Bitcoin’s fall from grace & FAANG’s bear market

Bitcoin’s fall from grace & FAANG’s bear market

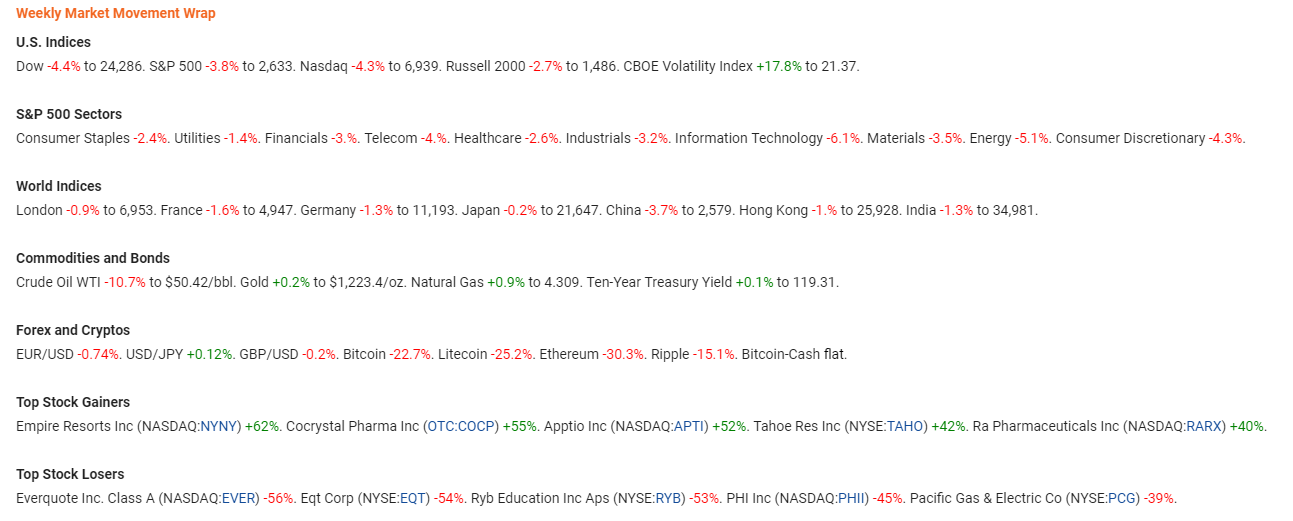

A really rough week coming to end would be like putting it very nicely… it was literally a bloodbath on the financial markets. As the weekend rolls in, we can take stock of things. Cryptos continued to bleed after taking out significant support levels, U.S equities closed the worst Thanksgiving week since 2011 & Greenback sprung back to life with the general risk-off sentiment in the markets. Here’s a quick look at the numbers before we move on.

Let’s kick off things with Cryptocurrencies as usual. The digital coins continued to post hefty losses amid a complete rout that started last week. Most of the Cryptos made new yearly lows. It seems like it is going to be a tale of two holiday seasons with the last one (2017) taking the Cryptos to the moon & this one (2018) taking them to depths of oblivion. There have been a lot of stories circulating about the reasons behind this plummet. Bitcoin Cash hard fork resulting in a ‘hash-war’ which has gathered pace, regulatory pressures from the Financial authorities & central banks’ interest in pursuing their own digital currency projects after a statement from the IMF chief last week. Also the most anticipated

Looking at the hourly chart for the Bitcoin, it has taken out the significant psychological level of $5,000 with the total market cap of the Cryptos dropping down to a mere $138 billion, a drop of more than 30% in the last week alone. The $5K level is now acting as the immediate resistance for BTC below which the gains should stay capped. A break above this would signal an extended consolidation but as long the strong resistance of $5600-$5800 holds we should continue to see weakness. Only a convincing break of this zone would signal a return to bullish ways.

