The Higher Prices Rise, The Harder They Fall (or do they?)

Crypto, dot-com and other bubbles — Their ludicrous similarities and the future ahead.

Finally, we can speak about the crypto bubble with no worries that a Johnny-come-lately “crypto-investor” will start throwing accusations about daring to spell out the word “bubble”. Most likely, these fellows must have lost all their piggy-bank savings by now and already forgotten about all those catchy investment terms, like the “upside potential” of the BullshitCoin and its ICO.

Truth is cryptocurrencies and blockchain are both a reality. Their potential is far from discovered yet and we just know (or say we know) that they’ll change the world anytime soon.

The Distributed Ledger Technology (read Blockchain) is indeed something groundbreaking. Its use cases are limitless and can offer features miles from what we have today, especially in terms of security. Most self-respected financial and tech companies in the world have already invested billions in Blockchain R&D. Reportedly, only recently they’ve slowed down their operations, fearing a failure of the trend to keep up with the expectations raised around it.

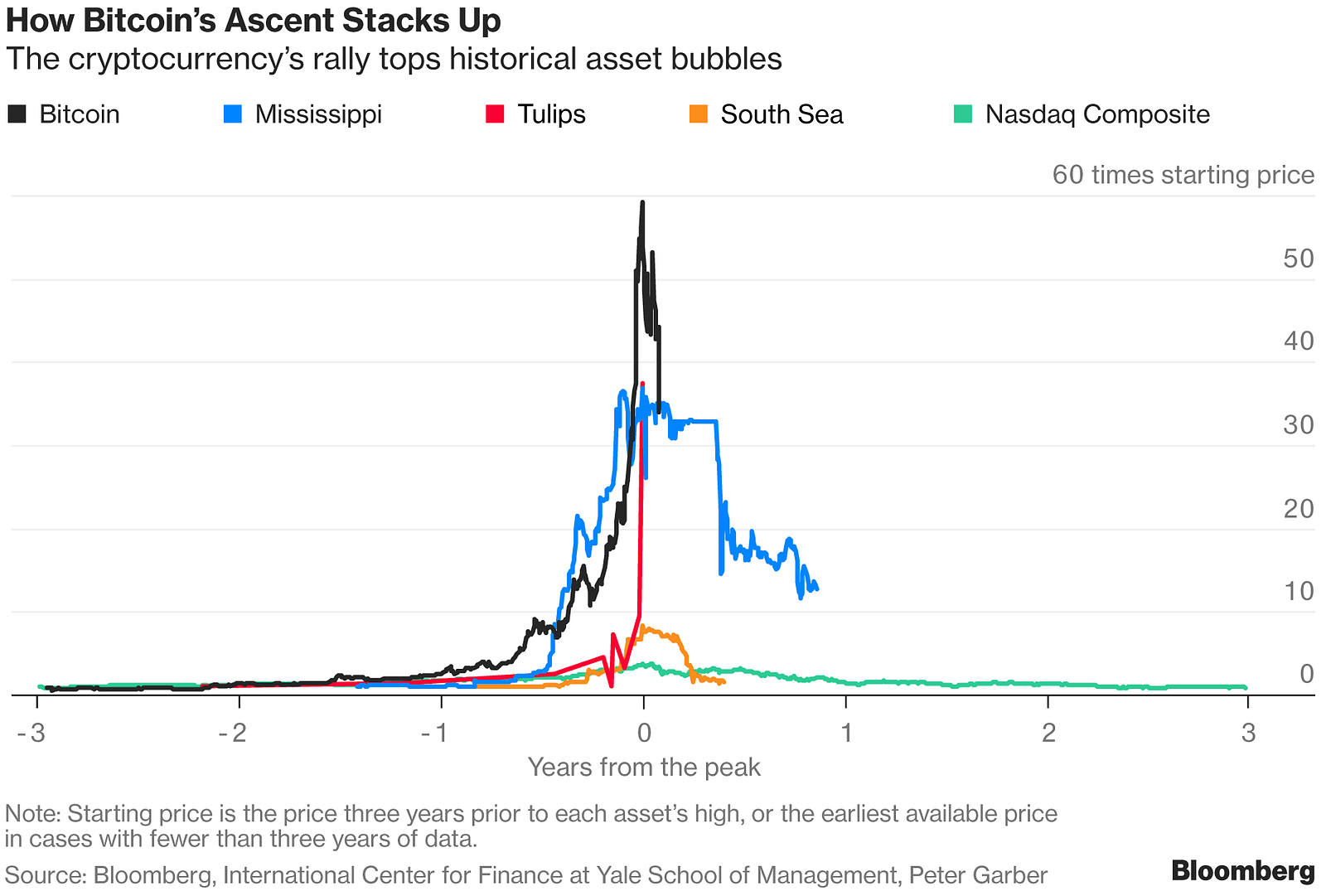

However, chances are you first heard of all this amazing stuff not from some tech head, while talking about IT systems security, but rather from another wannabe Warren Buffet, or -even worse- from the news. The pitfall was that while there was a whole new world of technological advancement in front of us, we only thought of how we can make money out of it and created the biggest bubble in history. So far…

Good idea, wrong implementation

As you probably know, the first cryptocurrency and first implementation of the Blockchain technology was Bitcoin. Bitcoin was designed to be a truly virtual currency and a means of payment. Currencies are not securities, like shares, but they do have their own price tag, the exchange rate. The number one factor that affects the exchange rate of a currency is inflation. Bitcoin is by design deflationary, due to its scarcity (only 21 million bitcoins will ever exist). Which means by design its price would move upwards, with an initial goal to become equal to the price of gold.

In a 2014 academic paper, Bitcoin was described as the “wrong implementation of the right idea”. Crazy as it may sound, Bitcoin possibly was the worst implementation of the Blockchain technology. And that’s because as a (virtual) currency, Bitcoin had to have an exchange rate, in other words, a price tag. Because of this, people unintentionally put a price tag to this technology altogether.

