Proof of Work vs Proof Of Stake

Proof of Work vs Proof Of Stake

Is the future of blockchain at stake?

A considerable amount of debate in the blockchain space has been focused on the comparison between the proof of work and proof of stake algorithms. Progress in the efficiency and scalability of blockchains relies on the speed and security of their consensus algorithms. These two algorithms currently are the two major consensus algorithms being developed, thus having significant influence on the blockchain space as a whole.

We’ll set out below how each these mining or validation algorithms work, in particular how data in a blockchain is confirmed by the consensus of participants in a network.

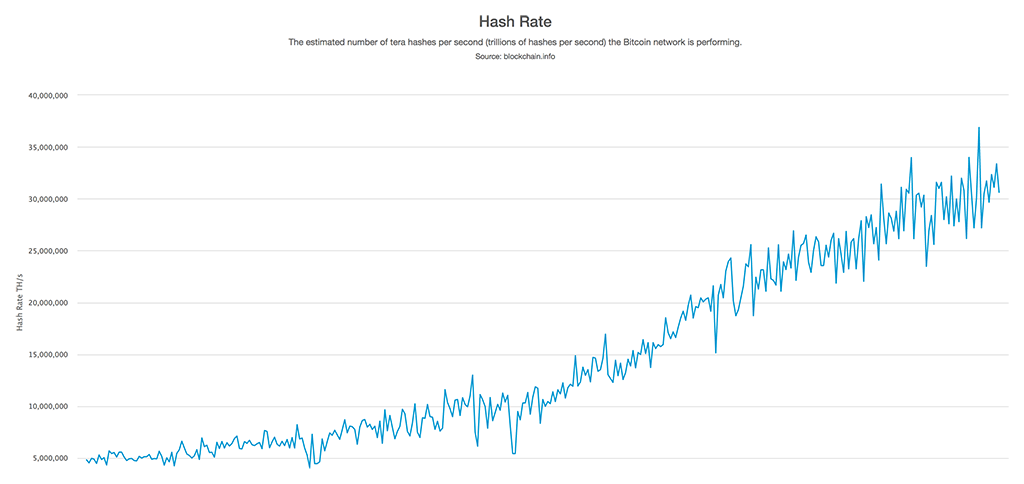

In the case of Proof of Work (PoW), miners solve a mathematical equation based on a hash function in order to acquire the rights to mine a block. The miner who solves the equation first is assigned the block to validate, thus obtaining that block’s “rewards” (usually currency). Because the hash functions used are cryptographically secure, these problems may only be solved by ‘bruteforcing’ the solution — i.e. trying all of the possible answers. The “work” is the computational power required to solve the algorithm, so by completing the problem you acquire the “proof of work” for a block. Because of this, blocks will typically be mined by those miners who possess the most computing power, as more computing power implies more capability to attempt solutions. Most Proof of Work blockchains also incorporate a model of increasing difficulty. That is, with each block mined, the difficulty of attaining the PoW for the next block increases — meaning more power is required to mine blocks overtime. PoW is currently the most prominently used mining algorithm, with Bitcoin, Ethereum and Monero all using PoW currently.

Proof of Stake (PoS), on the other hand, is a consensus algorithm whereby blocks are assigned to validating nodes via random selection based on the amount staked by each node. Typically the probabilities of a node getting assigned a block scale with the amount they have staked, although the degree of scaling depends on the specific implementation of the algorithm. After blocks are assigned to a node, they are validated in the same way as they would be in PoW (although some networks are different). PoS is being implemented by many of the newer smart contract platform projects, such as EOS, NEO and Tron.

The major difference between the two algorithms lies in what determines the distribution of blocks, and thus block rewards. PoW’s distribution is based on the computing power invested, while PoS is based on the amount of currency staked. Critics of PoW point to the massive resource requirements of mining as its major issue, as an increasing hash rate in a PoW network implies an increasing amount of power consumption. On the other hand, Critics of PoS suggest it inherently encourages centralisation, collusion and rewarding only those who own the most of the currency. From a neutral perspective, it seems that each of these algorithms have different use-cases, rather than necessarily being in competition.