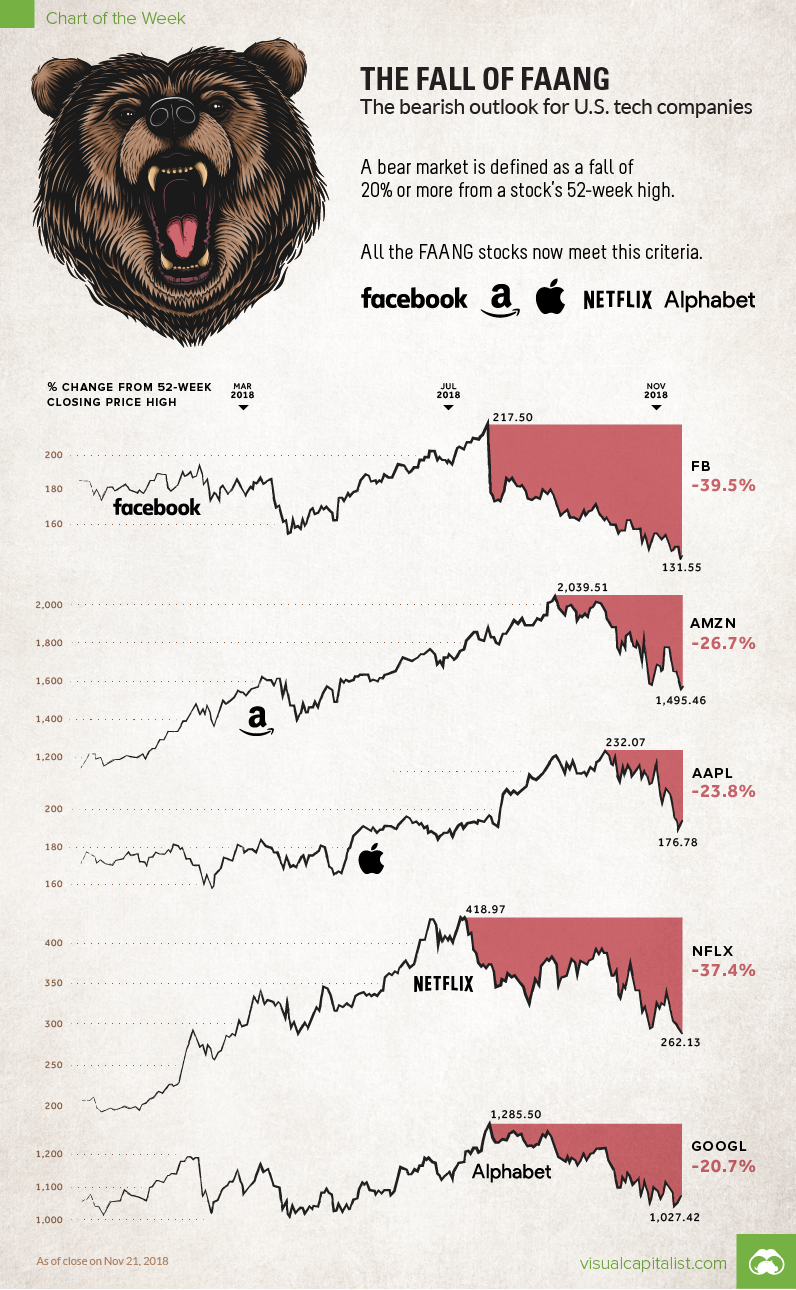

Global Equities saw widespread losses as well led by the U.S markets, whose major indices closed down 4%. The rout in U.S equities have been led by the Big techs — ironically, the same sector which powered the 10-year-old bull run, which at the moment, seems to be running out of steam. All the FAANG (Facebook, Amazon, Apple, Netflix & Google) stocks have now entered the bearish territory with losses of over 20% (see the figure below — as of 11/21).

