The resolution of the Bitcoin Cash experiment

Is Bitcoin Cash the Real Bitcoin?

There is something very wrong with Bitcoin Cash ABC and its “community” today. There is too much misinformation out there, and people seem too willing to believe anything if it comes from some influencer guy who they see as “respected by the community”, even when they have no idea why they are “respected by the community” in the first place.

In this article I will explain what ABC has irreversibly turned itself into:

- Censorable

- Centralized

- Unstable

- Death of “Permissionless Innovation”

- Anti Bitcoin Maximalist

I hope my perspective will be helpful for many application developers out there who are still confused about what they should do going forward.

Rid yourself from social obligations and social pressure. If your ideas are influenced by your employer, social clique, or by your past behaviors, try to be aware of this and think independently. You have choice. You can even leave your job and get a new one if you realize your employer doesn’t stand for what you signed up for when you got into Bitcoin.

Just think about WHY you are here in the first place.

That said, what IS wrong with Bitcoin ABC?

1. Censorable

Here’s a serious issue most ABC supporters seem to deliberately ignore out of cognitive dissonance, or because of misinformation.

Bitcoin Cash ABC has effectively become censorable. Yes, the very quality Bitcoin stands for — “censorship resistant money” — is dead on the ABC chain. you just can’t see it yet.

The manner in which the centralized checkpointing was executed throughout the “war” should be a serious risk to any developer considering building on top of Bitcoin ABC.

This whole scheme of centralized checkpointing was powered by a cartel of crypto exchanges behind closed doors. This is not only immoral (in terms of Bitcoin’s morality), but potentially illegal AND makes the coin vulnerable even in the real world sense. And it is this “real world” aspect I would like to discuss, since this is a very real risk. Morality is subjective, but risk is real.

Here’s a recorded livestream video where they explain, step by step, how this “capture the ticker mission” was accomplished by a cartel of ABC developers and crypto exchanges (instead of through Proof of Work):

What’s interesting about this centralized checkpoint is that it provides both the reason AND the means for a powerful adversary to take down the network in the future. They simply need to attack the associated ABC cartel, leveraging the centralized checkpoint to do whatever they want to the chain once compromised. And you wouldn’t even know what went on as a user.

Of course I can already hear many people saying “Shut up you shill, that’s all just theory and is unlikely to happen!”, but if you know anything about crypto or security, the rule of thumb is to be always paranoid than sorry, because crypto never forgets. And blockchain never forgets. A vulnerability once created never goes away.

Another rule is, where there is vulnerability there will be exploit. This is inevitable. It’s just a matter of when. If you don’t believe me, just ask Ethereum, their infamous DAO hack vulnerability had been known for a while but nobody thought it would actually happen for whatever reason.

Until it did.

Remember, if it can happen, it WILL happen, especially if it’s related to money and security.

Another lesson we can learn from Ethereum’s DAO hack is how the Ethereum team handled the hack afterwards.

Instead of moving on without messing with the economy, the core Ethereum team and the insiders decided to “bail out” the casualties of the hack, thereby saving some of the “important early members” of the Ethereum community.

This is why ETH and ETC (Ethereum Classic) split into two. ETC made up of people who believed in the principle, and ETH made up of people who have made a compromise. This demonstrated how a centralized protocol development team can play Keynes and roll back the ledger through powerful oligarchic actors conspiring with one another.

And this is where a lot of early Ethereum investors lost faith in the project.

It had turned into crony capitalism, as can be seen in the excerpt below:

I hope some of you are starting to see the parallels by now.

So, after all this, obviously I don’t feel comfortable building my entire infrastructure empire on top of something that can be seized by various unknown gatekeeper adversaries without me even realizing what’s going on.

Maybe not today, maybe not tomorrow, but if it can happen, it WILL happen, even if it’s after decades. It’s just a matter of time. That’s NOT sound money. It’s money with insecurities.

Ask yourself: Why would I want to build on something that can go down or be manipulated just like that one day? I am building something that will last forever, so this is already game over in my eyes.

2. Centralized

There are many aspects of centralization, but here I will only discuss the “protocol development centralization” which ABC has finally achieved through this war.

In the past you may have heard some anti bitcoin cash people criticize how “Bitcoin Cash development is centralized”. To be clear, this has never been the case, at least until this “hash war”. There were plenty of developers working on multiple implementations that follow the same Bitcoin Cash protocol, such as Bitcoin ABC, Bitcoin Unlimited, Bitcoin XT, Bitprim, Flowee, etc.

