An Update on Bitcoin Cash

An Update on Bitcoin Cash

Written by: Sherwin Dowlat / Lukas Schor of The Argon Group

The Scaling Debate

The Bitcoin community has known about transaction capacity limitations for several years now, with transaction frequency limited to ~3 per second as a result of its 1mb max block size set forth at creation. As the network began to feel the constriction of the 1mb block size capacity earlier this year, the block size debate heated up. One part of the community felt that increasing block sizes (or on-chain scaling) would be the proper solution, while the other felt that saving space via Segregated Witness or “Segwit” (which allows for transaction data restructuring and off-chain scaling solutions, such as the Lightning Network) would be the best choice. As a result, the community split into “big blockers” (most prevalent in the reddit community

Originally, Segwit adoption was poor and the community reached an agreement (dubbed the NYA agreement) to implement Segwit as long as it would precede a block size increase to 2mb (hence, Segwit2x). But when the deadline for the Segwit2x fork approached this November, the NYA subscribers called it off, citing weak support for it from the community.

Birth of Bitcoin Cash

The Bitcoin Cash fork occurred on August 1st, initiated by ViaBTC, in order to create an alternative scaling solution for Bitcoin. This was in line with the “big blocker” mindset, which were not particularly happy with the Segwit2x compromise. Ultimately, Bitcoin Cash (BCH) differentiates itself from Bitcoin (BTC) by allowing for a max block size of 8mb (versus 1mb in BTC) and an altered Emergency Difficulty Adjustment rate (which adjusts difficulty quicker than BTC, in response to the time it took to find a specified amount of prior blocks). Since the fork happened in August, Bitcoin Cash exists as a separate chain with a minority following besides the Segwit Bitcoin chain.

Notable (and very powerful) entities of the Bitcoin Cash community are:

- Bitmain — This is the Chinese ASIC-miner manufacturer which owns AntPool, the world’s largest mining pool with 23% BTC hash power.

- Bitcoin.com — The CEO of Bitcoin.com, Roger Ver, is one of the most prominent representatives of the Bitcoin Cash movement.

Advantages: Because Bitcoin Cash allows for larger block capacity, more transactions can fit in each block and ultimately lead to quicker block times and cheaper transactions. Additionally Bitcoin Cash’s more flexible difficulty (which was updated to be even more dynamic this week) incentivises miners in a way that in order to guarantee the consistent mining of new blocks.

Disadvantages: As a result of the larger block size, higher levels of mining and storage equipment are required to run a node. The greater barrier to entry could lead to mining centralization. Additionally, with a smaller, more concentrated amount of nodes running the network (and effectively being less “decentralized”), vulnerability to collusion/manipulation increases.

Current developments

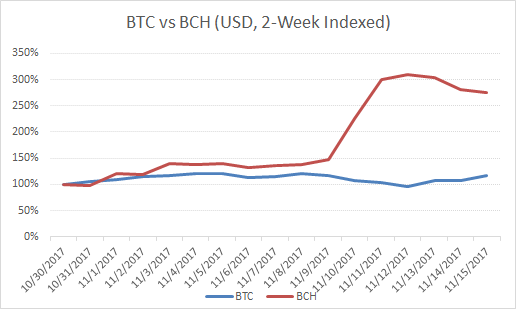

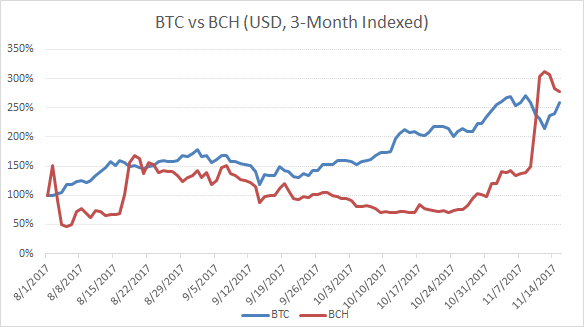

Shortly after the Segwit2x plan was cancelled, the market cap of Bitcoin Cash increased significantly. The liquidity in the market and the volatility of BCH was enormous and caused many Bitcoin investors to hedge their holdings against a potential “flippening” by buying into BCH. By far the largest amount of liquidity has come from the Korean yuan (specifically the no-fee Bithumb exchange). In total, the BCH/KRW trading pair accounted for ~⅓ of total BCH volume last weekend. This is in-line with the development in the past months, where the vast majority of speculative volume has shifted from Chinese exchanges to South Korea. This is due to the Chinese Government braking down on the cryptocurrency market earlier this year Japan embraced Bitcoin and cryptocurrencies and set in place regulatory structures and guidelines.