Shortly thereafter, Vitalik Buterin developed the Ethereum Blockchain, a blockchain designed mainly to develop decentralized electronic applications. In no way the Ethereum Blockchain’s tokens (Ethers) were meant to be used as a means of payment or a currency. Nonetheless, people, having Bitcoin in mind, assigned an exchange rate to Ethers as well and started trading them. That was one of the biggest misconceptions of modern financial history. Imagine how the world would now be, if the developers of the Internet Protocol (Khan and Cerf) had assigned an exchange rate to the Megabyte and people traded Megabytes at exchanges. 1Mb for $1.03. This sounds absurd, but it’s exactly what happened with most cryptocurrencies in circulation right now.

As if this was not enough, people started treating and trading blockchain tokens, not just as if they were currencies, but rather as if they were shares. That’s why cryptocurrencies ended up being a whole new asset class.

Déjà-Vu

Digging deeper into the financial aspect of the crypto bubble, we can find ludicrous similarities with the so called Dot-Com bubble of 2000, apart from the behavioral finance resemblance. This could have been an excellent guidance through the crypto frenzy, but can also serve as an excellent guidance for the future of both crypto and stock markets.

Back in the day, the unleashed and newly understood potentials of the Internet created a buzz. Everyone wanted to set up their online startup. In most cases, the goal was to have an online company, rather than create a viable product. The futility of this preposterous scheme was self-evident. Many entrepreneurs founded companies and then brainstormed about what their companies would do or sell. Little did they know on how to actually run a company or even how to work on the Internet.

Then, the “investors” came along. Cheap money started pouring into companies that entered stock markets at far-fetched valuations. Investors made money speculating contrary to fundamental principles of investing. It was the time of “irrational exuberance”, as Alan Greenspan, former Chairman of the Federal Reserve, set correctly at the time. More people wanted to become rich by just turning their savings to stock of some “.com” company. The bubble kept inflating.