Why canceling our ICO was the best decision we ever made

Why canceling our ICO was the best decision we ever made

We founded Coral Health to solve the massive data sharing problem in healthcare. We thought tokenizing patient data was a good mechanism to do it. The ICO market was also frothy and we thought it could accelerate our commercialization. After immersing ourselves in the ICO ecosystem, we learned it’s not all that it’s cracked up to be. We recently decided to forego our token sale. This is our story of why it’s the best decision

Coral Health’s genesis

Coral Health was founded by healthcare experts and technology heavyweights to facilitate improved data sharing across various healthcare entities. We realized the blockchain or a derivative of distributed databases could provide decentralization, immutability, and secure and seamless access to patient data between hospitals, insurance companies, laboratories, researchers and more. By using tokens as a medium of patient data exchange, we could both add a layer of convenience to raw patient data, and also take advantage of a healthy cryptocurrency market to accelerate early revenues. It seemed like a no-brainer.

We quickly started Coral Health with a few key tenets:

- We will never take shortcuts in product development to rush to a token sale

- We will never skip the hard work of getting product feedback and building partnerships to hastily run a token sale

- We will stay above board with all regulatory and securities laws

- We will always prioritize Coral Health as a long term, value driving company over token economics

With these tenets in mind, we planned on doing a token sale. Meanwhile, we never took our eyes off the importance of product development and market testing. We devoted the majority of our resources to building product and creating a massive competitive advantage over other blockchain companies, who typically run token sales based on hype alone. We have a fully fledged mobile app to show for it, nearly unheard of in the healthcare blockchain industry.

The honeymoon phase

Things were going great. We were building out our team, developing product, and getting great feedback from industry partners. We even opened up an office in beautiful Vancouver, BC and one in Toronto as well. We knew Coral Health would succeed as a company, as we had faith in our core tenets. What we were still unsure of were the tokens. Were we making the right choice in participating in this bubble-like ecosystem? What were the tradeoffs in doing a token sale? Surely there had to be some.

At the start of 2018, there seemed to be little to no downside in holding a token sale. Projects like SingularityNET were raising $35M USD in a matter of hours. Everything you touched in crypto turned to gold. However, we knew cheap money always came at a cost. Some projects seemed more developed than others. Crypto was the wild, wild west, especially for ERC-20 tokens that needed little to no technical knowledge to create and sell.

While the markets were booming and most projects had complete disregard for securities laws, we took the unusual step of seeking regulatory approval from our local securities commission. We knew how robust our platform was and knew at our core we weren’t in this to make a quick buck. We were confident the regulators would see this. Over several months they conducted due diligence on our business and token economics. We ultimately received a positive determination and at that point felt even more empowered to proceed with the token sale. Meanwhile, we had developed product extensively, signed up multiple industry partners and built up an enthusiastic development community in our social media channels.

The dark side of tokens

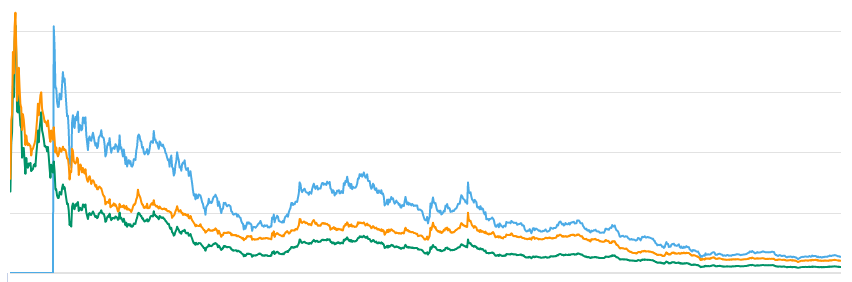

This is when we started to notice the warts in the token market. The obvious downside of tokens is they’re not nearly as cool when the market crashes. The crypto markets have declined dramatically this year. ETH prices are hovering around $235 USD/ETH at the time of this writing, over $1,000 off from its highs earlier this year. Other altcoins have seen similar or worse dips. New ICOs operating in this environment are suffering plummeting token prices post-ICO. The aforementioned SingularityNET has lost over 90% of their token value following their ICO. Almost all other healthcare projects who conducted or planned ICOs (e.g. Doc.ai, Artifact, Encrypgen, Patientory) have suffered similarly from the flailing market. Many of these projects have abandoned tokens altogether in favor of equity based fundraising.

