How to list your cryptocurrency on an exchange

How to list your cryptocurrency on an exchange

So one day you woke up with a plan of creating a new coin. Then somehow you’ve forked suitable codebase from GitHub, added your unique features and even probably launched testnet and eventually mainnet too.

And now your community asking you those question over and over again.

When Exchange? When the moon? When Lambo?

You are dreaming, that you can get listed on exchanges without paying listing fees or in the worst case you can ask your community to vote.

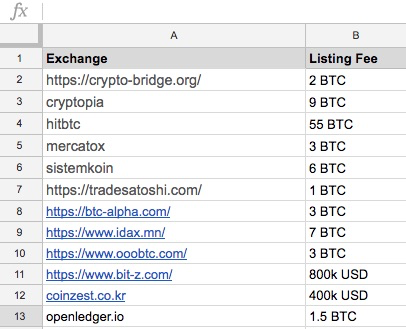

Let me ruin everything. It’s 2018. Exchanges want to get paid in real money for listing and they ask a lot. Well, actually they want BTC/ETH, not real fiat money for sure.

But wait I’ve heard rumors that few coins managed to get listed for free?

Well, probably it may happen if you are a world-famous developer like Vitalik Buterin with ETH or Pavel Durov with his outstanding Telegram ICO. Exchanges will list your coin or token for free just because they want to get some of your PR exposure and ride your marketing wave. Otherwise, I can’t imagine that any significant exchange will list anything for free.

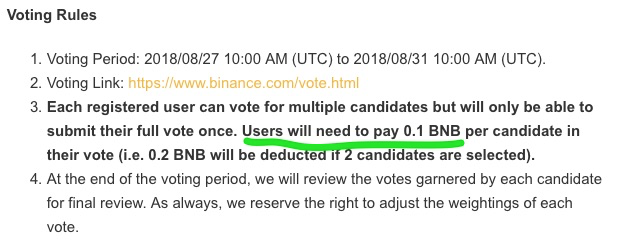

Hold on, what about community voting? I’ve seen a lot of this hustle on Twitter

The obvious winner in such community voting competitions is none other than exchanges itself. Exchanges don’t do it because they like new coins or care too much about the crypto industry. They do it because they want to get new users from your community signed up and/or eventually pay for votes.

I admit that virtually it’s possible to get listed via community voting. But competition at community votings is fierce, and a real price of winning in highly incentivized voting wouldn’t be significantly cheaper than direct listing fees.

Down to business, let’s look at exchanges

Now we are ready to think about how to get your wonderful coin listed.

