The Complete Guide to SAFEs

How SAFEs Work

SAFE stands for Simple Agreement for Future Equity. It was created by the team at Y Combinator and has been a popular method for investing at the earlier stage of a company.

At the early stage of a startup, it can be difficult to accurately assign a value to the company because there is usually very little data. That’s where a SAFE comes in to play — it’s a form of convertible security that allows you to postpone the valuation part until later on. A SAFE is neither debt nor equity, and there is no interest accruing or maturity date.

What if the company fails?

If the company fails, whatever money they have left will be returned to investors. If you’re the founder, this doesn’t mean you need to pay the money back if the company fails. The liability is on the company, not on the founder individually.

What if the company grows?

For a growing startup, the company will likely raise more money. As a startup investor, I’m not interested in just getting paid back. The risk associated with a startup is high, so I’m hoping that with high risk comes the potential for high upside. Because of this, I want my SAFE to “convert” into equity at a later stage. Basically, once someone decides to invest in the company in a “priced round,” my SAFE will turn into shares in the company.

If I invest $20,000 through a SAFE, the company will then use that money to build the company. But $20K doesn’t go that far. So once they make some progress, they may want to raise more money. Let’s say they find an investor that wants to buy 20% of the company for $2M. If 20% of the company is worth two million dollars after they invest, that means the post-money valuation is ten million dollars.

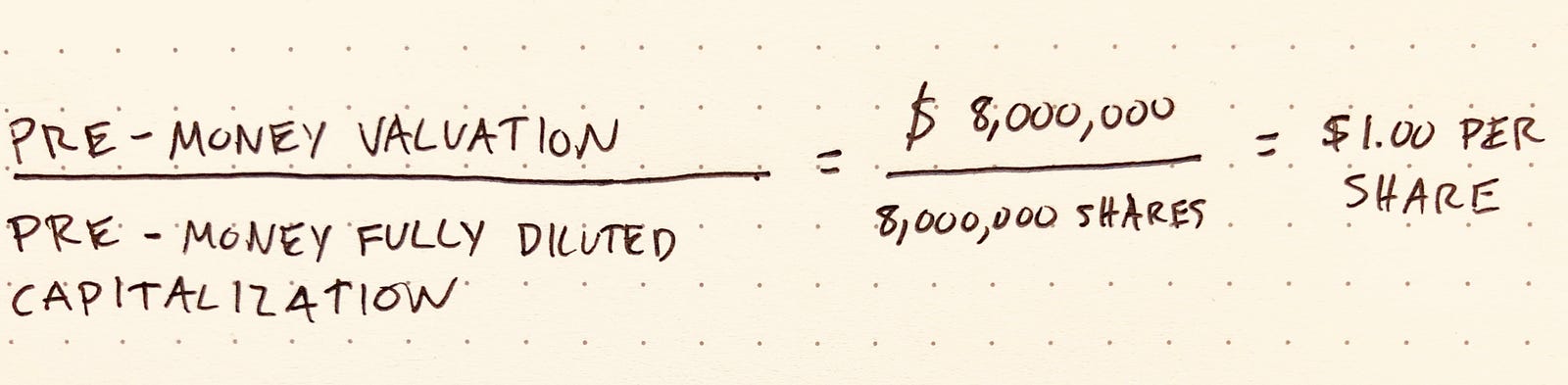

So if we assume for simplicity that your company had 8,000,000 shares before the $2,000,000 financing, we can calculate the new price per share.

Now that we have a $1.00 price per share, we can now do the conversion of the $20K SAFE. Assuming there was no cap or discount (we’ll explain those in a minute), my $20K SAFE will turn into 20,000 shares in the company.

Terms of a SAFE

SAFEs have a few common terms that can change how they convert to shares in the company. The main four terms I’ll go over are discounts, valuation caps, most favored nation provisions, and pro rata rights

At Dorm Room Fund, we invest using uncapped SAFEs with no discount. This means that when the SAFE converts to equity, the founders end up with more of the company than they would if there was a cap or discount. If the new investors are buying shares at $1.00, so is Dorm Room Fund.

Using the hypothetical scenario from above, your cap table will look like this after a VC invests $2M, and you have a $20K SAFE from Dorm Room Fund that has no discount and no valuation cap.