Bitcoin & Altcoins to Rally in Q4? The Bull & Bear Cases

Bitcoin & Altcoins to Rally in Q4? The Bull & Bear Cases

Coming into 2018, most cryptocurrency enthusiasts wouldn’t have predicted the underwhelming and bearish prices exhibited by Bitcoin. Despite the suppressed prices, there has been constant news and developments relating to the cryptocurrency market. Could these final months of 2018 mark a pronounced reversal leading into the next bull market?

Reasons to be Bullish

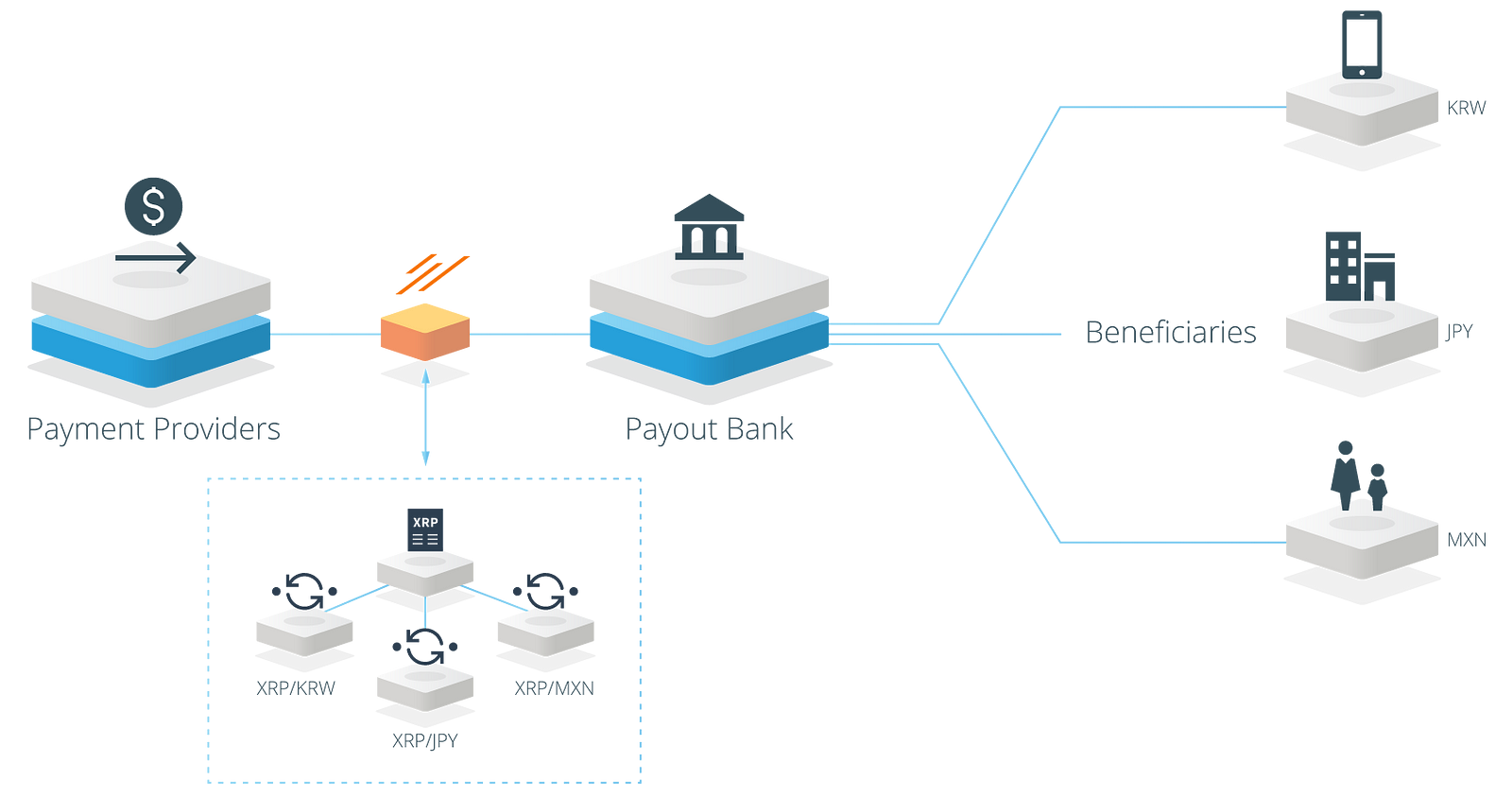

I believe Ripple’s XRP, often perceived to be the bane of the crypto world due to its centralized nature, could provide fuel for an altcoin resurgence. When I’m asked about Bitcoin, if Ethereum isn’t second, then it’s “Ripple” (NOTE: Ripple is the company and XRP is the token). On Monday (10/1/18), at the Ripple Swell conference, it was announced that Ripple’s

XRapid will use XRP to provide low cost liquidity for it’s customers and serve as bridge for currencies, quickly facilitating cross border payments. If XRP explodes because of xRapid, then it will certainly entice onlookers and expose them to the vast world of altcoins.

