Beware the Siren Song of “Crypto VC”

Beware the Siren Song of “Crypto VC”

Scott Kupor at Andreesen Horowitz published a piece advocating for investing in altcoins through VC funds like his.

The piece’s intent is to establish a strong parallel between “crypto investing” and investing in the equity of companies. This parallel needs to be established to lure investors away from just directly investing in bitcoins, which Mr. Kupor sees as the equivalent of only investing in the equity of a liquid, publicly traded company. The thesis is that if “crypto investing” is like equity investing then investors should have “asset class diversification across [bitcoin] and private assets”. For a complete explanation of equity vs currency, read

What are “crypto” private assets? They are “cryptonetwork tokens” that are under construction and not publicly listed, so if an institutional investor wants to have access to and vetting of the best deals they will have to go through a well-connected fund like Mr. Kupor’s “cryptonetworks-dedicated venture capital fund”. Eventually these “cryptonetwork tokens” will be publicly listed and the fund will be able to sell its stake, just as a VC fund would do with company equity.

How are private “cryptonetwork tokens” different from a public “cryptonetwork token” like bitcoins?

- A private “cryptonetwork token pre-mine”: the tokens are created out of thin air, upfront by a centralized entity. They are distributed by the promoters to investors and developers. This is analogous to how company equity is created.

- Public “cryptonetwork token mining”: bitcoins are mined at significant cost. This is analogous to how gold is created.

On this basis alone I would argue that we’re talking about two very different asset classes and that the intra-asset class diversification thesis doesn’t hold. In any case, for the sake of argument let’s say they both belong in what I call a “growth currency” asset class.

Bitcoin is not an investment

Warren Buffett astutely pointed out that bitcoins are a non-productive asset. That is, they must be exchanged for a consumer or capital good and can not be used directly for consumption or production. Modern currencies are all non-productive assets. When gold was used as a currency, most of its value came from its role as a non-productive asset, a “monetary premium”.

Purchasing and holding a currency is not an investment, if we define investing as using capital to produce goods and services. Instead, it is speculation. Speculation has a negative connotation, as it seems unanchored from “fundamental” or “intrinsic” value, at worst a negative expected value gamble when taxes and exchange fees are subtracted. The currency market is arguably a fixed pie, zero-sum.

When is speculating on a currency reasonable? The first scenario is one that Warren Buffett is very familiar with: when you are waiting for the market of producer or consumer goods to deliver a compelling investment or consumption opportunity. Holding cash is also used by investment managers who believe that productive assets are priced for perfection, and they are waiting for their relative value to drop. In this scenario you want to have a highly liquid currency with a short to medium term stable value.

A second scenario is speculating on monetary policy, borrowing a weak currency to buy a strong currency. If the weak currency’s issuer does not tighten its monetary policy then this degenerates into a speculative attack.

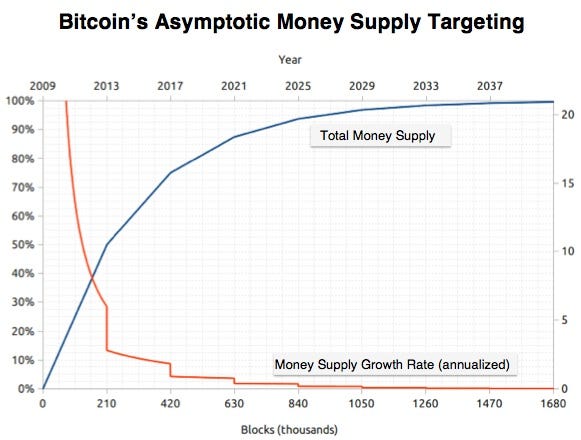

A third scenario is speculating on the future growth rate of a currency’s adoption. If the growth rate is greater than the rate at which new tokens are created, then the value will go up — “deflation” in monetary economics terms. This is where all of the “cryptonetwork token” speculation is: which tokens will increase in purchasing power. I call this bucket “growth currencies”.

Adoption drivers

There is a quasi-religious debate in “crypto investor” circles regarding what has and will drive the adoption of “cryptonetwork tokens”.

Fundamentally, adoption of a currency must be driven by differentiation from existing currencies. One side of the debate sees the differentiation coming from “cryptonetwork services” that can only be unlocked by its “token”. In their view, Bitcoin provides a very limited set of services, and thus is not sufficiently differentiated. Tokens which enable more services are being developed and Mr. Kupor is speculating on them. It’s unclear how much demand there is for “decentralized cloud services”, nor is it clear if those services can be built and scaled. Speculating on new “cryptonetwork services” is not like software startup investing in 2018, it’s like software startup investing in 1918 — the economics have zero positive track record (yet?). What we have so far is a negative track record of Ponzi schemes and exit scams.

The other side of the debate argues that the services provided by the Bitcoin network are enough for a currency: monetary policy and payments. The differentiation in those verticals is what matters. Bitcoin has a sound, credible, and legitimate monetary policy.

Its payment network is scalable, reliable, permission-less, and censorship-resistant. Bitcoin’s “cryptonetwork” itself has faced down direct attacks from powerful “stakeholders”, unlike any other network. Additional services would violate the Rule of Simplicity:

Developers should design for simplicity by looking for ways to break up program systems into small, straightforward cooperating pieces. This rule aims to discourage developers’ affection for writing “intricate and beautiful complexities” that are in reality bug prone programs.

Bitcoin has a positive 9 year track record of adoption. This gives us a baseline growth rate to extrapolate with. Perhaps its growth has peaked and there’s an adoption ceiling being reached. I haven’t seen any compelling evidence that this Bitcoin bear cycle, unlike past ones, is permanent. This track record is not due to new network services being added, Bitcoin has been harshly criticized for not adding new services. Existing network services are being refactored and extended, but that seems to have had only an indirect or perhaps even an immaterial effect on Bitcoin’s valuation. I actually agree with Bitcoin’s critics when they argue that it is riding on momentum, all it needs to do is keep delivering the services it has been delivering to succeed at becoming the premier global money.

Diversification

Diversification is not an investment thesis on its own. There has to be a compelling argument for why assets being added to the portfolio narrow the range of expected outcomes. The empirical data so far on “crypto assets” is that they are highly correlated. Mr. Kupor may hope that this will change, but institutional investors should make evidence-based decisions, not hope-based ones. Speculating on the most liquid public “cryptonetwork token”, bitcoins, gives investors exposure to “crypto” without having speculate on an entirely unproven “crypto VC” strategy around value accrual for unknown “cryptonetwork services”. The idiosyncratic risk of all of the “cryptonetwork tokens” are a strict superset of Bitcoin’s, if Bitcoin has a fundamental reason it can not function — regardless of any reasonable changes to its network consensus rules — then that flaw would inherently be shared with any other “cryptonetwork token”.

Institutional investors should figure out their speculative allocation to bitcoins as a growth currency separately from figuring out their investment allocation to venture funds. These allocations are backed by very different value accrual theses and face different risks.

At the very least, institutional investors should hear out both sides of the debate before making an allocation, so I’m glad Mr. Kupor put a piece out to try to push back on the rising tide of Bitcoin realism.