How the Fire Industry can Influence the Future of the Internet of Things

How the Fire Industry can Influence the Future of the Internet of Things

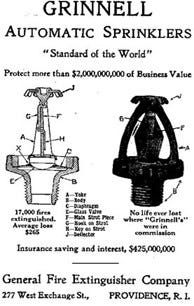

The automatic fire sprinkler has remained fundamentally unchanged since Frederick Grinnell invented the first practical sprinkler in 1882. His design was the first to use a deflector[1], which diffuses the water into a uniform spray pattern to suppress fires underneath. He continued to improve his invention, and in 1890 invented the glass disc sprinkler, which is essentially the same as the design which is commonplace today

The lack of transformative innovation in fire sprinkler design is in part due to the brilliance of Grinnell’s design, its successes in the industrial sector, but also the nature of the fire industry, which is understandably conservative, given the severe consequences of failure. This issue is multiplied by regulation and standards, which benchmark the performance and qualities of incumbent manufacturers, but invariably cause an over-reliance on widespread solutions with legacy approvals.

The framework for testing compliance is also unhelpful in the emergence of innovation, as the tests often do not explain the first principles that governed the acceptance criteria, or articulate clearly how the same result can be achieved by alternative means which would enable approvers to examine and validate the best of new technology on a level playing field.

Many regions around the world are moving towards a future where all new residential builds are mandated with installing automatic fire sprinklers. Their life-saving ability is undeniable but numerous studies estimate the effectiveness of fire sprinkler systems ranges from 70% to approximately 93%[4]. An admiral figure, but with room for improvement, when you compare them to another life safety device, say an airbag, which has an effectiveness of 99.9%[5].

In the home, sprinklers fail 1 in 9 times[6], primarily because they are largely ignored and are designed to blend in and be forgotten. 64% of failures are due to the system being shut off, other leading causes include lack of maintenance. Reliability in residential systems tends to be lower than in commercial because there is no maintenance manager isn’t risking losing their Factory Mutual claim payout due to lack of maintenance. They are also unpopular because water damage is a consequence of activation. They expel enough water to fill a standard bathtub in 5 minutes and run for up to 30 minutes[7]. The nature of the common design also means it is susceptible to leaks if heads are physically damaged and pipes must be protected from bursting due to freezing.

Solving problems, such as these, are difficult, especially in an industry where adoption of new ideas is slow, because the culture and its framework of standards makes it hard for innovation to breakthrough.

Modernisation of Insurance

A similar status quo could also be found, not too long ago, in the Insurance Industry. The business of insurance, assessing risk, collecting premiums and paying claims stem from 1861, when a group of underwriters sold the first paper policies to protect London homeowners against losses from fire[8]. This formed the basis of the model adopted by the vast majority of companies, who offered variants of the same thing, once a benchmark was established.

In an industry that’s increasingly competitive on cost, digital technologies first provided insurers with new ways of setting themselves apart from the pack. Spreadsheets, and manual inputting of data between systems, reluctantly gave way to automated software to improve accuracy and reduce bottlenecks. It was a surprisingly difficult transition to make because, often, only a finite group of people understood the legacy knowledge behind the established models, whilst others feared the risk of losing data, functionality and customer satisfaction whilst newer products were being introduced[9].

How the Insurance Industry was, draws a number of parallels, with how the fire industry is now. Take car insurance for example 15 years ago, as with fire sprinklers now:

1) A consumer’s decision to take up protection is often mandated.

2) This decision, through price comparison, was largely governed by selecting the cheapest protection.

3) The consumer would generally ignore the protection during its lifetime, but expect it to work as intended.

4) The smallest oversight from the consumer can lead to a reduced payout, or not being compensated at all when something goes wrong.

5) Poor customer satisfaction is common when the protection is activated.

In order to remain competitive, insurers have found ways to offer more compelling products that can meet the changing expectations of modern customers. Insurers have realised that there is an opportunity to change the customer-insurer relationship from one borne out of necessity when something goes wrong or when the policy requires renewal to a long-term relationship involving the exchange of data and more frequent conversations about prevention.

In Italy, this now means, 16% of auto insurance contracts now feature telematics devices, providing data that allows for pricing based on the driver’s journey instead on a snapshot of static data at the beginning of the year[10]. The use of connectivity, sensors and GPS enable following a car crash, not only invaluable information about driver behaviour to be captured, but a faster, more comprehensive claims response, with far less reporting burden on the consumer.

With the integration of technologies like Artificial Intelligence, Blockchain, the IoT and Drones entering the insurance mix, the sector is being forced to rethink its model. The market is maturing to realise that insurance technology has huge potential to revolutionise the industry with more and more mature firms investing in emerging technologies. This is not happening in isolation. Finally, we are also seeing the same glimmers of innovation in the fire sprinkler industry.

The Future of Fire Sprinklers

Watermist technology presents a unique platform on which to build this wave, because it has one fundamental benefit that makes it more applicable in homes than its predecessor. Critically, it can provide the same level of fire performance using 90% less water than standard sprinkler systems[11]. This is so important because water supply remains one of the biggest hurdles to the adoption of fire sprinklers, often requiring a commercial grade water feed or a large tank to operate[12].

There are sprinkler companies that want to deliver a greater understanding to insurance underwriters too. One possibility is having all activity relating to the fire stored in a ‘black box’ like a flight recorder, offering a chance to realise the scale of the damage and its causation, while analysing any preventative measures for the future — making insurance claims, for all parties, easier and more cost effective. Technology like this would also be able to compare relative customer risk and propensity to have a fire by the frequency of “close calls” of the suppression activation.

In the pursuit of improvement, a sprinkler company has invested in electronic fire sprinklers operated by an “intelligent” electronic detection and control system. Testing demonstrated the benefits of electronic sprinkler technology when compared to existing mechanically operated fire sprinkler technology which resulted in earlier activation and less damage, as well as requiring less water supply due to the avoidance of head skipping[13]. This effectively improving the performance potential with all its positive collateral effects which will benefit the owner as well as the insurer.

What makes the fire sprinkler so interesting is it is a sunk cost within many homes. Unlike other smart home devices which are dependent on consumer buy-in. You have to have a fire sprinkler to meet building code in many places, and in the 2999 of 3000 homes that do not have a fire in their lifetime[15], it provides no real value other than peace of mind. Admittedly, this statistics is more frequent in higher risk demographics and building categories, but utilising the sensors these dormant giants rely on to operate, mean they can provide further value and customer satisfaction.

Conclusion

The Insurance Industry is now one of the primary markets for connected and IoT devices, and manufacturers are pricing these gadgets with insurance firms’ data guiding the process. The reason this is happening is that more value can be extracted for all stakeholders. This new technology is replacing old models of risk assessment and we are finally seeing more companies begin to apply the same logic in the Fire Sprinkler Industry because it can do the exact same thing: extract higher value from a regulatory or insurance requirement. It’s these changes which will force a departure from the well-trodden platform that Grinnell inspired but hopefully, we will end up with a better solution centered around the needs and requirements of modern homes and people. This becomes more and more interesting, where the Insurance and Fire Sprinkler Industry converge and they work together to minimise risk, to minimise claims, and perform their shared function together to protect people and property.