When the imminent launch of xRapid was announced, XRP experienced a price surge, rising from around $.27 (on 9/18/18) to as high as $.65 a few days later (on 9/21/18). At this time, no headline grabbing entity, like a major bank, has proclaimed usage of xRapid. XRP’s price has slightly retraced since the over-exuberance prior to Swell, but xRapid’s progress may be best reflected and sustained later in Q4. Nonetheless, this signals potential adoption of xRapid and a familiar name may soon start using this product.

Here are some events that I believe could boost the market:

- ICE (Intercontinental Exchange)’s Bakkt Launching in November — Bakkt, created by the same group who owns the New York Stock Exchange (NYSE), will provide a Bitcoin Future’s platform that also serves as an all-in-one consumer marketplace to buy, sell, and store cryptocurrencies. Microsoft and Starbucks are supporting this endeavor and Bakkt could help crypto become mainstream.

- Possible Approval of The CBOE’s VanEck & SolidX ETF — SEC Commissioner Hester Pierce has expressed her dissension of recent Bitcoin ETF (Exchange Traded Fund) denials, which can be seen as a ray of hope. If approved, this ETF could very much catapult the market to a new stratosphere. The next decision date deadline is December 29, 2018, but the SEC can issue a delay into February 2019.

- Google Ad Ban Lifted — Google has partly had a rollback on its ad ban against crypto, allowing regulated exchanges from US and Japan to advertise. These ads could pique the interest of new investors.

- Coinbase Expanding Its Offerings — Coinbase is likely to add new coins soon and has recently revamped their listing/application process, opening the door to adding a wider array of cryptocurrencies. It also added Coinbase Bundles, which acts as an index fund for retail investors.

- Historical Q4 Trends Repeat — Last year, the crypto market rose from $145 Billion to more than $600 Billion in Q4, topping at around $800 billion in January 2018. Q4 has been historically strong for Bitcoin.

- TD Ameritrade’s Creating Their Crypto Exchange— Although not opening until early 2019, TD Ameritrade has introduced its ErisX crypto exchange. Bitcoin, Ethereum, Bitcoin Cash, and Litecoin will be available for trading followed by a future’s platform. This further shows that traditional finance can’t strategically ignore crypto. Anticipation of this may push cryptos higher in Q4.

- StellarX Decentralized Exchange (DEX) Shows Growth— The StellarX DEX (built on Stellar [XLM])recently launched (on 9/28/18), offering zero fees and acting as a fiat on-ramp. Current DEXs have glaring shorting comings, but the StellarX shows advancement in DEXs. Notably, Binance — the world’s largest crypto exchange, will launch a DEX in 2019

- Yale’s Crypto Investment — David Swensen, who manages the university’s endowment, just invested $300 million into cryptos. Swensen is well-respected and is seen as a pioneer. With this plunge, other endowments may seek to follow Yale’s lead.

Reasons to be Bearish

The New York Attorney General office alleges that a few cryptocurrency exchanges, such as San Francisco based Kraken, have engaged in illegal operations. This comes after the NY AG has prompted exchanges to provide information, with Kraken balking at this probe, insinuating that the NY AG is overstepping it’s bounds.

It’s conceivable that some cryptocurrency exchanges are not totally honest and that the NY AG is not approaching this from a position of objectivity, possibly to uphold the unsavory essence of the New York BitLicense, which does anything but cultivate crypto businesses. Either way, this power struggle could get ugly.

- 1Broker Exchange Closed— The FBI seized the 1Broker (on 9/27/18) website, an exchange based in the Marshall islands, by violating SEC regulations. Not being properly registered, 1Broker offered security-based swaps to U.S. citizens. It’s possible that other non-compliant exchanges could face SEC sanctions.

