The Otherside of Unstable, Stable, and Pegged Coins

The Otherside of Unstable, Stable, and Pegged Coins

Cryptocurrencies fall under 2 main categories, unstable and stable. Unstable coins are really great for day traders because of their volatility, but a nightmare for economists. The opposite can be said about stable coins. This article splits the stable coin into 2, making 3 categories, namely unstable, stable, and pegged coins. That is, the latter category of stable coins is splint into stable and pegged coins. The reason for this is because it seems logical that a stable coin has agreed upon value, albeit not intrinsic, and a pegged coin has value based upon what it is pegged to.

Why did developers create pegged coins? This was probably in order to solve the problem of the 2008 economic crisis. Cryptocurrency is supposed to disrupt and supplant the current economic system. An unstable coin, as genius as it is, does not have the capability of doing this. This article suggests that either a stable or pegged coin might be more adept to achieve this goal.

Disclaimer: this article does not offer financial advice, nor does it endorse any system, currency, or cryptocurrency. It is an exploratory article examining the categories of cryptocurrency for both beginners and those who have been around the cryptoworld for a long enough time to form opinions on these types of coins. The term coin will be used to refer to cryptocurrency for simplicity sake.

Unstable Fiat Currencies

Many government backed currencies issued by their central bank have high price volatility and are unstable in value. These currencies include the Russian rouble, the Sudanese pound, and the Venezuelan bolívar. These currencies are usually unstable as a result of a weak economy, high inflation, and sometimes international boycotts. Due to their high price volatility, these currencies are generally only used domestically and rarely used to conduct international trade and commerce.

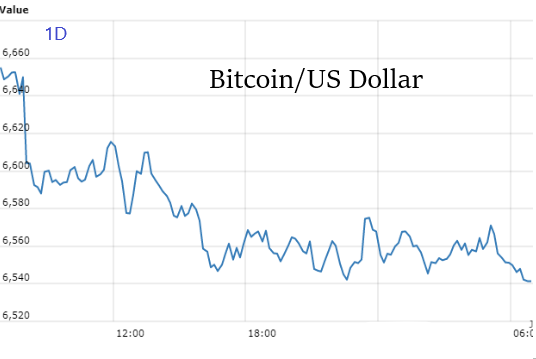

Unstable Coins

The majority of cryptocurrencies including Bitcoin, Ethereum, and Ripple are unstable coins. The main characteristic of an unstable coin is high price volatility. As a result of high price volatility, Bitcoin, Ethereum, Ripple, and many other cryptocurrencies are difficult to use to conduct everyday commerce, trade, and transactions between consumers and merchants. Additionally, many of these cryptocurrencies have been regarded and sometimes even officially classified as an asset class rather than as a medium of exchange. There is a lot of speculation around these coins. Regulation is still not established and classification as assets and securities are also not always clear. The latter has implications for taxes and other regulatory issues, such as registration of securities as SECs.

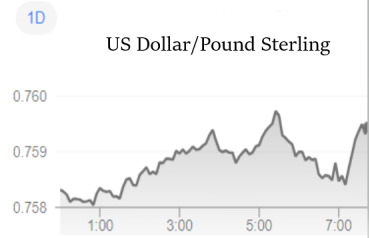

Stable Fiat Currencies

An economy needs a stable base to build upon. Major FIAT currencies such as the US dollar, the Euro, the Japanese Yen, the Swiss Franc, the Pound Sterling, the Canadian Dollar, and the Australian Dollar are all backed by government and central banks. They are reasonably stable in value and are generally regarded by consumers, businesses, economists, and the banking industry as stable currencies. These currencies are widely used for both domestic and international trade and commerce. They form the economic base for trading.

Stable Coins

In cryptocurrency, stable coins are cryptocurrencies with low volatility and stable value. This is an essential element that gives a cryptocurrency the ability to really compete with a FIAT currency as an everyday medium that enables transactions to be conducted with confidence both domestically and internationally between consumers and merchants. This has the potential to solve the economic problem.

Stable coins are much like their fiat counterparts in that a fiat currency today basically has no intrinsic value. Fiat currencies are no longer pegged to either gold using the Bretton Woods System or pegged to a stable commodity that gives it is value. Therefore we basically use a digital currency, which is similar to cryptocurrency when we do digital banking. However the digital system is centralised in Fiat currency, whereas a cryptocurrency is decentralized, cuts out the middleman, and is about as transparent as humanly possible.

