Everything You Need to Know About a Bitcoin ETF Approval:

What’s the SEC’s problem?

The SEC recently denied ETF proposals that were based on spot markets (Bats BZX / “Gemini” ETF) and derivative markets (Direxion, GraniteShares and Proshares). ETFs based on the spot markets are less complex to operate (as spot is the direct asset price) and arguably have less variability in pricing than derivative products, but the lack of even a single

Risk of manipulation because of insufficient regulated trading volume

In each Bitcoin ETF denial, the SEC has made clear that the largest impediment to approval is the lack of significant trading volume on any regulated exchanges (whether spot or derivative), which are subject to federal oversight for fraud or manipulation. While there is no explicit volume level which is considered “significant”, the general threshold is considered to be one which would either make it incredibly difficult, or outright impossible, to manipulate price via trading tactics on unregulated exchanges. The rationale is that if the volume requirement is met, the ETF sponsor will be able to properly monitor and prevent any attempts at price manipulation via a fraud monitoring agreement with the market exchange. This is an increasingly challenging burden for a sponsor to meet in the current Bitcoin climate because an overwhelming

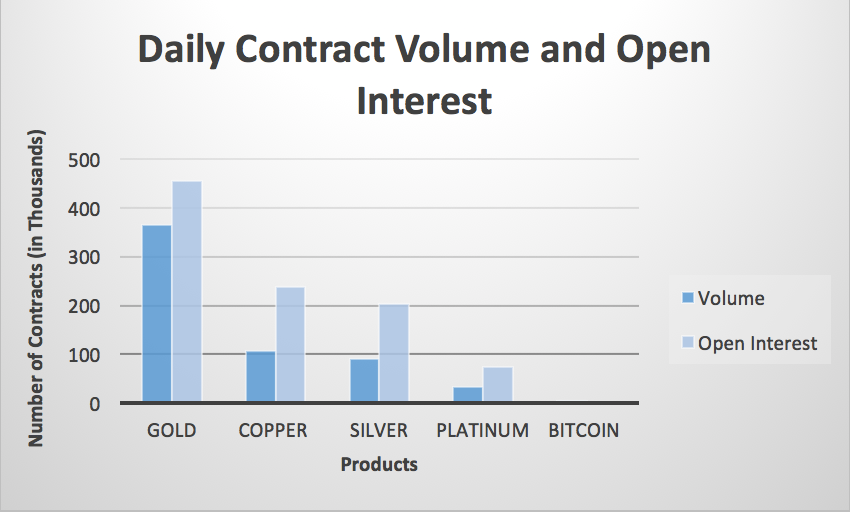

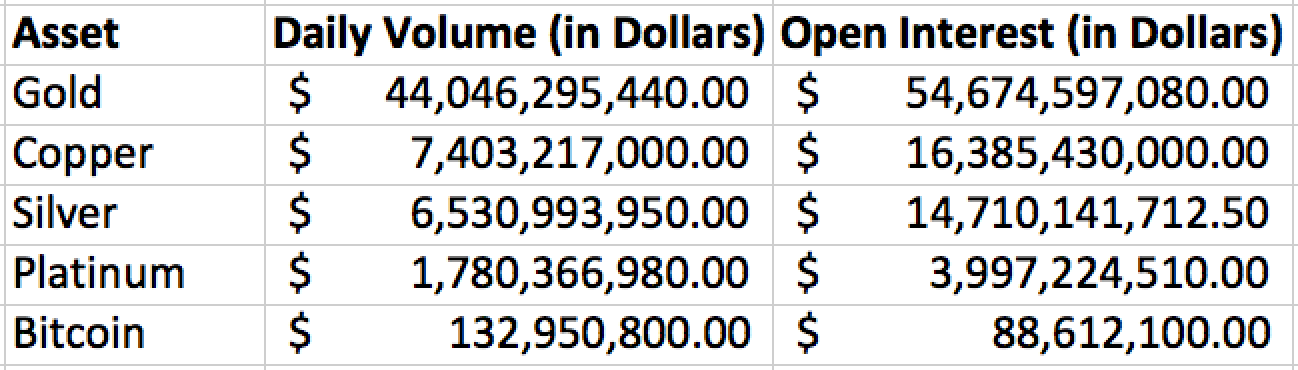

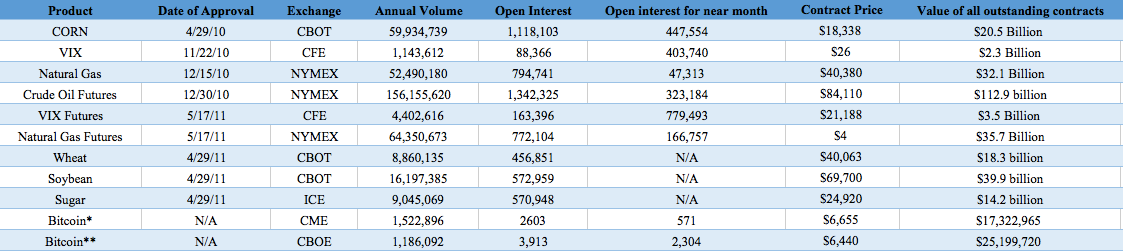

Bitcoin futures began trading in January 2018 on CME and CBOE, two US-based regulated derivatives exchanges, but saw significantly lower transaction volume and open interest than other similar futures products. Please see the below charts which compare data as of Wednesday, September 26th.

When viewed from this perspective, it is clear that Bitcoin’s regulated derivative volume and open interest (on CME) falls well short of those of other assets. Arguably more relevant is how Bitcoin metrics compare to other commodities as of the date of their respective ETF approvals. Even from that perspective, Bitcoin open interest is multiple orders of magnitude below those of other commodities (as noted by the SEC in footnote 37 of the Direxion ETF denial).

In addition to the insufficient trading volume, the SEC recently noted that there isn’t sufficient trading history to make a determination regarding potential fraudulent CME or CBOE Bitcoin futures trading. While a concern today, a future CME or CBOE based Bitcoin ETF proposal could be viable once the two exchanges’ Bitcoin products mature.

Nevertheless…

A derivative product is only as good as its underlying spot market

