Blockchain explained in 1000 words

Has trying to understand blockchain ever left you dazed and confused? Sick of hearing nonsense like SHA256 algorithms and byzantine fault tolerance? Just want to know what the hell blockchain is and why people keep talking about it?

Well you’re in luck. In this article, I’ll explain in plain English what blockchain is, how it works and why it’s so important in less than 1000 words. Let’s get to it.

What is blockchain?

At its core, a blockchain is not so different from a regular database. It stores information on things that happened in the past, with unique attributes, such as:

- Decentralisation — no single party has control over what information goes in

- Consensus — many different parties store exact copies of the same ledger, so the majority has to agree on the information being added

- ‘Add-only’, meaning you can’t edit what’s already there, you can only add information

- New information can’t conflict with what’s already been added

- Information is able to be accessed and replicated by everybody on the network

The most important feature of a blockchain is decentralisation. Copies of a blockchain ledger are stored and updated on computers all over the world, meaning that there is no central authority to make decisions.

At its core, a blockchain is not so different from a regular database. It stores information on things that happened in the past, but with unique attributes.

Let’s take a look at a Bitcoin transaction as an example of how blockchain works (Bitcoin is just one possible application of blockchain technology. Blockchain is to Bitcoin what the internet is to email):

Let’s say I have one bitcoin and I want to send it to you. Everybody who holds a copy of the Bitcoin ledger can see that I have one bitcoin and you have zero (but on the Bitcoin network our identities are relatively private).

I can then send you one bitcoin, and the network will see this and immediately update every ledger.

But what if I’m greedy, and want to try cheat the network?

I could change my copy of the ledger to say I have 2 bitcoins, send you one and use the other to buy myself something nice.

But in the history of the Bitcoin network this act of double-spending has never happened.

Why not?

Blockchain security

To understand how and why blockchains are so resistant to tampering and fraud, we need to understand how they work.

Without getting too technical, let’s take a look under the hood and see what’s going on.

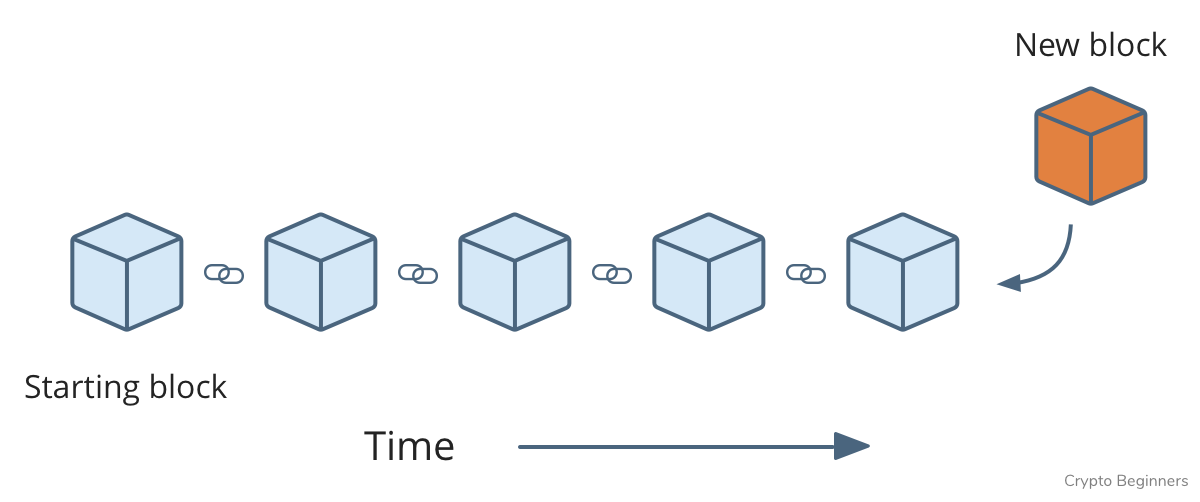

The information stored on a blockchain is stored in groups — called blocks — and each block is time-stamped and linked to the one generated before it in time, creating a linear chain of blocks — hence the term blockchain.

