeriodCoupon) 14 15 else:#不是從0.5開始,需要在起始日期以0.5年遞增 16 LinearInterpolation(PeriodCoupon, Term, Term % Period) 17 e4Calc = (Price - getPreSum(PeriodCoupon, Term, Term % Period)) / (FaceValue + PeriodCoupon) 18 19 YTM = math.log(1 / e4Calc) / Term 20 21 dicE4Calc[str(Term)] = e4Calc 22 dicResult[str(Term)] = round(YTM, 9)

8.把計算結果寫到輸出表中

1 sorted_dicResult = sorted(dicResult.items(),key =operator.itemgetter(0))#把求出的收益率按期限排序,把字典轉為列表 2 # print(dicResult) 3 print(sorted_dicResult) 4 Term = [i[0] for i in sorted_dicResult ]#遍歷列表中的期限 5 Yield = [i[1] for i in sorted_dicResult ]#遍歷列表中的 6 data={"Term":Term,"Yield":Yield} 7 columns=['Term','Yield'] 8 df=pd.DataFrame(data=data,columns=columns) 9 df['TermBase']='Y' 10 df = df.set_index("TermBase") 11 df.to_excel(OutputPath,sheet_name='OutPut') 12 13 print(df)

9.繪製出收益率曲線圖

1 x = Term 2 y = Yield 3 plt.plot(x,y) 4 plt.xlabel('CouponFrequency')#期限 5 plt.ylabel('YTM')#收益率 6 plt.title('Zero coupon yield curve')#命名 7 plt.show()

最終結果如下:

複利的計算也類似,完整程式碼如下:

1 #複利計算 2 import pandas as pd 3 import numpy as np 4 import matplotlib.pyplot as plt 5 import math 6 import os 7 import operator 8 import sys 9 import xlrd 10 from openpyxl import Workbook 11 from openpyxl import load_workbook 12 from openpyxl.utils import get_column_letter 13 from openpyxl.compat import range 14 15 InputPath=sys.argv[1] 16 OutputPath=sys.argv[2] 17 print(InputPath) 18 print(OutputPath) 19 20 filePath = InputPath 21 df = pd.read_excel(filePath) 22 bondsCount = df.shape[0] 23 dicE4Calc = {} 24 dicResult = {} 25 Period = 0.5 26 27 def getPreSum(pCoupon, targetTerm, startTerm): 28 sum = 0 29 p = startTerm 30 while (p < targetTerm): 31 sum += dicE4Calc[str(p)] * pCoupon 32 p += Period 33 34 return sum 35 36 def LinearInterpolation(pCoupon, targetTerm, interval): 37 sum = 0 38 p = interval 39 while p < targetTerm: 40 if str(p) not in dicResult: 41 r_Left = str(p - interval) 42 r_Right = str(p + interval) 43 44 if r_Left in dicResult and r_Right in dicResult: 45 r = (dicResult[r_Left] + dicResult[r_Right]) / 2 46 47 elif r_Left in dicResult and r_Right not in dicResult: 48 r_Left2 = str(p - interval - interval) 49 r = dicResult[r_Left2] + (dicResult[r_Left] - dicResult[r_Left2]) / (interval) * (p - float(r_Left2)) 50 51 dicResult[str(p)] = r 52 dicE4Calc[str(p)] = pow(math.e, -r * p) 53 54 p += interval 55 Period = 1 / df['CouponFrequency'].max() 56 df['Coupon']=df['Coupon'].fillna(0) 57 for i in range(bondsCount): 58 59 FaceValue = df.loc[i, 'FaceValue'] 60 Price = df.loc[i, 'Price'] 61 Term = df.loc[i, 'Term_Y'] 62 Coupon = df.loc[i, 'Coupon'] 63 CouponFrequency = df.loc[i, 'CouponFrequency'] 64 YTM = 0 65 e4Calc = 0 66 67 if Coupon == 0: 68 69 e4Calc = Price / FaceValue 70 71 YTM = pow(FaceValue / Price,1/ Term) -1 72 73 else: 74 PeriodCoupon = Coupon * Period 75 76 if Term % Period == 0: 77 LinearInterpolation(PeriodCoupon, Term, Period) 78 79 e4Calc = (Price - getPreSum(PeriodCoupon, Term, Period)) / (FaceValue + PeriodCoupon) 80 81 else: 82 83 LinearInterpolation(PeriodCoupon, Term, Term % Period) 84 e4Calc = (Price - getPreSum(PeriodCoupon, Term, Term % Period)) / (FaceValue + PeriodCoupon) 85 86 YTM = pow(1 / e4Calc,1/ Term) - 1 87 88 dicE4Calc[str(Term)] = e4Calc 89 dicResult[str(Term)] = round(YTM, 9) 90 91 # print(dicE4Calc) 92 # print(dicResult) 93 94 sorted_dicResult = sorted(dicResult.items(),key =operator.itemgetter(0)) 95 # print(dicResult) 96 print(sorted_dicResult) 97 Term = [i[0] for i in sorted_dicResult ] 98 Yield = [i[1] for i in sorted_dicResult ] 99 100 data={"Term":Term,"Yield":Yield} 101 columns=['Term','Yield'] 102 df=pd.DataFrame(data=data,columns=columns) 103 df['TermBase']='Y' 104 df = df.set_index("TermBase") 105 df.to_excel(OutputPath,sheet_name='OutPut') 106 print(df) 107 108 x = Term 109 y = Yield 110 plt.plot(x,y) 111 plt.xlabel('CouponFrequency') 112 plt.ylabel('YTM') 113 plt.title('Zero coupon yield curve') 114 plt.show()