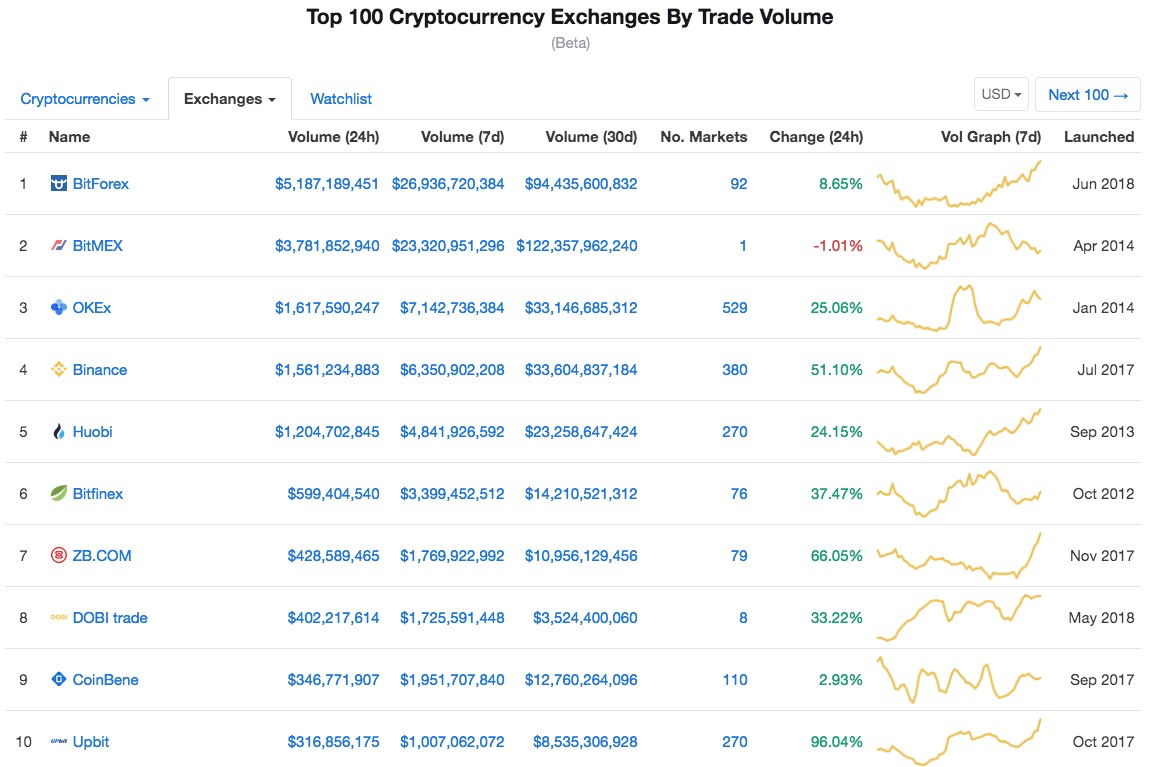

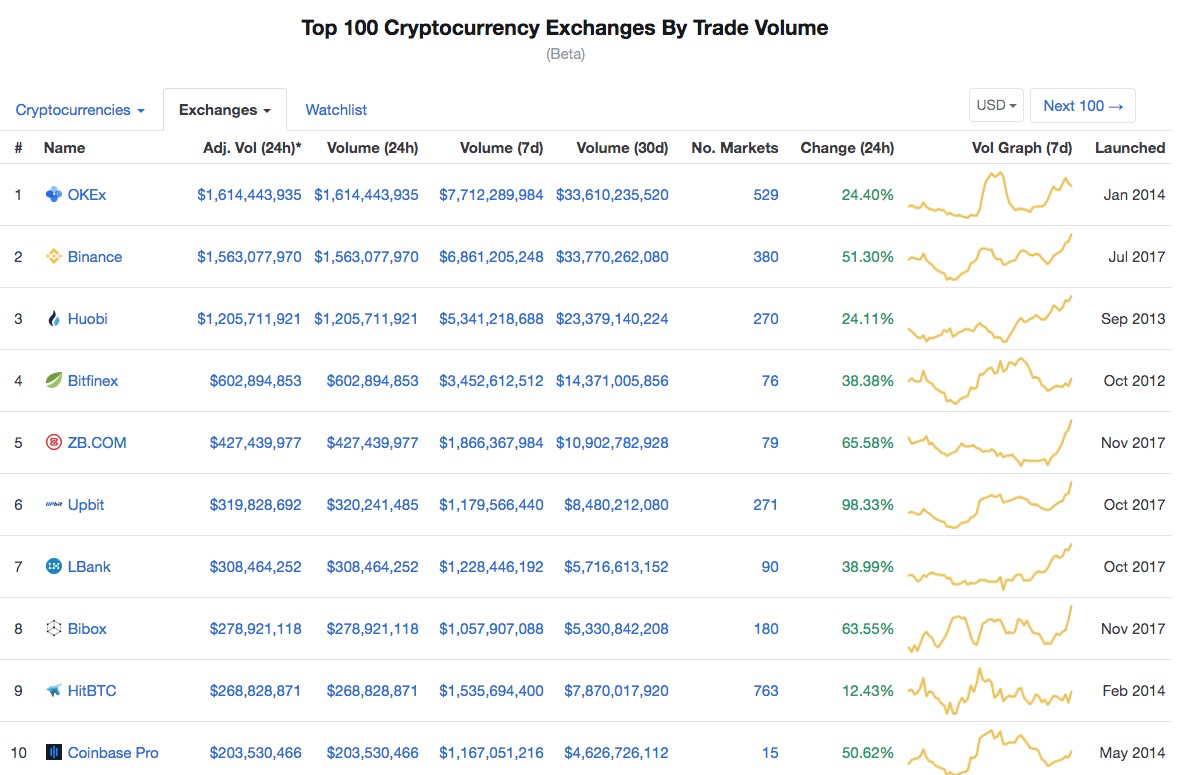

Let’s take a look at Exchanges Top at Coinmarketcap. There are two different Exchange tops on CMC, Reported Volume and Adjusted Volume:

Wondering why? Simply because most of the crypto exchanges faking their daily volume. It’s widely discussed, and I encourage you to read the great wrap up about it here, and one more here.

So when you looking for the exchange, keep in mind that daily volume, not the best criteria to compare exchanges.

Do your own research, don’t look at the daily trading volume only!

