What energy disruption looks like?

Disruption is a big word, nowadays we often hear about disruptive innovation with reference to different technologies and products. Sometimes this word is abused but in many cases it perfectly pictures the scenario of a given sector.

A disruptive innovation is something that creates a new market and value network displacing existing markets and business models

The energy sector certainly went through profound transformations over the last two decades and many progresses were made, something unbelievable 15 or 10 years ago.

So, what disruption looks like in the sector of energy?

Traditional Sources of Energy

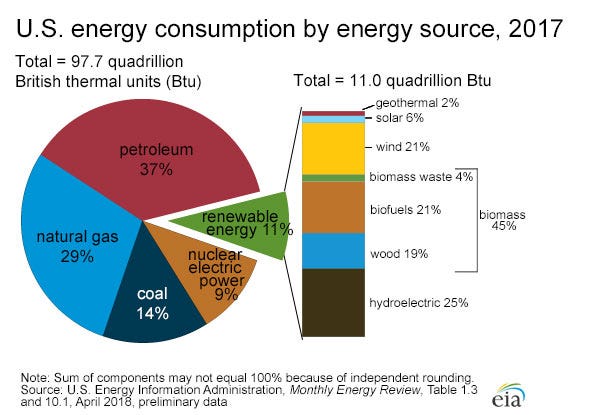

Let’s start by taking a look at the sources that we are currently using to generate energy. Although there has been a significant growth in renewable energy sources, unfortunately we still rely heavily on fossil fuels to meet our needs.

Here is the example for the United States (one of the major countries for energy consumption) that breaks down all the energy consumed, including transports.

Well, this is our situation right now and there is absolutely no guarantee that this figure will be the same for the coming years

Indeed, the picture is changing and it is changing really fast, especially if we talk about the production of electricity. Another aspect that must be taken into account is the growing electrification of machinery, heating production devices and transports.

Together with advancements in storage technologies, generation technologies and distribution, it paves the way for a radical transformation in the next decades.