But today, while these multiple implementations still DO exist and may even look like they are doing fine, they will only exist as ghosts of their past.

As of today, no one can deny the reality that the only client that has the ultimate power in Bitcoin Cash is Bitcoin ABC. Everyone else has become decimated to the point where they simply function as a “follower client”. ABC doesn’t even need to discuss anything with the other teams. They can simply add new features arbitrarily in a “permission-less” manner, and push it out.

You can see this in action with the last couple of releases where ABC has added adjustable checkpoint system (with a default of 10 blocks) WITHOUT even consulting any other developer team. You can watch the outrage over at Bitcoin Unlimited forum:

There’s an internal conflict going on there — those who are too deep in the game with ABC that they fail to see the problem, and those who are calling them out — but I don’t think this will have any effect because these people have no influence under the new Bitcoin ABC puppet state regime.

3. Unstable

Bitcoin ABC is no longer “sound money”. There are so many things, but I’ll just list out a few that make it a dealbreaker for me:

First, these various reactionary “amendments” written into the constitution of Bitcoin Cash in order to defend against some imaginary attacks from Bitcoin SV that may or may not have even existed should be a huge red flag. The war started last week with version 0.18.1, but after just a week it’s already at 0.18.5. And according to their development repository, they’ve already finished 0.18.6 last week. So we’ll probably see another release soon.

Second, these amendments have added needless technical debt and serious security vulnerabilities, which is why they’ve been releasing patch after patch — to fix the bugs they introduced with the patch before. The reckless rapid fire releases resulted in the network being split among multiple nodes, each with different versions of rules (I’m only talking about ABC clients, imagine what this means for other clients like Bitcoin Unlimited who have to keep up with following these patches every day to stay in the game. And as far as I know, Bitcoin Unlimited was the only client that has even attempted to follow ABC’s continuous delivery).

I think these “follower node” developers (Bitcoin Unlimited, etc.) may have some irrational hope that this power dynamic will change somehow in the future, but this time it’s different. You’ve lost the moment you let ABC upgrade with a centralized checkpointing system and conspire with external actors to execute on their goal. You have not given power to ABC, but to external centralized actors.