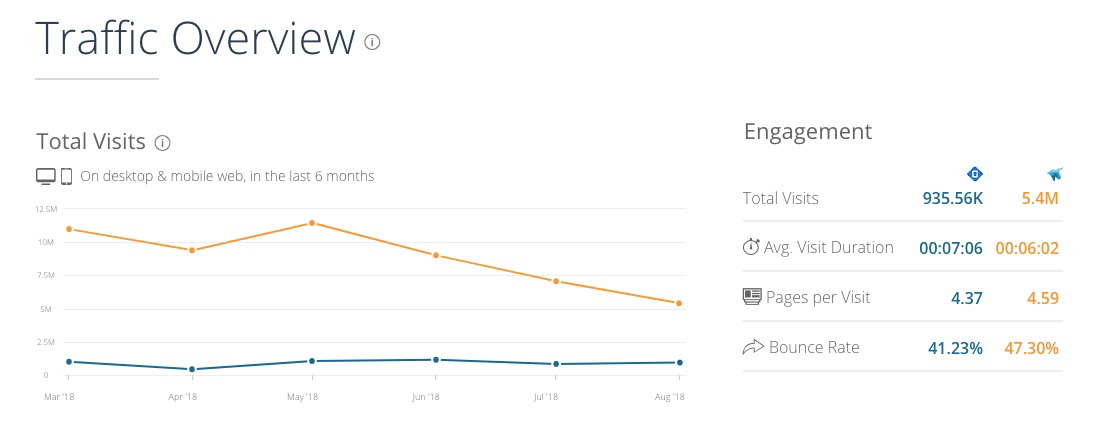

It is a good approach to check exchanges with similarweb, to get to know where is traffic comes from to exchange website and how it acquaintances with reported daily trading volume.

Here, for example, I’ve compared Coinbene (346Mil daily) and HitBTC (268Mil daily), looks strange right? Can you guess who is faking more trading volume? :)