If enough people agree upon the value of the cryptocurrency, the system could supersede the current economic model because of its decentralized nature. No single person or entity has control and there is no big brother, or government. It is controlled more by the individual owners of the currency, which balances out the power more.

The obvious question is how much power the “rich” will have in any specific cryptocurrency. In other words if some stake holders combine their wealth in a particular coin, will that give these stakeholders the power to control that coin and effectively form a “government” or ruling body over the rest of the stake holders?

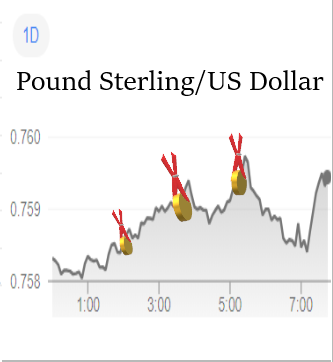

Pegged Fiat Currencies

Most major currencies including the US Dollar, the Euro, the Japanese Yen, the Pound Sterling, and the Australian Dollar are floating currencies. However many other currencies, often from countries with smaller economies are pegged to stronger, larger, and usually more stable currencies such as the US Dollar or the Euro. This means there is a fixed exchange rate.

The method that countries use to peg a currency is by controlling the monetary supply. Either a country will decreasing money supply when their currency decreases in value against the other currency or increases money supply when their currency increases in value against the other currency.

Advantages of Pegged Fiat Currency

There are many advantages these countries receive from pegging their currency. First, and foremost, the pegged currency is more stable and protected from high volatility in currency movements. Lower production costs in the countries with the weaker currency result in cheaper goods thereby increasing their exports. In addition these countries provide a source of cheaper imports for the countries with stronger currencies which becomes a great drawcard. Pegging also increases economic growth and raises living standards within the weaker currency countries.

Disadvantages of Pegged Fiat Currency

One of the major disadvantages is the high volume of foreign reserves that a central banks are required to keep in order to peg their currency. Frequently the scenario of higher than normal inflation will play out, which requires the balancing out of the countries currency. This is achieved through selling it on the open market.

Pegged Coins

Like many FIAT currencies, some cryptocurrency coins are pegged to the value of a major currency such as the US dollar or the Euro. Other cryptocurrencies have chosen to be pegged to the price of gold or diamonds. These cryptocurrencies are known as pegged coins. The main reason that a cryptocurrency would choose to be pegged to a major fiat currency or stable commodity is prevent price volatility. This would enable the pegged cryptocurrency to be used as a viable trade and commerce medium for both consumers and merchants to conduct everyday local and international transactions.

However much like the fiat counterparts, these coins will have to the disadvantages to work through in order to maintain stability. Unlike their fiat counterparts, however, these cryptocurrencies could over a period of time disrupt the fiat system to the degree that they eliminate the need for such a system and potentially also disrupt the entire existing economic model. This indeed is the ultimate goal. As pointed out earlier this idea emerged as a method to solve the global economic crisis that the world faced in 2008.

The main question here is what is the best thing of which to peg the coin. This is a crucial factor in the coin’s success or failure. If cryptocurrency does succeed in supplanting fiat currency, then pegging cryptocurrency to a fiat currency would become obsolete. Is a commodity like gold or diamonds an alternative? Would a cryptocurrency be able to be pegged to a commodity without being vulnerable to becoming centralised? Does whoever owns the “central fund” that the cryptocurrency is pegged to own the cryptocurrency too? Again the question of creating a conglomerate of stake holders seems threatening.

Conclusion

Will any cryptocurrency actually just disrupt the economic system or supplant it? Which type of coin will achieve this goal, if any is also a big question. Another similar question is will more than one system replace the current economic system or will the current one be among the solutions. Will the current system completely disappear or compete with its own type of cryptocurrency or digital solutions and remain centralised? While there is still a long way to go and much to play out before answers to these big questions begin to surface, the stable and pegged coins are competing with and disrupting the current economic model. Everything is still speculatory and time will tell. How this will play out is anyone’s guess. Therefore it is essential to do your own research. Do not invest more than you can afford to lose. This article does not give any financial advice nor endorse any systems, fiat currencies, or cryptocurrencies. The purpose is to explain the 3 categories, in both fiat and cryptocurrencies and hopefully open debates and better ways of thinking about these systems.