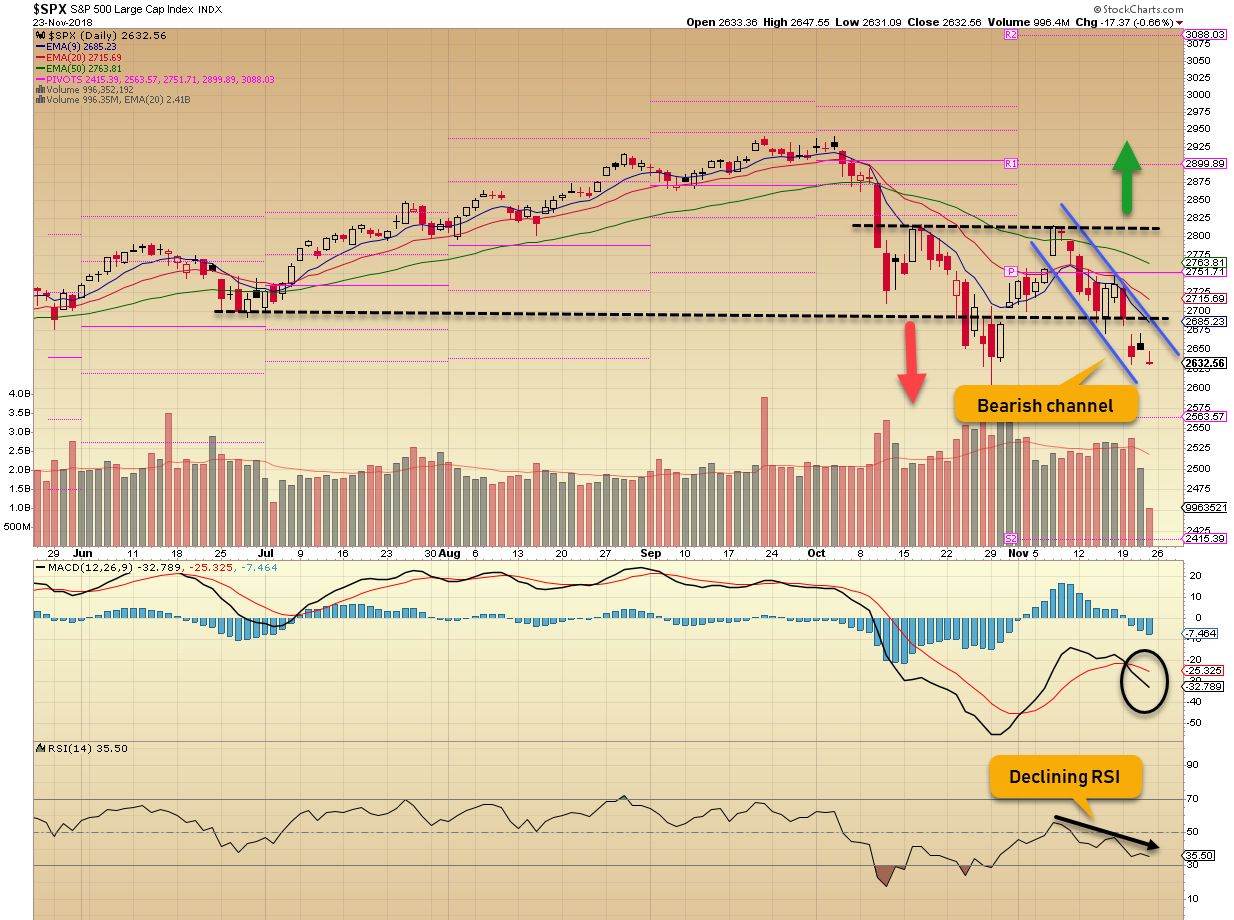

Losses have been pretty widespread across different sectors of the market. The biggest loser so far has been Oil. The Thanksgiving week saw the commodity post a heft loss of over 11% of whom 7% came on the last day alone. Global growth concerns are putting severe pressure on Crude as it accelerates its bearish momentum. Analyzing the benchmark S&P 500, it looks as if it has resumed its downward trend after failing to hold the higher low from last week. The index continues to trend downwards in a bearish channel with immediate resistance around 2690 which needs to break to extend the consolidation. However, only a break of the previous high around 2815 would signal a creation of a base and the resumption of the upward trend. Declining RSI & bearish MACD divergence is pointing towards further losses for now.

Coming to the Forex markets, Greenback gained ground against all the Majors with the traders opting for the security of the Reserve currency in the bearish markets. Bearishness in other markets generally means USD bulls have a heyday — and that’s what we see in the FX markets right now. Reviewing the Dollar Index chart, USD continues to honor the floor of the bullish channel by making a higher low every time to march forward. Immediate support lies around 95.70 which needs to hold to continue this bullish trend towards the previous high of 97.65. A break of this support would signal an extended consolidation. Major support of 93.50 needs to hold for the medium-term trend to stay intact, a breach of which signal the start of a new bearish trend.

There were some significant individual moves in the USD Majors that I would like to touch base about. The first one being GBPUSD which has taken the brunt from the Brexit inspired political & economic uncertainty. The elevated volatility continues to mark the moves of this pair; which can only get a meaningful direction with the settlement of the Brexit issue — intraday resistance @ 1.2845. EURUSD’s technical rebound seems to be coming to an end with the weak PMI numbers from Germany — Europe’s biggest economy. A temporary top seems to be in place @ 1.1472 with immediate intraday resistance @ 1.1360. Finally, USDCAD seems to have nowhere to run with the current bearish run in Oil with which this pair has an inverse relationship. Bullish momentum is intact for the pair with the intraday support @ 1.3180. USD Durable goods orders, EU OECD outlook & CAD CPI mark the economic calendar next week as significant data events.