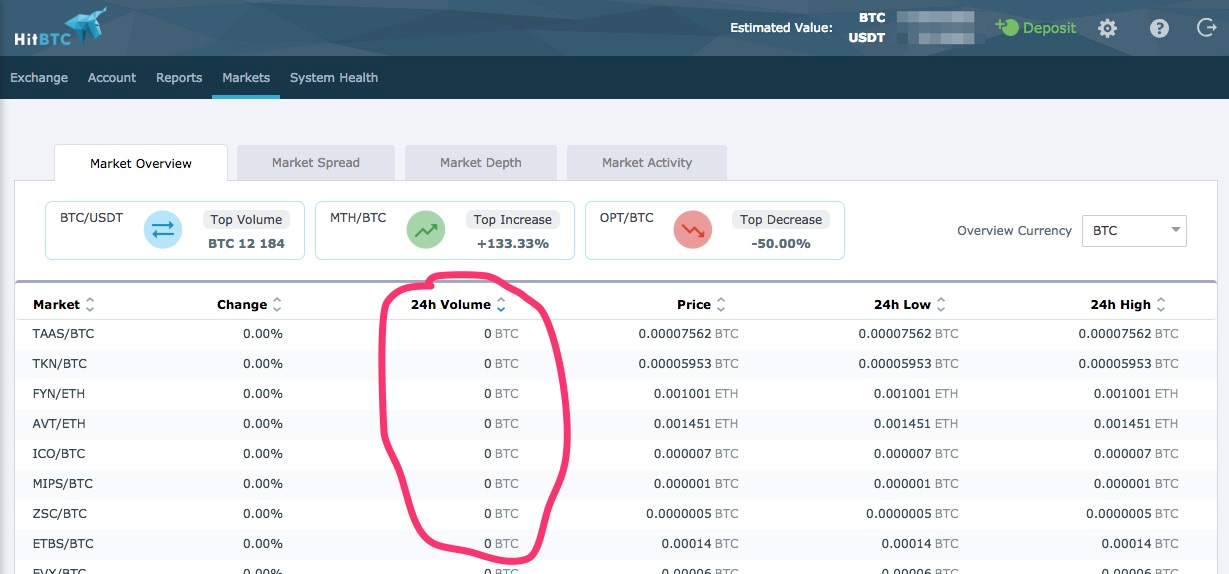

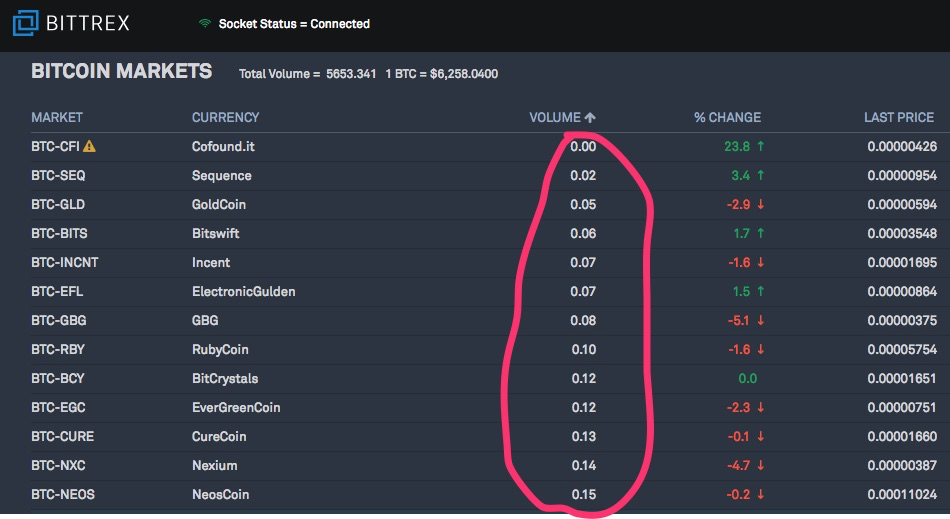

Another popular community myth that big exchange always means big trading volume for each coin listed.

Enough said, just a couple of screenshots from Hitbtc and Bittrex:

Best exchange for PoW/Minable coins

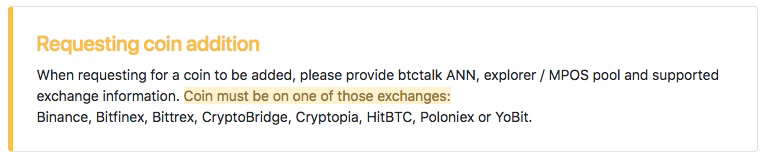

If your coin is PoW minable, you probably want to get more exposure to the miners’ community. In this case, you need to get listed on exchanges that supported by most popular mining profitability calculator whattomine.com

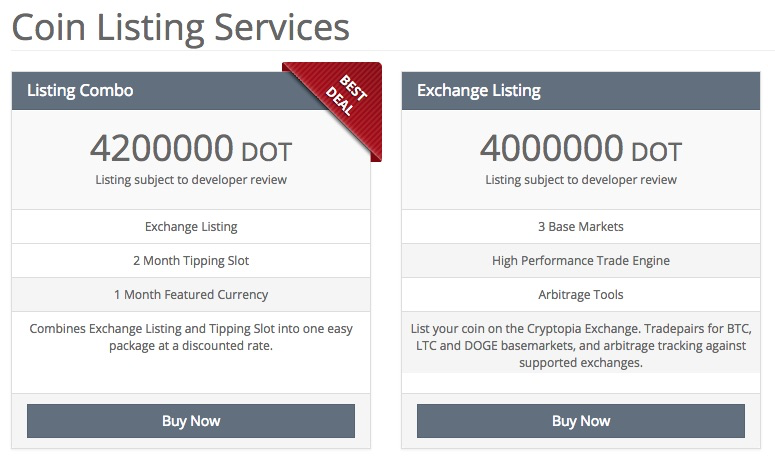

In most cases, Cryptopia would be the best choice for your first exchange listing. With listing fees about 6 BTC, Cryptopia offers the best value for money.

How to get your coin listed — step by step

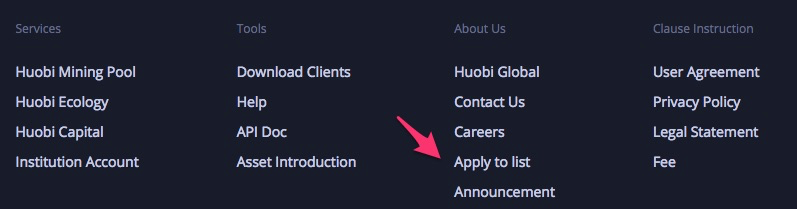

First, obviously, we need to reach exchange. Usually, exchange’s sites have “Coin listing” or “Apply to list” link at footer or business development person email at contact us.

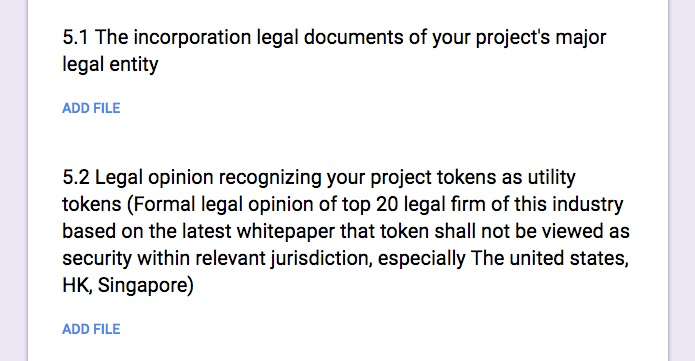

Next, you’ll find yourself filling a lengthy listing form with information about your team, community, and project description as well as technical details about your coin or token. Depends on the exchange, you’ll notice a couple of documents required:

We need Legal Entity

Nowadays, if you want to get listed on major(think, TOP 30 Coinmarketcap) exchanges you have to be incorporated company, not just topic on bitcointalk and whitepaper with your awesome roadmap.

