Crypto: this is how the Dollar dies

Crypto: this is how the Dollar dies

Venezuela is the latest country succumbing to runaway inflation. Venezuelan President Maduro waived his wand, magically cutting 5 zeroes from their currency in order to make it appear, you know, more normal.

And now President Maduro is introducing the first of its kind nation-state crypto, the oil backed cryptocurrency,

When traveling through South America a year ago, wherever I went I met Venezuelans — in Chile, in Peru, and especially in Ecuador, so many Venezuelans working behind the counter, in bars, on the street, at the hostels I stayed at. They took any job and seemed thankful to even have one.

These are the lucky ones.

But even the “lucky ones” had stories to tell. I met a Venezuelan who was a technician who serviced medical equipment in the local hospitals near Banos, Ecuador. I met him in an English style pub at the corner of the main square. He told the following story:

“A gang of men broke into my family’s house, blindfolded and tied up myself and my parents and held guns to our heads. They stole all of our money, and drove off in our two cars. I told my parents the day after that I had to leave Venezuela…”

When money becomes worthless, first comes the stealing, and then the violence erupts.

Switch “US” with “Venezuela” and “Bolivars” with “Dollars” and you can get a sort of preview of what is to come.

If Bitcoin use becomes more ubiquitous, starts to be used as easily as normal fiat currency, such as US dollars, then the value and use of the dollar will decline. The US dollar will follow Venezuelan level inflation because of the introduction of a technologically superior currency.

- Deflationary

- Fixed

- Decentralized

- Not owned (and manipulatable) by a single country

- Mathematically fixed supply (21 million)

- Borderless

If I asked the normal person on the street: would they rather have 100 bitcoin, or 100 dollars, what would they say? Well, they’d probably look at me blankly, because they simply don’t know. Why would they? Only 5% of Americans even own any.

They don’t know a single bitcoin has been worth as much as $20k, and as little as $4,750 in the span of a year.

But, what do they do when I tell them 100 bitcoins were worth anywhere from $47,5000 and $2,000,000 in the last year, and currently around $670,000? What do they say when I ask them again whether they would want 100 US dollars, or 100 Bitcoins?

They choose Bitcoin, every time.

Americans are already conditioned to buying their lattes with a mobile app, or a Starbucks card. Tokenization already exists. And once linked to a deflationary, fixed supply, technologically superior currency which they use every day for every day things — then what do you think will happen to the other currency?

The Dollar will go the way of the Bolivar.

The Fed will try to reign in Bitcoin — but how can they? When the money exists on our cellphones, how will they stop the flight from fiat (Dollars) to crypto (Bitcoin)?

They will first try to ban it by announcing that only dollars can be used.

Well, crypto can be converted to dollars — so that will be the thing for awhile.