To sign off here is a comic which signifies correctly what happened to the bulls in the Thanksgiving week! Happy Trading everyone…

Recent Articles:

相關推薦

Bitcoin’s fall from grace & FAANG’s bear market

Bitcoin’s fall from grace & FAANG’s bear marketA really rough week coming to end would be like putting it very nicely… it was literally a bloodbath on

Do not throw System.Exception, System.SystemException, System.NullReferenceException, or System.IndexOutOfRangeException intentionally from your own s

sonarqube的掃描結果提示 https://docs.microsoft.com/en-us/dotnet/csharp/programming-guide/exceptions/creating-and-throwing-exceptions https://stackoverflow.com/q

Ex-Chancel Industrial IoT lor Schröder brokered activist's release from jail in Turkey

www.inhandnetworks.de Former chancellor Gerhard Schröder intervened directly with Turkish President Recep Tayyip Erdogan to arrange the release of

Zipf’s Law from Scale-free Geometry – Like Galaxies, Like Cities touch screen for vending machine

www.inhandnetworks.com A schematic illustration of Zip’s Law for galaxies or cities. On the left is a simulated population distribution with dar

Learning from Artificial Intelligence's Previous Awakenings: The History of Expert Systems

aitopics.org uses cookies to deliver the best possible experience. By continuing to use this site, you consent to the use of cookies. Learn more » I und

Insights on big data from Optum Technology's first Technical Fellow

Kerrie Holley has had a storied career in the technology industry spending nearly three decades at IBM before moving to Cisco as a chief technology officer

Rebuilding Mint’s UI From the Ground Up Using CardParts (iOS)

It’s impossible! Too ambitious! Overhauling the user interface of Mint — a multi-feature iOS application that has not changed significantly since it’s laun

Flipboard: Researchers claim AI can diagnose Parkinson's disease from smartphone data

Parkinson's disease, a neurodegenerative disorder that affects movement, impacts more than ten million people worldwide; roughly 60,000 are diagnosed each

Easter Island inhabitants collected freshwater from the ocean's edge in order to survive: Process of 'coastal groundwater discha

The team, which included Binghamton University Professor of Anthropology Carl Lipo, measured the salinity of coastal water around the island of Rapa Nui,

'Vampire burial' reveals efforts to prevent child's return from grave

The skeletal remains, uncovered by archaeologists from the University of Arizona and Stanford University, along with archaeologists from Italy, included a

Machine Learning: Andrew NG’s course from coursera

Have you ever wondered how handwritting recognition, music recommendation or spam-classification work? The answer is Machine Learning. I’ve taken this yea

Learning Montezuma's Revenge from a Single Demonstration

We've trained an agent to achieve a high score of 74,500 on Montezuma's Revenge from a single human demonstration, better than any previously publis

The Guardian’s Migration from MongoDB to PostgreSQL on Amazon RDS

轉載一片mongodb 遷移pg 資料庫的文章 原文: https://www.infoq.com/news/2019/01/guardian-mongodb-postgresql The Guardian migrated their CMS's datastor

Nasa InSight Mars lander sends back 'beautiful' selfie from red planet's surface

Nasa's brand new Mars lander has sent back the first stunning of the surface of the red planet, taken at the end of a terrifying journey. As well as showin

C/s模式&&B/S模式

http client ref 最大 aid 都是 信息 管理系 電子商務網 C/s模式:是客戶端/服務器(Client/Server)模式,主要指的是傳統的桌面級的應用程序。比如我們經常用的信息管理系統。 C/S 客戶端/服務器 例如QQ,網絡遊戲,需要下載客戶端才能訪

jsp頁面,使用Struts2標簽,傳遞和獲取Action類裏的參數,註意事項。<s:a action><s:iterator><s:param>ognl表達式

ram abc 從數據 -- xml文件 struts2標簽 ice 由於 spa 在編寫SSH2項目的時候,除了使用<s:form>表單標簽向Action類跳轉並傳遞參數之外,很更多時候還需要用到<s:a action="XXX.action"

Memo1.Lines.Add(s) 與 Memo1.Lines.Append(s) 的區別是什麽?

tar arch arc 區別 lines 什麽 cnblogs http get Memo1.Lines.Add(s) 與 Memo1.Lines.Append(s) 的區別是什麽? http://www.cnblogs.com/del/archive/2008/06/

poj 3207 Ikki's Story IV - Panda's Trick 2-sat

name continue ios sat code bug != sin debug 題意: 問給你n個點和m對點 如果每對點必須一個在圓裏一個在圓外是否可行 思路: 我們對每個點建造虛點 進行四次連邊 然後跑一遍2-sat就可以了 1 #in

一道leetcode題的收獲如何比較字符串的大小重寫sort中的compare[](string &s,string &t){return s+t>t+s};

etc ++ ansi 匿名 gin leet clas size_t first KEY:一種很好的想法,寫法也很好,使用for(auto i:num)遍歷訪問num lambda表達式重寫比較compare參數,相當完美 while處理[0,0,0]情況的輸出。優雅的解

POJ3207 Ikki's Story IV - Panda's Trick 【2-sat】

game mos decide rcu Circul 區間 not following have 題目 liympanda, one of Ikki’s friend, likes playing games with Ikki. Today after minesweep