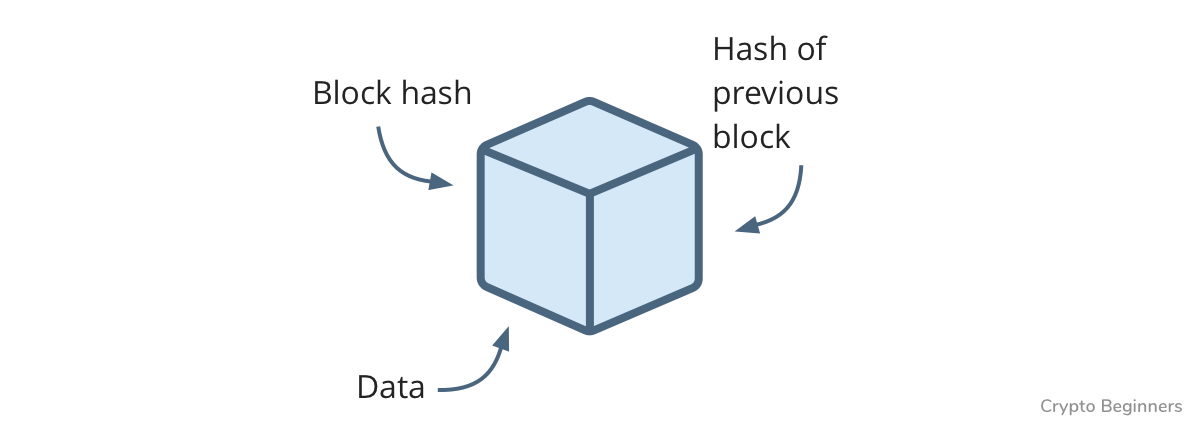

Each of these blocks contains 3 types of information:

- Data on transactions

- The block’s hash

- The hash of the previous block

This is really important, so bear with me while I explain what a hash is. Essentially it’s like a block’s fingerprint — a unique string of numbers that identifies each block. The numbers are automatically calculated based on the information stored in the block. If you change the information in the block you change the hash, and therefore the block’s identity.

The hash of the previous block also sits in each block, which is what creates the chain of blocks, and is what makes a cryptocurrency like Bitcoin so secure.

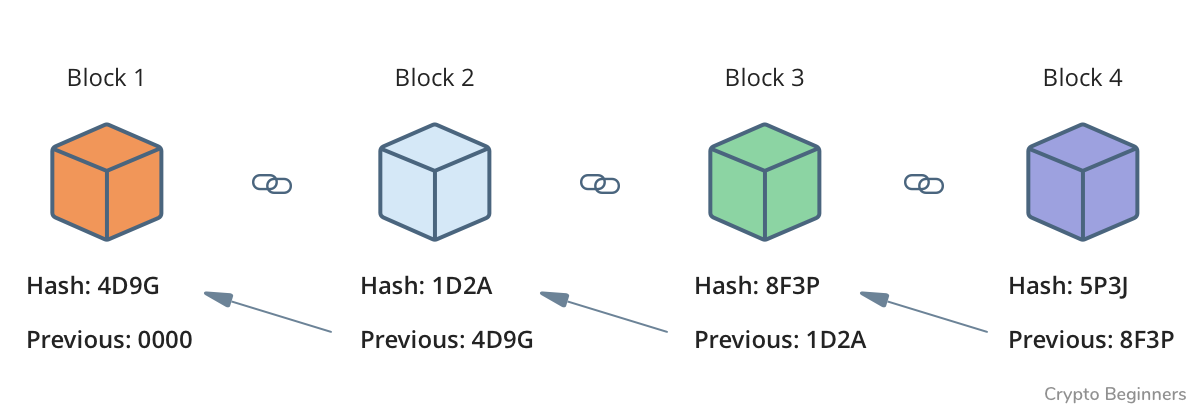

Take a look at this graphic:

