Thoughts on Decentralized Exchanges and Real World Usage of their own Tokens

Thoughts on Decentralized Exchanges and Real World Usage of their own Tokens

One of first things you learn when diving down the crypto rabbit-hole is how to navigate exchanges, as they are instrumental to the movement of cryptocurrencies.

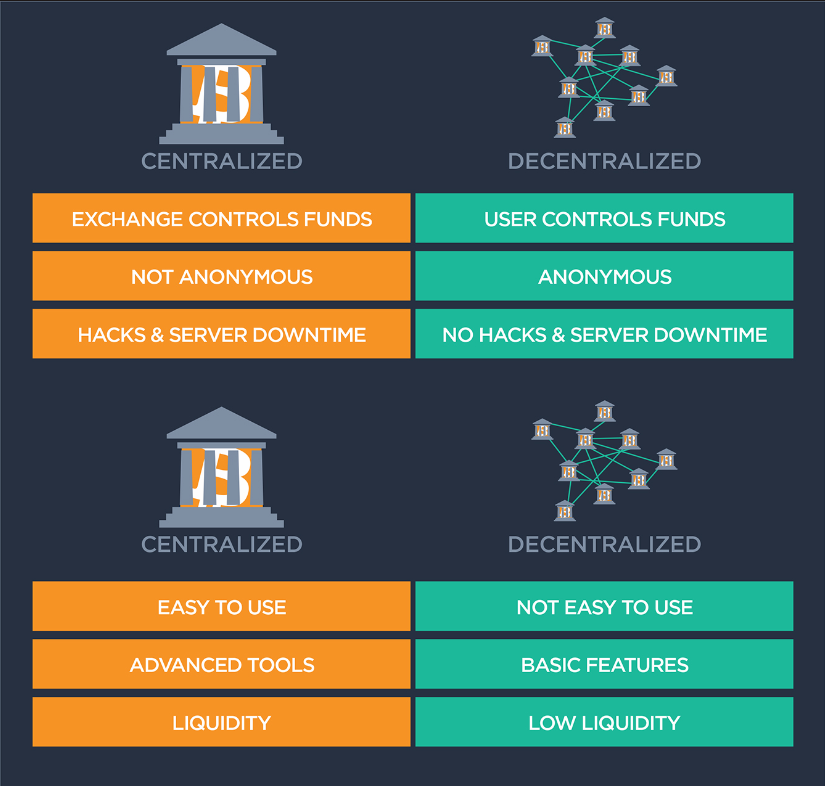

Currently, more than 99% of crypto’s transactional volume goes through centralized exchanges, but I expect this dominance to gradually fall. Over the last year or so, there has been more and more discussion of the pros and cons of decentralized exchanges. [Excellent Primers:

The blockchain revolution was founded on principles of decentralization, and yet we find ourselves in a curious situation where certain entities control the scene.

Centralized exchanges are seated near the top of the pyramid. This is because they act as gate-keepers, offering a simple way to get rid of your fiat for crypto (and vice versa). They have decent user experience; its easy to pick up the basics, but there are also plenty of advanced features for seasoned traders like margin calls and stop losses. Liquidity is generally good, and a wide range of coins can be traded.

In the face of this, what advantages can decentralized exchanges offer?

Essentially, these are:

- No single point of failure — data and funds are more secure as ownership is in the hands of the users

- No single point of control — not restricted by law, KYC/AML procedures

DEXs are also relatively simple to get up and running, and it’s intriguing to watch a steady stream of new projects popping up (see here for a comprehensive list:

Another feature of DEXs I want to explore in more detail is that they are often underpinned by a token.

These tokens grant the holders certain certain rights or discounts, but can also be instructive to see how much momentum a project has gained.

Let’s look at a few different DEX players who have tokens that are being used in the wild.

0x— an open and non-rent seeking protocol that facilitates trustless, low friction exchange of Ethereum-based assets. Developers can use 0x as a platform to build exchange applications on top of. For end users, 0x will be the infrastructure of a wide variety of user-facing applications.

Bancor— a decentralized liquidity network that allows you to hold any Ethereum token and convert it to any other token in the network, with no counter party, at an automatically calculated price, using a simple web wallet.

Kyber Network— provides rich payment APIs and a new contract wallet that allow anyone to seamlessly receive payments from any token. Users can also mitigate the risks of price fluctuations in the cryptocurrency world with derivative trading.

Loopring— a protocol and decentralized automated execution system that trades across the crypto-token exchanges, shielding users from counterparty risk and reducing the cost of trading.

Airswap— a decentralized token exchange based on the Swap protocol, which provides a decentralized trading solution based on a peer-to-peer design.

Blockport— a hybrid-decentralized exchange with a strong focus on user-friendliness, social trading features and building a knowledge sharing community.

Everyone’s fixated on price, so we’ll get MARKETCAP out of the way first.

0x absolutely dominates, with more value than the others combined! Not really surprising considering the scope of the project and its ability to ship product.