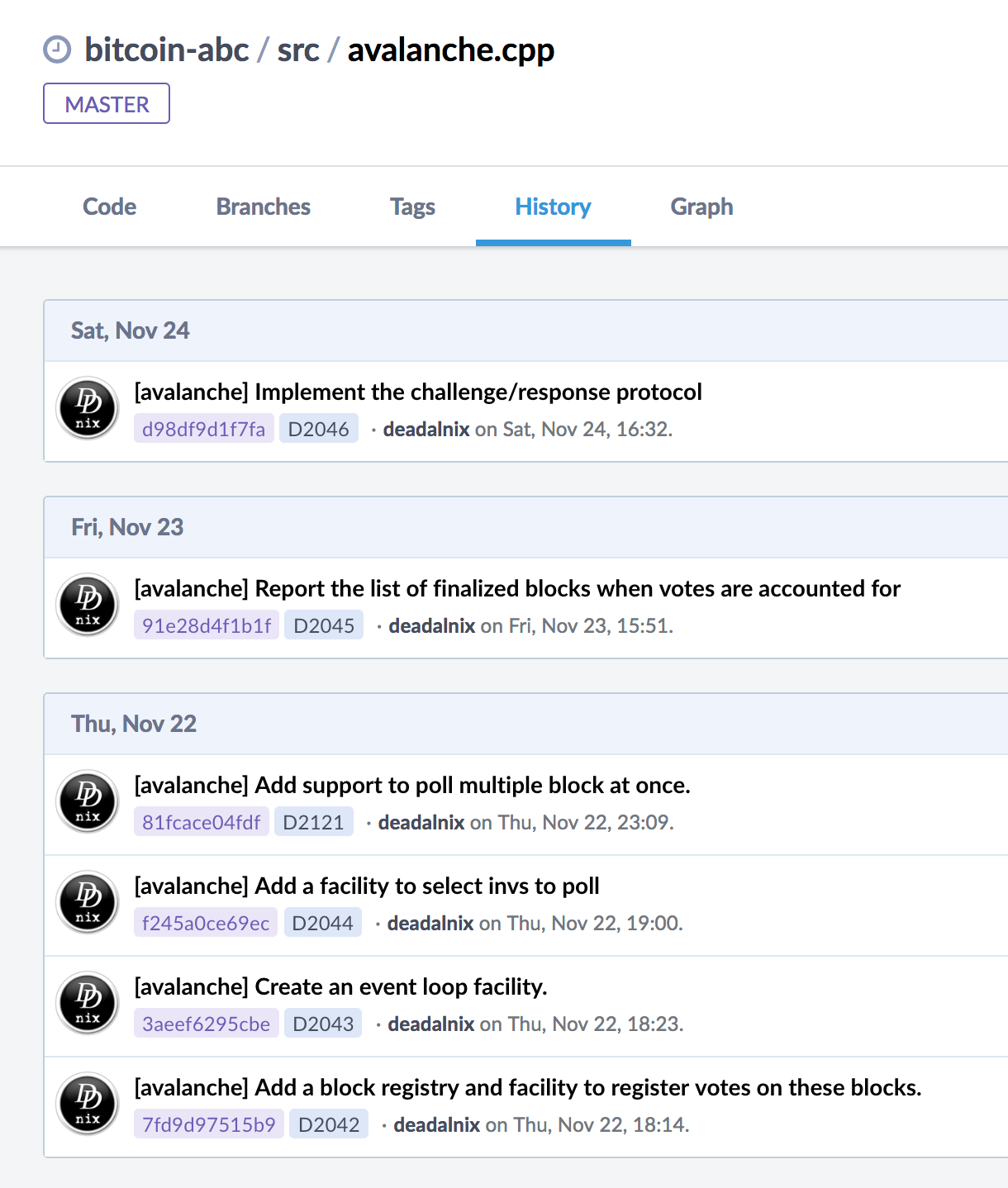

Lastly, now with Bitcoin SV gone and no one to provide checks and balances, they’re happily adding all kinds of bells and whistles to Bitcoin. For example, here you see the code for Avalanche — also known as the infamous “Pre-consensus” — on their master branch.

I know many ABC supporters will say this is not really a big deal because it’s “just being used for mempool synchronization”, but you have no idea what kind of economic implication this will have. Economics is subtle, this is why classical and Austrian economists always say “When in doubt, Laissez-faire”. Things like this is what’s called “Keynesian” and ABC is working very hard to achieve that status.

Unlike changing the block size limit, something like Avalanche changes the entire dynamic between the mempool and the blockchain, which is directly related to miner’s incentive, and one would be lying if he claimed to know exactly how this will turn out economically.

The first time Europeans brought gold from their foreign colonies they had no idea that would cause inflation. They just thought they would become rich. Obviously, you have more gold you become rich, right? And they did become “rich”, in the short term at least. But then inflation happened, and nobody knew what was going on.

Same with Bitcoin. Just because mempool becomes faster, doesn’t mean you’ve succeeded. If the mempool synchronization becomes 1000 times faster but it completely messes up the economics of Bitcoin, it’s effectively a useless ledger. Congrats, you can now experience its uselessness 1000 times faster.

And don’t forget, this is not something you can just complain about and it will go away. This Avalanche feature was the main reason why this entire “hash war” happened (also known as “pre-consensus”):

ABC can’t give up on this feature because if they do, then it will be admitting they didn’t know what they were doing. And that will mean they have lost everything for nothing. This is why they will very likely go ahead with this, and when this happens, one of the two scenarios will happen:

- The “community” follows blindly so as not to rock the boat (Just like how the entire BTC camp is betting on Lightning and choosing to ignore all the red flags)

- Some may DEFINITELY not like the change and decide to fork off again, therefore reversing adoption one more time (See the Bitcoin Unlimited forum for the early signs https://bitco.in/forum/threads/gold-collapsing-bitcoin-up.16/page-1301) But too late, ABC already has added all kinds of baggage and will have added even more by the time you realize you need to fork off.

Well, good luck to you, and I wish you the best with your coin, but either way it’s too unstable, and this is not Bitcoin.

And I only build on Bitcoin.

4. Death of “Permissionless Innovation”

One of the talking points of Bitcoin ABC camp has been “Permissionless Innovation”. Ironically, Bitcoin ABC is no longer a place for “permissionless innovation” either.

While everyone on team ABC seems to be very happy that they got the BCH ticker and proudly say the war was over even before it had started because of their coordination with the exchange cartel, they don’t realize it is EXACTLY this point that makes Bitcoin ABC a deal breaker for any pragmatic application developer.

They have effectively turned themselves into crony capitalism blockchain.

