量化策略多因子選股之抓取不同時段的歷史價格,及資料庫操作

阿新 • • 發佈:2018-12-15

#獲取20170831,20180323的滬深三百成分及中證500的成分股當日收盤價

# coding=utf-8

import pandas as pd

import tushare as ts

import sys

from sqlalchemy import create_engine

import numpy as np

reload(sys)

sys.setdefaultencoding("utf-8")

hs300=ts.get_hs300s()

code=[]

price=[]

hs300_code= hs300['code']

for stock in hs300_code:

try:

df=ts.get_k_data(stock,ktype

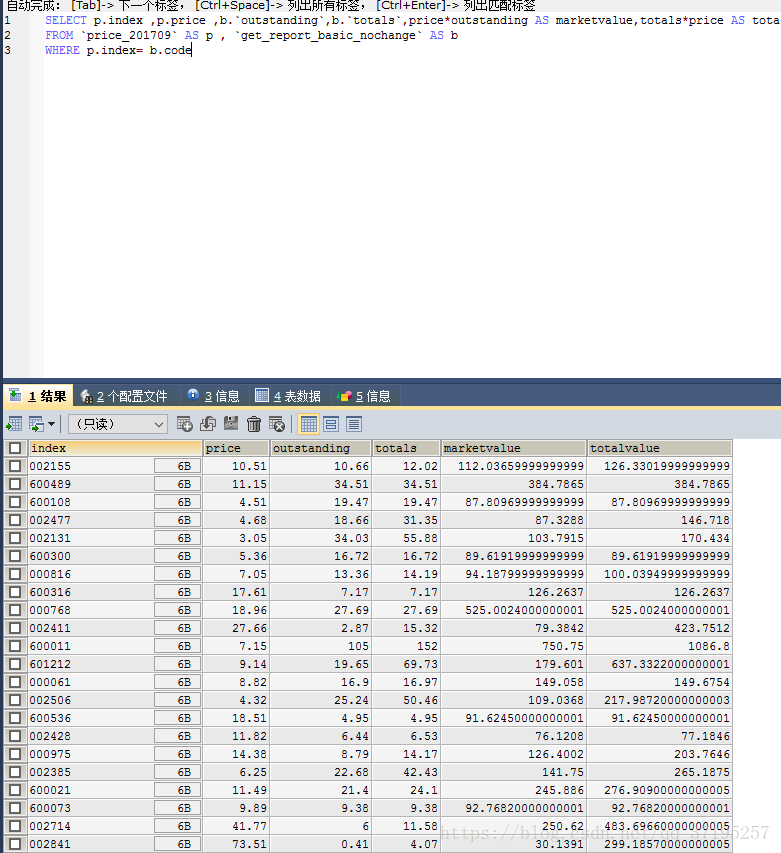

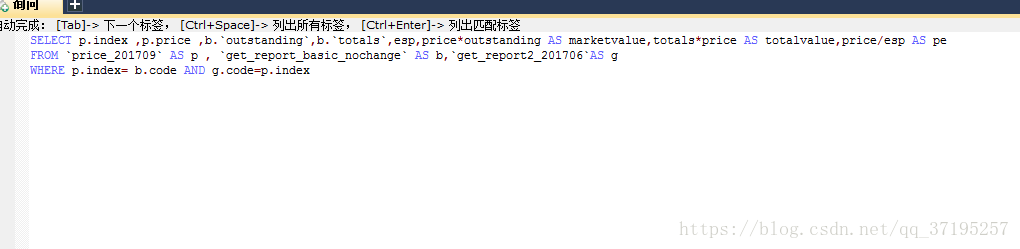

然後在MYSQL進行表連線,將需要的財務資料(2017年第二季度)、歷史股價連線

計算市值 (總市值和流通市值)