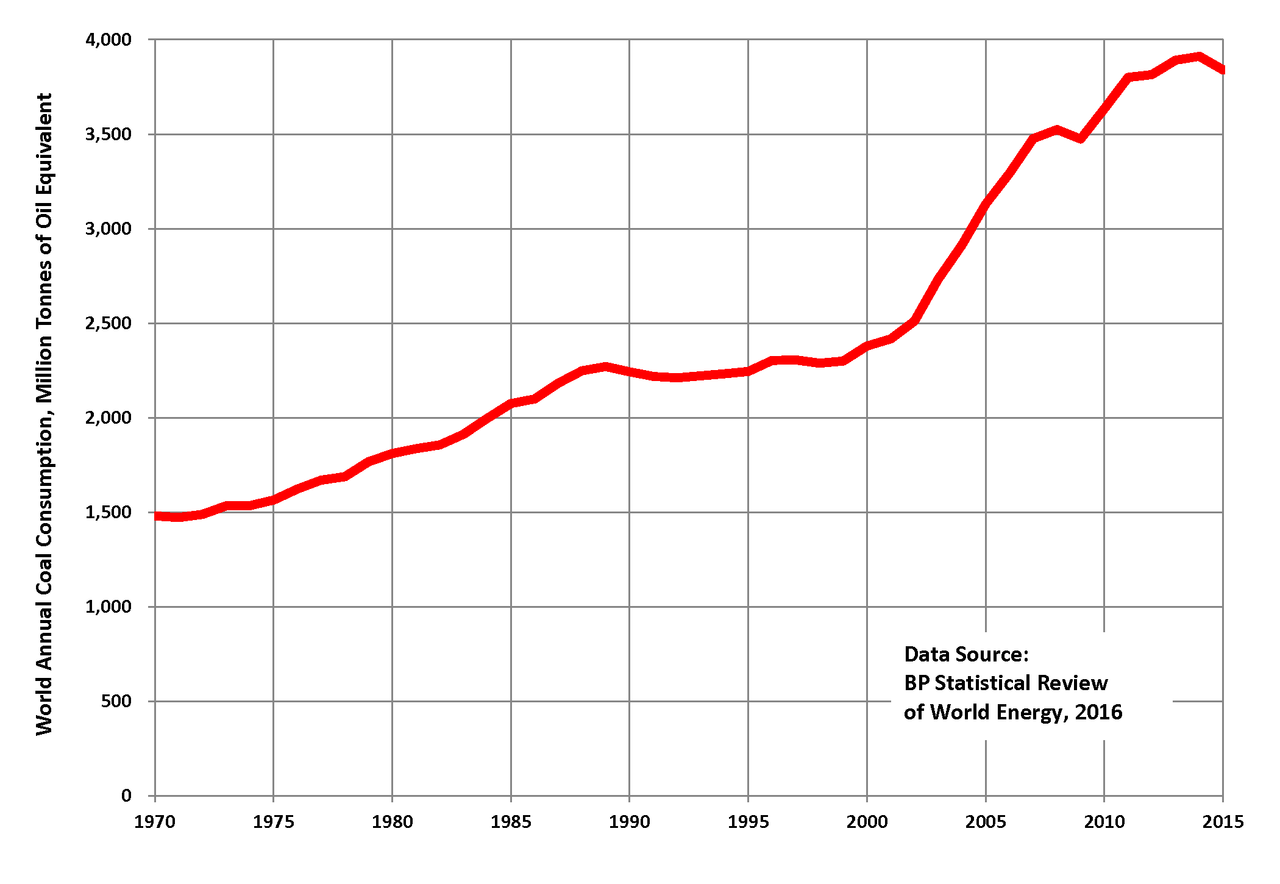

One of the main sources of energy for electric power production until recent years has been coal. In order to have a first idea of the displacement that is going on in the sector, take a look at the major coal companies.

This is the Dow Jones U.S. Coal Index, that tracks stocks in the coal sub-sector:

What you notice is that coal companies that were doing well in their business some years ago, in many cases today struggle to continue their operations, and here’s why:

The worldwide demand for coal peaked in 2013 after rising for 150 years since the industrial revolution and the coming of steam engines.

This means that the world has started to use less and less coal and this trend is taking place also in other resources, like oil and gas.

The same thing is going to happen soon also with oil, in fact major oil companies all say that oil demand will peak by 2020.

Don’t bet on the oil market to last forever, the world is inventing better technologies to move stuff than oil.

“Remember that the age of stone didn’t end because lack of stones, and the oil age will end long before the world runs out of oil”

The disruption comes from economics, it has to do with consumption. If other forms of energy are cheaper or more flexible, we go for them.

What is happening?

The transition toward renewable sources of energy that we are seeing now, is made possible by the existence of cheaper alternatives.

The lower cost compared to traditional sources of energy, made possible by improvements in technologies, is the main driver of this change.

Building and running a coal powered or gas powered power plant, results into an average energy cost of roughly $6cents/ kWh.

Although clean energy resources have been around for quite a lot of time, there hasn’t been a wide adoption because of the higher price compared to traditional alternatives. They used to be completely not competitive.

The situation has changed in a very short period of time and the rate of change is exponential. Let’s dig deeper to see some data about wind and solar energy.