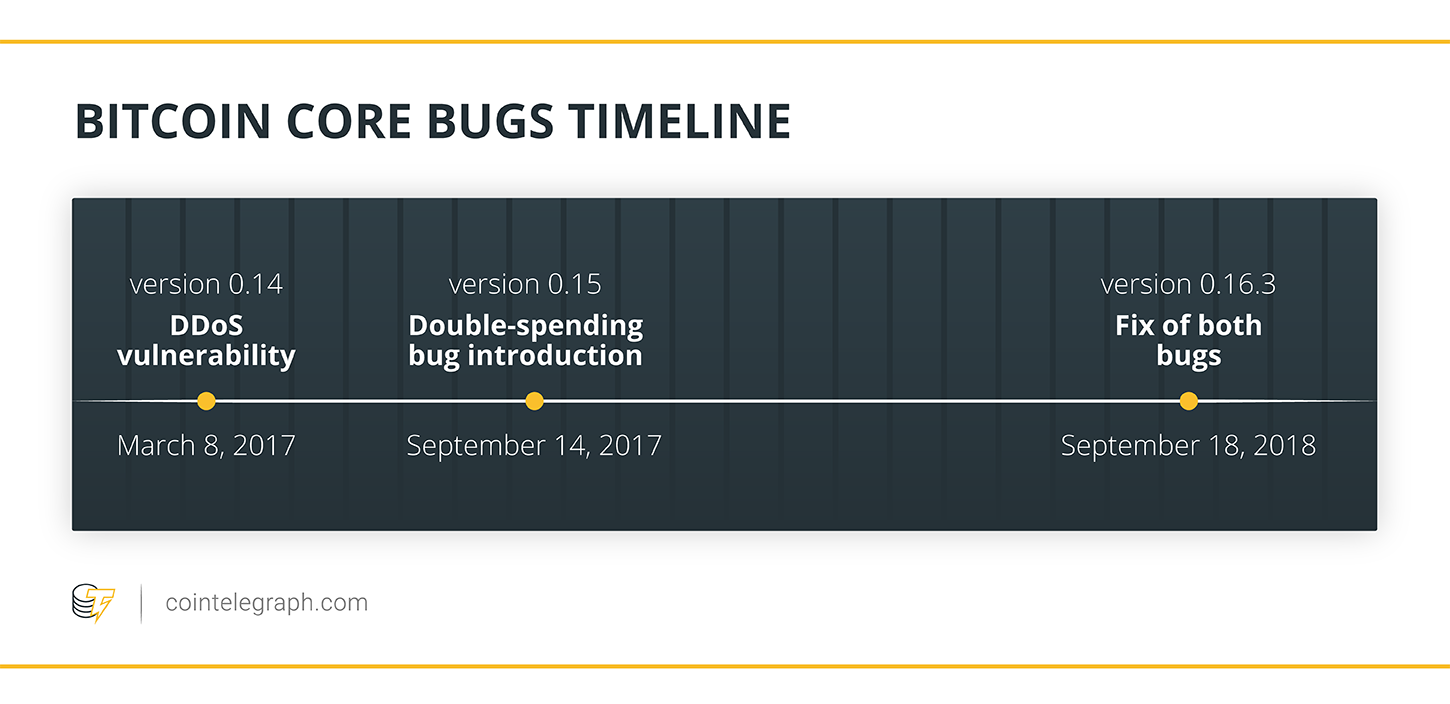

- Bitcoin Bug(s) Found— An inflation bug was discovered, which could’ve been exploited by a malicious miner. There’s the potential that future and lingering bugs could be used to disrupt the Bitcoin network and it could hamper short-term confidence.

- Outright CBOE ETF Denial — If the SEC denies the CBOE ETF, the market could take a dive. The SEC has cited possible manipulation in previous denials and such a rejection may breed a perception of market immaturity.

- ICO Funding Has Dried Up — Since it’s apex in February 2018, Funds raised during ICOs (Initial Coin Offering) has rapidly declined. However, this could signal that ICOs created for the sole intent to be money grabs are less likely to flourish under current market conditions.

- False Rallies That Kill Sentiment — If there are short lived price pumps leading to a dump, patience and hope for the next rally will be crushed. If this is observed, anger and apathy is to be expected by many.

- Tether’s Backing is Suspect — Tether has dropped Puerto Rico’s Noble Bank. Now Noble Bank is looking for a buyer and is no longer profitable. This however has increased the scrutiny of the US Dollar backed stable coin. If Tether is not totally backed by USD and fails, then the market will take a major hit. Stable coins are steadily being added to the market and if a Tether crisis is experienced then other stable coins (e.g., True USD) may be viable alternatives.

Final Thoughts

I believe that a rally will occur, especially with the infrastructure and developments that have been witnessed in the previous quarters of 2018. At the same time, I would not be surprised if we continue to trade sideways or even drop to new yearly lows. Nevertheless, I think we are at or near a relative bottom in the market. In my opinion, 2019 is setting up to be special year for cryptos and that foundation is being solidified now