The Global Economy is in Trouble

The Global Economy is in Trouble

Fears about slowing economic growth and rising interest rates have led to a flash crash of the markets this week.

- Amazon shed $56 Billion

- Apple $51 Billion

- Netflix $13 Billion (8%)

- Facebook $16 Billion

- $172 billion for FAANGs on October 10th, 2018 alone.

Basically, analysts are alarmed since they doubt that the fresh stimulus from China’s central bank will help prevent US President Trump’s trade war from triggering an economic slowdown. The world is connected, we are one entity.

As the trade war tensions escalate, the global economy would take a significant hit. Warnings about global growth from the International Monetary Fund are contributing to the concerns, as are rising interest rates. Thursday October 11th should be a very interesting day for the future of the global economy.

US stock markets open at 9:30 a.m. ET, or 2:30 p.m. in London.

The IMF earlier this week cut its forecast for global growth to 3.7 percent this year and next year — down 0.2 percentage points from an earlier estimate. Still, the Dow tumbled more than 800 points on Wednesday. That is what amounts to a sea of red. Chinese Tech stocks bottomed out, with American Tech stocks not far behind. I’m talking about unprecedented losses. So Wednesday’s selloff appears to have been sparked by concerns about global growth and conflicts over trade.

With the U.S. and China locking trade horns, the the World Trade Organization really has some restructuring to do. There are in addition several growing risks to the global economy. These include a broader escalation of trade tensions, a no-deal Brexit, renewed concerns about fiscal policy in some highly indebted euro area countries, and a faster-than-expected normalization of monetary policy in advanced economies.Other risks include:

- High Debt levels

- Reeling emerging Economies

- US Economy will Peak Soon

- Trade Conflict

- Failing Banks

- Hard Brexit

- Italian Government Policy

Many of these risks are inevitable and setting up the likelihood of a major 2020 economic recession.

The IMF recently detailed how further escalation in the burgeoning trade war could see investors spooked and “significantly harm global growth” with a sudden sell-off in financial markets. Is Wednesday’s panic the start of it? How badly could a hard Brexit really impact the global economy? Has the U.S. economy already peaked?

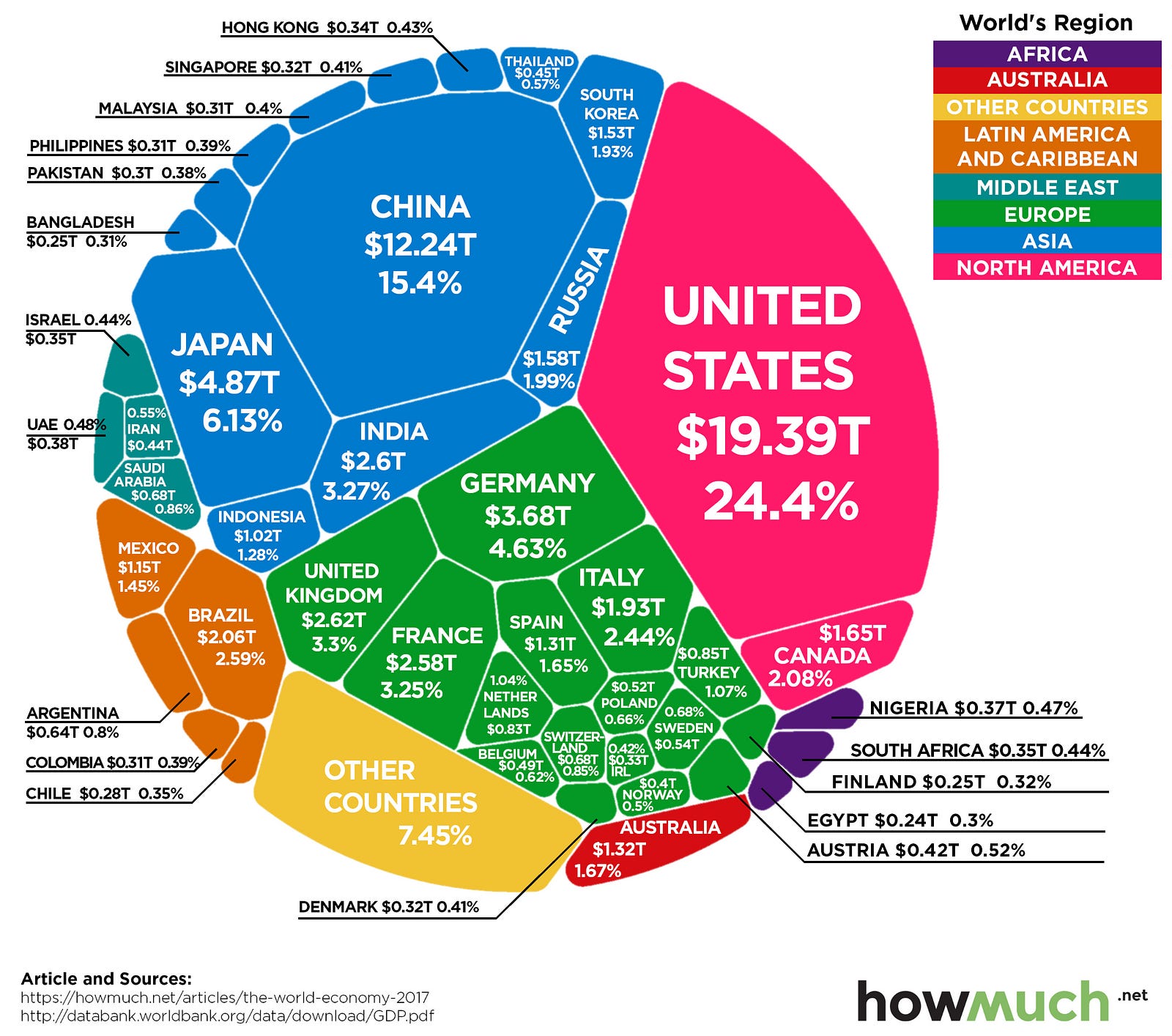

The trade war initiated by the U.S. has hurt China but in doing so it’s hurting the entire global markets. It’s a horrible abuse of power in an era where the U.S. might not have many years left as the leading global economy. America’s own federal debt amounts to more than $66,000 per American citizen.

The borrowing binge is also very alarming. Emerging market economies are borrowing more in international markets and face the risk that they will be unable to refinance a substantial portion of their foreign currency debt.

Growing trade tensions have come at a time when emerging markets have been put under pressure and that intersection could have dire consequences for the global economy.