計算PE

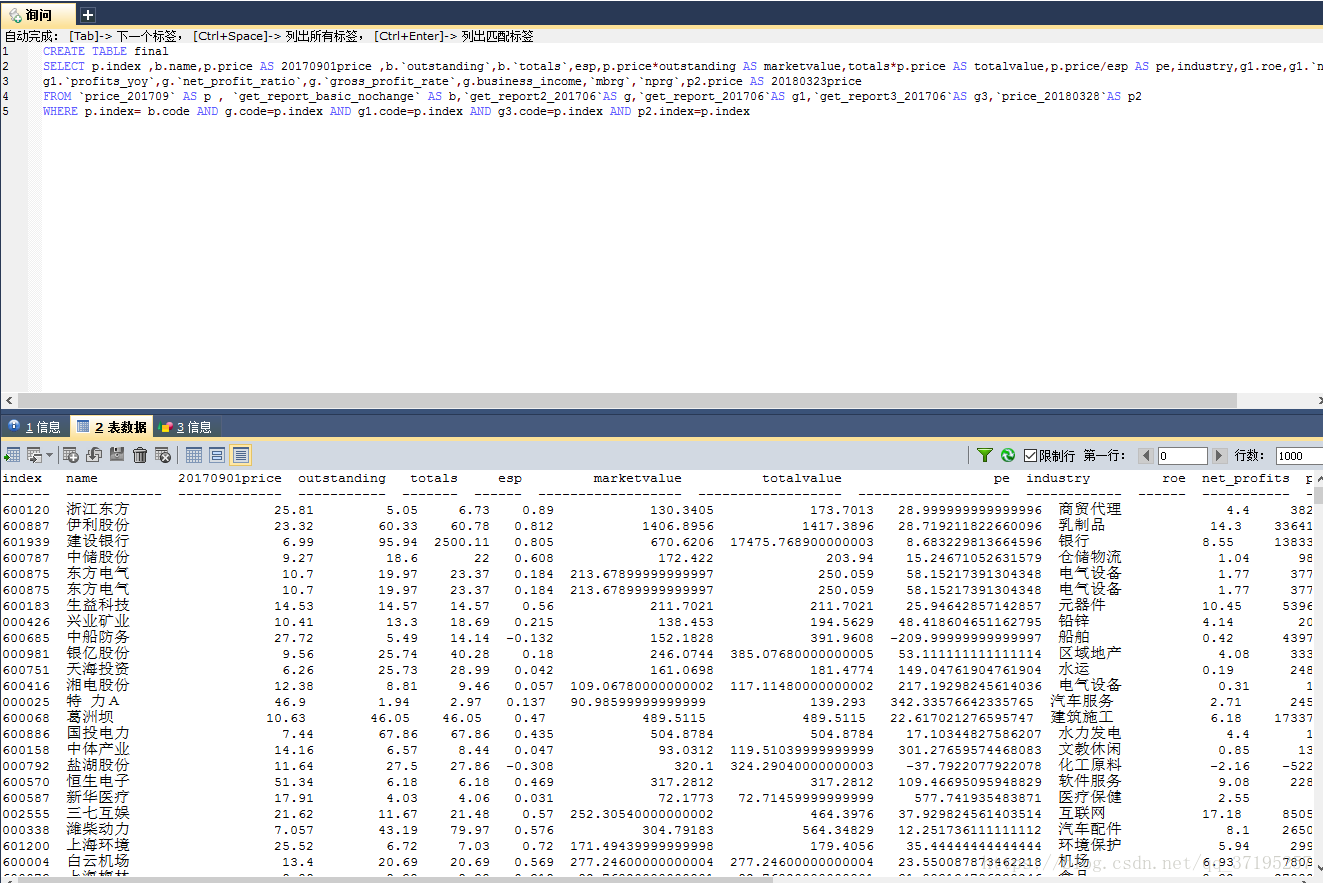

CREATE TABLE final

SELECT p.index, b.name, p.price AS 20170901price, b.`outstanding`, b.`totals`

, esp, p.price * outstanding AS marketvalue, totals * p.price AS totalvalue

, p.price / esp AS pe, industry, g1.roe

, g1.`net_profits`, g1.`profits_yoy`, g.`net_profit_ratio`, g.`gross_profit_rate`, g.business_income

, `mbrg`, `nprg`, p2.price AS 20180323price

FROM `price_201709` p, `get_report_basic_nochange` b, `get_report2_201706` g, `get_report_201706` g1, `get_report3_201706` g3, `price_20180328` p2

WHERE p.index = b.code

AND g.code = p.index

AND g1.code = p.index

AND g3.code = p.index

AND p2.index = p.index

瀏覽結果:

接下來就是對部分財務資料進行取對數,檢查資料的缺失值。。。