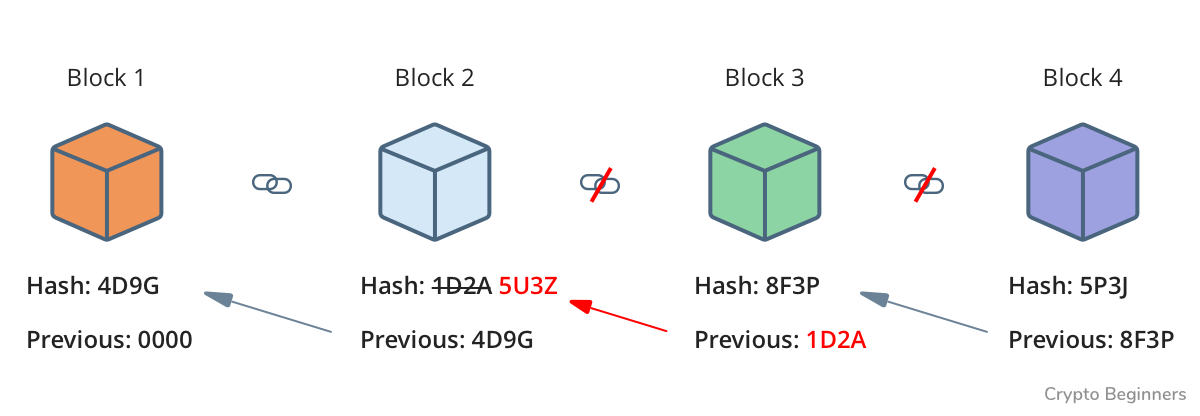

Each block contains the three elements listed above. But watch what happens when I try to tamper with the information in block 2 to give myself that extra bitcoin:

Block 3 contains the hash of block 2, but when block 2 is changed, so does its hash, meaning everything in block 3 and beyond becomes invalid, breaking the chain.

I’d then need to re-calculate the hashes of every block that has changed.

But it doesn’t stop there. The Bitcoin network makes it intentionally difficult to find these hashes. On average, the hash for a block is found every 10 minutes by computers constantly guessing random numbers and seeing if one fits (it’s actually a lot more complicated than this). This process is called ‘proof-of-work’ (PoW), and is done by powerful computers called miners.

So for every block I stuffed up, it would take me 10 minutes of intense calculation to mine each block and find the correct hashes.

And that’s just for my copy of the ledger.

The Bitcoin ledger exists on thousands of computers all over the world, so to fake that transaction, I’d need to somehow get access to over 50% of the computers, and repeat the mining process for all the ledgers I control.

This is insanely expensive from a computational standpoint, as I’d need an almost impossible number of computers to pull it off.

But by the time I did, and was able to give myself bitcoins at will, the rest of the network will have noticed. They would either try to kick me off, or would desert Bitcoin in droves, crashing the price and leaving me with control over a worthless currency.

So it’s pretty easy to see that blockchains are incredibly resistant to fraud, and why they’re considered ‘trustless’ — it’s in everyone’s best interest to play by the rules.

So why is all this important?

That’s a good question. Blockchain technology is still very much in its infancy, but promises to revolutionise many different industries, such as:

Banking and payments

Bitcoin and other cryptocurrencies like Litecoin, Monero and Zcash are making the storage and transfer of value simpler and cheaper by removing the need for middlemen such as banks.

Governments

Governments can use blockchains to implement secure and accurate voting, public record keeping, citizen identification (IDs) and border control.

Healthcare

Medical records are notoriously inaccurate and difficult to transfer. If they were hosted on a blockchain they would be secure, accurate and easily accessible by approved parties.

Supply chain

Want to know if those apples are actually organic? Or if that diamond ring is sourced ethically? Putting goods like these on the blockchain would allow consumers and businesses to gain greater transparency on the lifecycle of their products.

Insurance

No more calling up and hassling your insurer for weeks before getting your payout. With the implementation of smart contracts on the blockchain, insurers would be able to instantly accept and pay out claims to customers based on predefined rules.