Although a large amount of volume came from South Korea, the volume traded worldwide in the BTC and BCH pairs in the 24 hours around this event (~$11b) was substantial. As a reference point, BTC + BCH volume was ~⅔ of the daily average volume of SPY, 1.2x that of FANG (FB+AMZN+NFLX+GOOGL), and 12x that of gold (GLD).

Rumors have circulated recently that Bitcoin Cash has been subject to manipulation by key figures such as Bitmain’s Jihan Wu and Bitcoin.com’s Roger Ver. According to these accusations, Segwit2x was a facade, intended to allow BCH to escape attention. This would have allowed to accumulate BCH at a cheap price until, after the 2x call-off, when it can be propagated as the true scaling solution for Bitcoin.

Despite this, we note that a meaningful portion of the BCH action could be attributed to the migration of the “big-block” community moving over, in support of BCH’s on-chain scaling proposal now that Segwit2x was off.

To understand the economic reasoning of having these two Bitcoin networks, we first need to understand the utility which the concept Bitcoin tries to achieve. This utility consists of being a store of value and medium of exchange.

Store of value or “digital gold”

Essentially, stores of value are items where the value does not decay over time, but can in fact increase. Arguably, the intrinsic value of Bitcoin lies in its function as a store of value. Meaning, it is an asset that is not heavily correlated with most other assets and can therefore be used to hedge someone’s wealth against the general market development and retains purchasing power into the future.

In order for a digital currency like Bitcoin to achieve being a store of value it must show the key properties durability, portability, intrinsic value and unit of account. Bitcoin is a good (though far from perfect) fit to become a sustainable store of value, as it is technologically and economically designed to meet most of these requirements.

- Durability: Because Bitcoin is built to be immutable and not controlled by a central institution, it is protected against many malicious attacks and hackers. As with any security, there may be weaknesses related to counterparty risk, such as storage on central, third-party institutions like exchanges.

- Portability: Transferring big sums of money is difficult as this needs a high level of security and high import taxes in some countries, such as India. Bitcoin makes it much faster and easier to securely move a lot of value worldwide.

- Intrinsic value: Bitcoin’s utility as a store of value is dependent on its utility as a medium of exchange. We base this on the assumption that for something to be used as a store of value it needs to have some intrinsic value, and if bitcoin does not achieve success as a medium of exchange, it will have no practical utility and thus no intrinsic value and will not be appealing as a store of value. Read more

- Unit of account: A unit of account is something that can be used to value goods and services, record debts, and make calculations. Bitcoin/dollar volatility has averaged almost seven times that of gold in 2017, which makes it not suitable as a unit of account. Even merchants accepting Bitcoin as a payment option measure the value of the goods in the standard fiat currency and only at the very end convert the price into Bitcoins.

Medium of exchange or “digital cash”

Bitcoin aims to be not only a store of value, but also a peer-to-peer payment solution or medium of exchange, partially because (as we’ve seen above) it is the necessary utility which legitimizes the use of Bitcoin as a store of value in the first place.

Fees, bitcoin wants off-chain solutions like lightning network, atomic swaps or micropayments etc.

Roger Ver, CEO of Bitcoin.com (one of the loudest voices in the Bitcoin Cash community), argues, that in order for a digital currency to truly become a store of value, it also needs to be a medium of exchange. He states that all other “stores of value” assets like gold, property and art have a “use-value”. He goes on, saying that with the current technical disadvantages of Bitcoin (mainly high transaction fees and slow confirmation times) it loses its prior use as a medium of exchange. Through the bigger block-size of Bitcoin Cash it can guarantee the function as “digital cash” and therefore, in the long run, will also take over the position as the main store of value from Bitcoin.