We need Legal Opinion Letter

Exchanges won’t list tokens or coins that could be recognized as securities. So you have to find lawyers who will write a legal opinion letter for you. Most of the exchanges want legal opinion written by a law firm in the same jurisdiction as your legal entity. Here is a sample of legal opinion request from one of Top 10 exchange:

We need you to provide us with the Legal Opinion, stating that tokens are not regulated and no licensing applies. This document should contain the following parts:- Background- Project Description- Token Classification- Legal Analysis- ConclusionThese parts may vary a little. A Legal Opinion must also be verified by an attorney of the same country where your company is registered. In case if your Legal Opinion is verified by a foreign attorney, you’ll need to provide a document confirming that this attorney at law is authorised to perform international legal activities, including verification of foreign companies’ documentation.

The most popular destination for crypto projects incorporation and getting legal opinion it is Malta, Estonia, and Hong Kong.

All required legal paperwork for exchange listing could take about 2–4 weeks, depends on jurisdiction and would cost you around $10,000.

We (probably) need a smart contract security audit

If you are going to list token on the exchange, it’s most likely that you would have to provide your smart contract security audit.

There a lot of companies offering such services and a price may vary. Keep in mind that a smart contract security audit can take 2–4 weeks.

Next steps

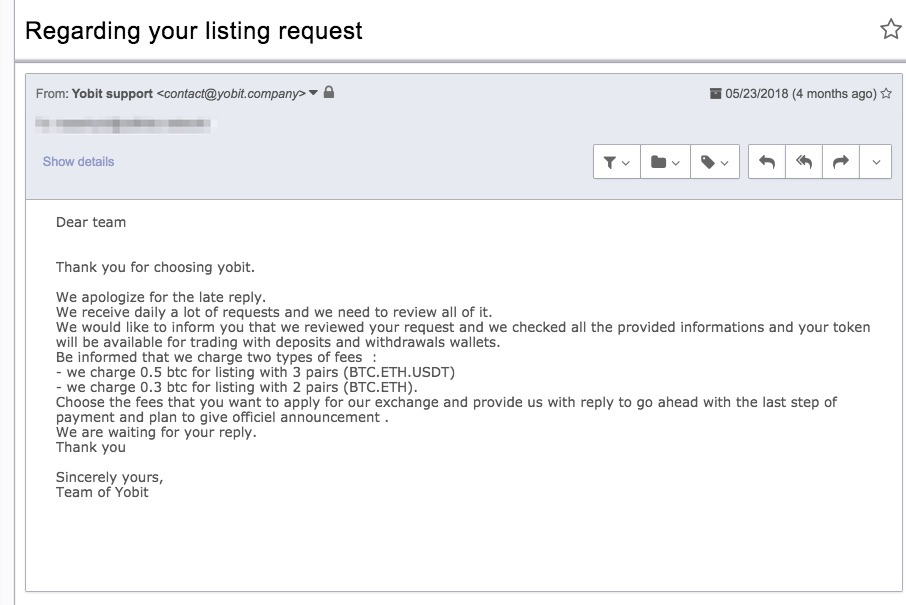

If you’ve done everything right, and exchange evaluated and approved your listing request (it may take about 1–3 weeks) you’ll get something like “ok, send us xx BTC to the wallet address 1BvBMSEYstWetqTFn5Au4m4GFg7xJaNVN2 and give us txid when ready”

Be careful, always double check email for authenticity!

It’s hilarious that exchange listings, even with lump fees as 55 BTC goes without any written contracts, with just emails “send us your BTC and pray that we’ll list your coin”.

Be prepared that exchange may change the conditions after you have paid. It’s not an uncommon practice in the wild crypto world.

Final words

If everything went well, your coin will start trading on an exchange. Worth to mention in final words that many exchanges charge for node updates. So if you have upcoming hard forks at your roadmap, start saving now to pay update fees.

Another important thing that you have to keep in mind — it’s delisting policy. Most of the exchanges will delist your cryptocurrency if a trading pair doesn’t meet certain requirements or if something critical happens with your network.