What ABC has done by very successsfully pulling off this “capture the ticker” mission is they have demonstrated a textbook example of how a protocol developer can conspire with outside actors (a cartel of exchanges and centralized miners) to enforce centralized consensus, and do it so effectively that it even overrides the competition with a decentralized hash power. There exists no checks and balances, only the illusion of it.

This is pretty scary if you think about it. I know many people are afraid of centralization, but this is worse than centralization because it has the illusion of decentralization to the public yet it is centralized where no one can see it.

At least in centralized platforms they are completely transparent about their centralizedness, but crony capitalism looks just like capitalism to the outside world and crony decentralization looks just like decentralization to the outside world.

This means now you have to play politics and play nice with exchanges, miners, and the companies that control access to these actors such as Bitcoin.com, Bitmain, and Bitcoin ABC— they are effectively the consensus makers.

It is exactly like the world you live in today, full of corruption. And Bitcoin was supposed to fix that.

I don’t want to invest my time and resources working on a platform that can easily undermine my “permissionless innovation” anytime. For example, if you happen to build anything that competes with wormhole, expect it to get sidelined in various subtle ways, so subtle that you won’t even realize it until it just hits you in the form of an ABC protocol update.

As an application developer, whatever you build can be overridden by this opaque cartel, just like how Twitter can always steer their “open API” to block their potential competitors from competing on equal terms on Twitter. (See Meerkat vs. Periscope)

And what’s worse, the users will not even care that you’re dead, they will witch hunt you and even try to silence you because they don’t want to stir the pot and make the coin price go down. They will prefer the gatekeepers just win the war and carry on with no hiccup to the outside world. You can already see a glimpse of this in Reddit r/btc today.

I signed up for Bitcoin Cash because it was the only open platform that fit my vision. It was the only truly open platform where an pseudonymous person like myself could just build things for the world and be judged by what I build, instead of having to attend offline events and hackathons, “making friends along the way”, and playing politics to get ahead.

But now in order for me to operate in this new reality of ABC regime, I will need to play nice with bitcoin.com, bitmain, and several exchanges who effectively own the chain. Even if I do play politics, suck up to them and gain influence, this is all illusion because ultimately these gatekeepers are the ones with all the power to morph the protocol at will anytime if it makes sense for them.

This is EXACTLY the thing that needs to disappear from the face of earth, and Bitcoin was supposed to be the solution.

If you’re a bitcoin application developer, regardless of which position you’ve been taking until now, step back and think about this for a moment: Do you feel the need to play nice with team ABC, Bitmain, and bitcoin.com in order to “get ahead”? Is this what you’re already doing because you think that’s the road to success? If the answer is yes, then you’re doing it wrong. That means it’s no longer “permissionless innovation”. You are already assuming permission.

Google didn’t need to be friends with Tim Berners Lee, neither did Facebook. They just built something valuable. And people came. That is not possible with ABC anymore.

5. Anti Bitcoin Maximalist

I am a Bitcoin Maximalist. I am NOT building for the world where there are millions of happy little coins happily playing nice with one another like a bunch of hypocrites and going nowhere.

If I believed this was what Bitcoin was, I wouldn’t have wasted my time building any of the infrastructure I have built, such as BitDB and Bitsocket. I have better things to do with my life.

The biggest problem I see in Bitcoin ABC camp is that these people have no interest in seeing Bitcoin become the single ultimate currency for the world. Here are the things I’ve picked up so far:

- They think Bitcoin Maximalism is “dumbshit”

- They think Proof of Work doesn’t scale

It’s an extremely irresponsible mindset coming from a core protocol developer towards all the investors who are betting on them for the success of the currency.

“I want my coin to co-exist happily ever after with millions of other shitcoins”, said no investor.

Dear investors, do you really want to bet on a coin where the very developers who work on it not only don’t believe it will be the only coin that will dominate the universe, but think it’s “dumbshit” to think that way?

There is only one king. And that is Bitcoin.

I have been working on two important infrastructure projects in Bitcoin Cash. They are:

- Bitdb: NoSQL Database for Bitcoin

- Bitsocket: Realtime Message Bus for Bitcoin

And the fundamental assumption of these projects are:

- There will only be ONE ledger

- Proof of Work Works

- Bitcoin Scales Infinitely

Here’s a quote from the “What chain does BitDB support?” in BitDB documentation where I make this very clear:

It’s important to note the main assumption of BitDB is that the base layer has the potential to scale on-chain infinitely, without sacrificing security provided by Proof of Work.