Because a derivative product would be subject to the fluctuations and market behavior of the underlying spot market, the SEC seems to desire regulated exchanges of both spot and derivative markets with significant volume (comparable to the underlying products of other approved ETFs) before approving a derivative-based ETF.

Thus far, no US-based spot exchanges (including Gemini, Coinbase/Coinbase Pro, itBit, and Kraken) have been deemed in compliance with all relevant SEC regulations. Even if fully compliant, none of those exchanges rank in the top 5 of worldwide Bitcoin volume, meaning that the overall market would still be susceptible to the trading mechanics of unregulated exchanges. Researchers have alleged that many of the top exchanges artificially inflate their transaction volume through wash trading and conduct other manipulative practices (such as trading against their own users). As such, federal oversight of exchanges may be necessary prior to the SEC’s approval of such exchanges to support underlying pricing of an ETF.

The SEC has reportedly sent notices to a number of cryptocurrency exchanges and suggested they may also register under an Alternative Trading System Form (“ATS”) but an August publication of approved ATS applicants does not list a single cryptocurrency exchange. Further, the New York Attorney General report on cryptocurrency exchanges indicated that none of the exchanges they studied were fully compliant (and many are not even taking the minimal initial steps — such as conducting low-level KYC/AML checks — required to be deemed the same). Once regulated exchanges come online and reach significant volume levels, much of the SEC’s concerns would be relieved.

Market risk because a handful of whales may be controlling the tides

Even if there were an exchange on which to rely, the SEC noted concerns regarding the structure of the Bitcoin market in general. Research has found that there may be a small number of people or organizations who hold a dominant share of Bitcoin. Academic research cited by the SEC found that when there is a small number of people who hold a dominant share of an asset, it is more easily manipulated. This aligns with intuitive conceptions of big-money market movers manipulating retail investors. This concern is exacerbated by the pseudonymous nature of Bitcoin — making it difficult (or nearly impossible) to identify these market participants or even the fact that a large number of apparent users are in actuality one participant. Thus, it is difficult to estimate the distribution of Bitcoin holdings and their effects on trading patterns. This uncertainty, in conjunction with large swings in daily valuations, and an air of seediness surrounding the Bitcoin marketplace (as explored in Nic Carter’s recent article) and its early uses (e.g. Silk Road), contribute to the SEC’s hesitance to approve a Bitcoin ETF.