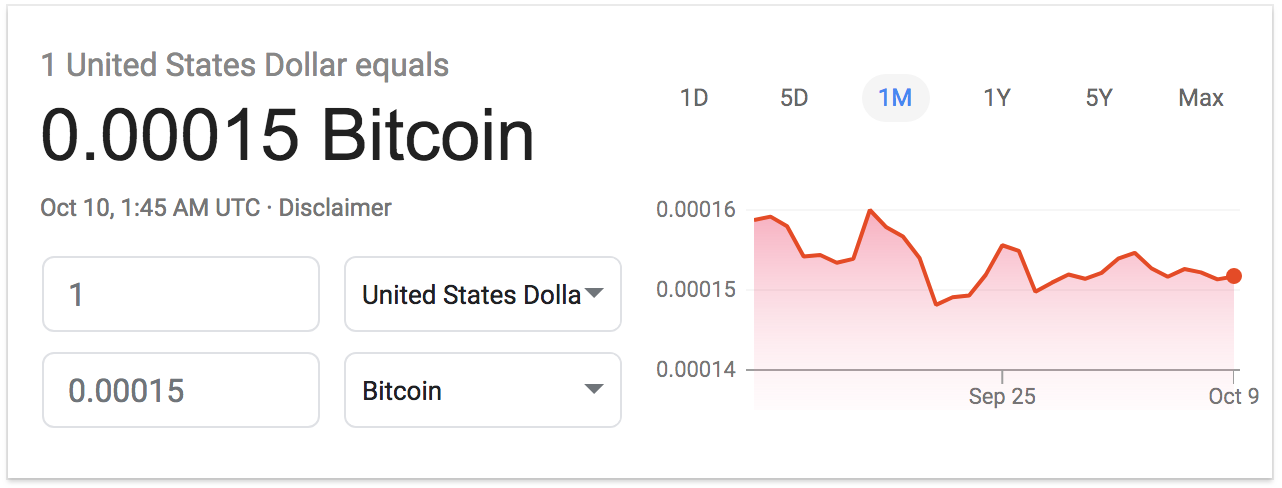

But the dollar will inflate — because no one will want it. They will want a Satoshi, because 1 satoshi today can be worth $1, but tomorrow $1 can be worth 50 cents. $1 already is worth only .00015 Bitcoin.

Runaway inflation is already here, we just don’t know it yet.

Inflation is only apparent when compared to a superior currency, like the Bolivar to the US Dollar.

The inflation of the dollar in the face of the overwhelming technological superiority of Bitcoin, even in the face of few use cases, has already begun.

Few use cases — WTF are you talking about? Right now, the use case is the movement of capital from an inflationary asset (The dollar) to a deflationary one (Bitcoin). The use case is investment, until the moment when bitcoin becomes truly universal in the US. Once the Starbucks and Trader Joe’s and Netflixes and Amazons of the world start to accept it — because, why wouldn’t they?

Every year Bitcoin is worth more than a dollar; when the realization hits that the dollar’s inflation rate hits 1,000 percent, and that by keeping their assets in dollars rather than Bitcoin it just inflates their money away — what do you think people will do?

What if I told you that the pinned currency is not the US dollar? The pinned currency is Bitcoin, the out of control inflationary currency is actually not Venezuelan Bolivars, but rather the US dollar?

650,000% inflation is here now. A Bitcoin is still worth one Bitcoin.

And what will companies like Apple do once they realize that their 256 Billion dollars in cash reserves are worth nothing? It would take 39,000,000 Bitcoin at current values. There are not enough Bitcoin to service Apple’s surplus.

But, last January 2017, at the height of Bitcoin fever, their hoard was equivalent to only 13,000,000 Bitcoin.

This is what I mean by capital flow. Do the math: empty the coffers of a single company into BTC and what do you get? BTC double its current valuation at around $12,000 per coin.

And that’s just a single company.

Forget the trade war, China will dump and buy more Bitcoin, which will start to be used for trade rather than the US dollar. The current administration has already pushed other countries to call for a different settlement currency. Currently, the US Dollar is used for settlement in trade, especially for Oil. That is the main reason for the stability of the dollar.

What happens when it isn’t?

What happens when our former allies start using a different currency than the dollar in order to purchase cheap oil from Russia? Currently, Europe gets a third of its oil from Russia, all of it paid for with US Dollars.

Europe will never stomach using the ruble or the yuan as a settlement currency. They would use a neutral currency, the Switzerland of currencies, with no ties to a country’s ideology — Bitcoin.

Let me put this a different way: what if you found out that 1 Mexican peso was suddenly worth $1,000 US? What if every couple of years a Peso added a zero to it’s worth: from $1,000 to $10,000? What do you think every US citizen would do?

They would open up their arms wide, and grab every peso they could!

Now trade “Peso” with “Bitcoin.” Since Bitcoin is electronic, borderless and decentralized, what do you think Nation states like Russia and China will do?

Everyone will try to corner the market. Because at first, money is power. And then power is power.

The truest answer I have ever received by the question of, “What is the dollar backed by?” was not Oil, or that it was even a shared illusion (which I think is more true). The truest answer I ever received on what the US Dollar was backed by was this: the military.

And the dollar will not go down easily.

The US will try a national cryptocurrency at some point, and will very soon fail, much like the Petro. Because it’s deficient in comparison to Bitcoin. A national cryptocurrency will still be vulnerable to national manipulation to further the needs of the nation state. Americans, just like Venezuelans, will crowd toward the currency that meets their needs the best. When a satoshi buys the bread that the US Dollar can’t, then Americans will flee to BTC.

It’s still unclear which cryptocurrency will win this zero sum game of being the best money. Right now it’s BTC, but it wouldn’t surprise me if it shifted to XRP, XLM, or something completely different.

What is clear to me is that it will.