PoW currency is considered by many to be more suitable as a store of value, comparable to precious metals in an non-digital context. This is largely because of the baseline economic value PoW currency is given by its mining process (much like that of Gold or Silver — although these have uses elsewhere). Because newly minted currency has a resource cost equal to the computational resources required to mine a coin, that same value is tied to all of the coins in circulation.

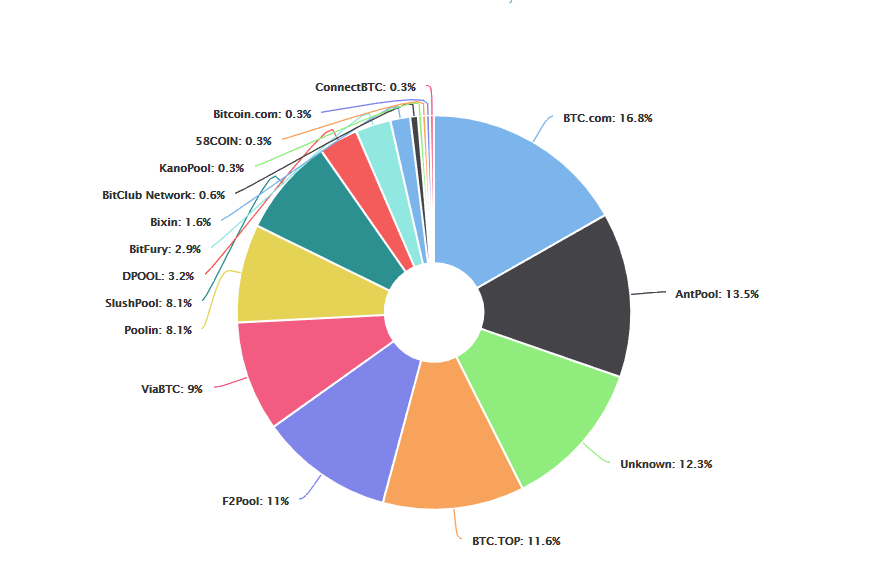

Some also suggest PoW networks have a higher degree of decentralisation than PoS networks in both governance and mining. Many PoS networks have a relatively small amount of validators comparative to their PoW counterparts (for example, EOS only has 21 validating nodes). Most current models of PoS blockchain governance are based around a select number validators who are voted in on-chain, leading to a considerably more centralised system than PoW. Whilst some have raised concerns about significant amounts of centralisation in both Bitcoin and Ethereum’s mining pools, these pale in comparison to the collusion issues the existing PoS networks are already facing (See EOS’s recent issues). For investors looking for a currency which best acts as a store of value, the PoW based assets seem clearly more suited.

At this point, however, PoW is not a sufficient solution for blockchains requiring significant levels of data and transaction processing. Smart contract networks looking to handle enterprise loads efficiently need more than the ~13 transactions per second that PoW can handle. Because PoS doesn’t require the same level of complexity in its mining process, it is capable of handling a exponentially higher transaction load (some networks in excess of 10 thousand transactions / second). Many smart contract networks have thus chosen to use PoS as their mining algorithm of choice, with Ethereum also deciding to transition to their PoS model ‘Casper’ in order to ease bottlenecks on transaction processing.

Along with its ability to process a much higher load of transactions at a faster rate, PoS currencies consistently have lower/negligible transaction fees. For organisations looking to make a high volume of changes to their smart contracts, PoW becomes very costly extremely quickly in the current environment. This is easily seen just by comparing the transaction fees of Ethereum’s gas system relative to EOS’s zero fee structure, with many dApps making the migration to EOS just to save on fees. Whilst there is some potential for some cost minimisation in PoW systems via the implementation of side chains (We will have another article on this), PoS is fundamentally the cheaper mechanism. Certainly at this point PoS seems like the future for projects based around smart contracts, although major concerns still exist around its ability to prevent collusion and centralisation.

Despite the constant comparisons between the two algorithms, at this point it is more likely that they will compliment each other in different contexts, rather than compete. As above, Proof of Work has its place as an algorithm underpinning assets that wish to be a store of value, whilst Proof of Stake seems more suited to serve as a system for processing very high transaction volume probably with much lower average transaction values.