Not only that, we started to understand that maintaining tokens as part of a core business strategy is crippling, distracting, and serves as little more than a millstone around a company’s neck.

- How many Telegram communities have you seen where company founders are answering mundane and repetitive questions from faceless community members who may or may not be there simply to troll the company? Probably way too many.

- Also, why on earth are company founders wasting their time on Telegram when they should be making sales and shipping product?

- How much time should founders really spend answering questions like “when lambo?”, “when moon?”, “when sadness ends?” and “when exchange?”

This gets particularly distracting when token prices are low, like we see in the crypto market right now. Projects face unrelenting pressure from their token buyers to keep token prices up. Companies have to waste tremendous resources and mental energy on regulatory compliance, and some (e.g. Emrify) even have to shut down their tokens due to legal pressure. All of these annoyances prevent good projects from achieving sustainable revenues, hitting product milestones, and providing value to their equity shareholders.

Coral Health’s decision

Coral Health has actively been monitoring the market and conducting market testing to anticipate the results of its token sale. We’ve concluded that while we’re far ahead of 95% of ICOs in terms of products developed, technical teams recruited, and partnerships signed, it is not wise to conduct an ICO in this environment as the downward market forces are too strong. In addition, we’ve refocused our engineering efforts so that whatever technical value tokenization would have brought us, we are able to replace those workflows with traditional APIs and cryptographically hashed data securitization processes.

When we made the decision to cancel our ICO internally, there was unanimous excitement amongst founders, employees and shareholders. It was very evident that we were making tremendous progress as a company but tokens were contributing exactly 0% to that success. Our forthcoming token sale would surely have been a negative, persistent distraction. The distraction-free revenues we’ll enjoy will more than make up for any marginal funding we would’ve gotten from an ICO.

The decision turned out to be even better than we thought!

Perhaps due in part to serendipity, and in part to foresight, we are now able to focus on dominating a market that’s arguably even hotter than crypto was at its zenith. Healthcare data interchange companies are selling and being invested in at incredible valuations. Companies not much older than Coral Health like PointClickCare and CollectiveHealth recently raised nearly $200M each at $1B+ valuations. What a time to enter this market token-free!

Another major advantage to not having tokens as part of a company portfolio is that it makes a future acquisition much more likely. A major player like Google who has a history of buying growing companies will probably never consider acquiring a company that’s encumbered by a token ecosystem. Can you imagine Google having to take over a company’s annoying Telegram chat? Who on Google’s board of directors will ever approve spending resources to get one of their subsidiaries listed on crypto exchanges? ICOs are a death knell for future acquisition opportunities, leaving equity shareholders little in the way of long term payoffs for their patience and hard work.

Moving Forward

In the short time since we decided to forego our token sale, we’ve experienced a heightened sense of energy and enthusiasm at Coral Health. We have some of the largest health systems in the US interested in our suite of applications. We have one of the top 5 pharmaceutical companies in the world already piloting our app.

We have a team of very smart, perceptive people. They were all thrilled to hear we decided to move away from tokens and focus on dominating one of the hottest software markets in the world: health IT. We believe we will be one of the trendsetters in this space. There are very few reasons to run an ICO in this environment and most blockchain projects with real merit and value have already or will soon consider de-tokenizing.

Coral Health has left the treacherous waters of uncertain token sales to become a wildly successful startup!

To learn more about Coral Health, visit www.mycoralhealth.com.

About Coral Health (@Coral Health)

Coral Health is a technology company that is building a more connected future in healthcare by enabling secure, real-time, shared access to validated medical information. At the heart of the Coral Health system is our cross-platform, personal health records app that uses SMART on FHIRto provide patients seamless access to all of their health records. We allow individuals to share access to their data to improve care coordination and fuel a vibrant ecosystem of third-party digital health apps.