But there is actually a bigger case to be made here. No matter if the fees are low and transactions are fast, it is still more than unlikely that Bitcoin can ever achieve to be a sustainable medium of exchange. This mostly comes down to its deflationary nature. If a currency in deflationary, the currency owners are less likely to spend their coins as they continue to grow in value by holding. Bitcoin owners would end up holding (or even hoarding) their coins which reduces the supply of Bitcoins in the marked driving the price even higher. This is known as the deflationary spiral and it is the biggest nightmare of any central bank as it ultimately results in the destruction of the currency and the underlying economy.

Bitcoin vs. Bitcoin Cash

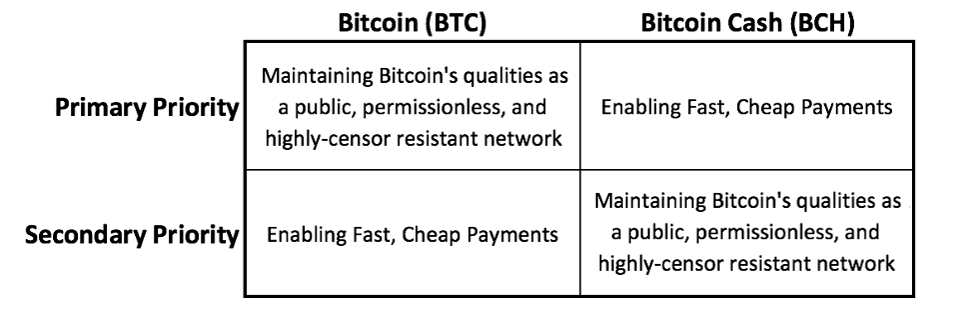

In the end, the difference between both Bitcoin networks comes down to prioritization of properties. While BTC is focused on maintaining public, permissionless and highly-censor resistant (all important qualities of a store of value), BCH prioritizes on enabling fast and cheap payments.

Both approaches are aiming to achieve both, being used as a payment solution and as an asset that stores wealth. As seen above though, we doubt that the former is achievable based on the economical mechanisms of a decentralized and limited currency.

Bitcoin still has the same fundamental economics which make it a store of value or “digital gold”. But there is the counter argument, that the function as a store of value can only be sustained if the currency is also used to buy products and services (because Bitcoin does not have any other preliminary use case or “intrinsic value” like gold which can be used in jewelry or electronics).

What’s next?

We can conclude that from this perspective there are three different outcomes to the Bitcoin Cash situation:

BTC = “Digital Gold” (and “Digital Cash”)

Bitcoin manages to remain the main store of value. Through future (second layer) scalability solutions it will be able to regain its use case as a medium of exchange. Or Bitcoin might end up being solely a store of value cheap & fast transaction. In this case Bitcoin Cash will loose attention and probably continue existing as a minority chain similar to Bitcoin Gold.

BTC = “Digital Gold”, BCH = “Digital Cash”

Another outcome could be that the use cases are split between BTC and BCH. While Bitcoin remains the go-to asset to store wealth, Bitcoin Cash might end up being a more attractive for payments / transactions. In this case, both networks are able to coexist and both are legitimate parts of the digital currency ecosystem. This might be comparable to the Ethereum / Ethereum Classic situation.

BCH = “Digital Gold” and “Digital Cash”

Finally, Roger Ver could end up being right that only if Bitcoin is a suitable payment solution, it will also be a sustainable store of value. In this case, BCH would replace BTC over time, if BTC is not able to find and implement the right off-chain scalability upgrades.

Conclusion

At this point, any predictions are mere speculation. There are an unlimited amount of factors playing into the future developments of Bitcoin and Bitcoin Cash as well as powerful parties wanting to achieve different outcomes based on their individual economic interest.

We at The Argon Group see Bitcoin Cash (BCH) as a viable hedge against potential outcomes as discussed above and as an alternative on-chain scaling solution for the off-chain approach taken on the Bitcoin (BTC) chain. We will continue to follow the developments and will push an updated analysis should there be any new findings.

To get future updates, follow us on…

Dig deeper into this topic

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be an investment advice.