Wind Energy

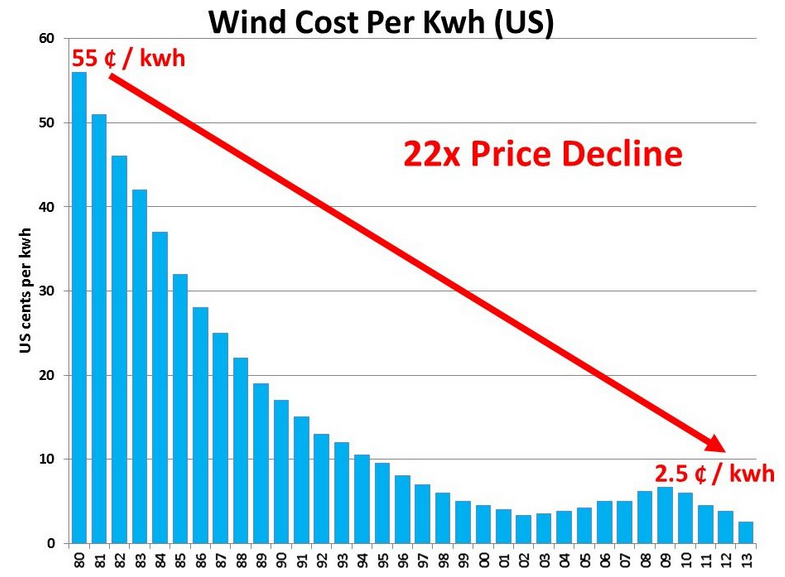

This chart presents the cost of a kWh of energy coming from wind generation according to the annual wind report released by the U.S. Department of Energy.

As you can see, in 1980 the cost of one kWh from wind energy was about 10 times the cost of the same kWh produced by a coal power plant. Today, you can generate wind power for about 2.5 cents/kWh, a 22x price decline in about 30 years!

What is even more important, is that the cost of generating wind power fell below the cost of power generation with coal or gas.

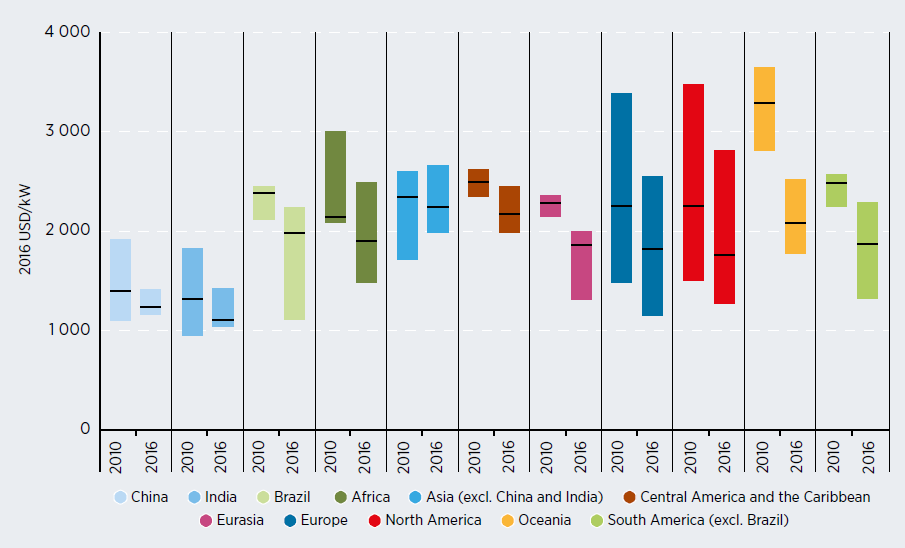

As for the total costs of running the installed onshore wind farms, from 2010–2016 in the following countries, installed costs decreased significantly across all the nine geographical regions covered by the analysis.

Total installed costs ranges and weighted averages for onshore wind farms by country/region, 2010–2016

The costs for offshore wind farms, that is where the wind is stronger and wind projects harvest more energy than onshore wind projects, are declining too. As a result, offshore wind projects are starting to become economic sustainable and therefore is a strong incentive for their development. It’s likely to see a significative increase of offshore wind power in the coming years.

In every country around the world the cost of wind power is plunging, below the price of coal and gas electricity.

Solar Energy

When we look at the trends and the potential of solar power, it makes wind power looks slow and stagnant.

Photovoltaic panels (PV) were invented many years ago but the high costs coupled with low efficiency resulted into a slower adoption rate.

The global PV market has grown rapidly in the last decade and net additions grow year after year.

The progress made with PV is really incredible, it looks like a digital transformation but instead it is applied to a physical asset with costs dropping far more rapidly than expected.

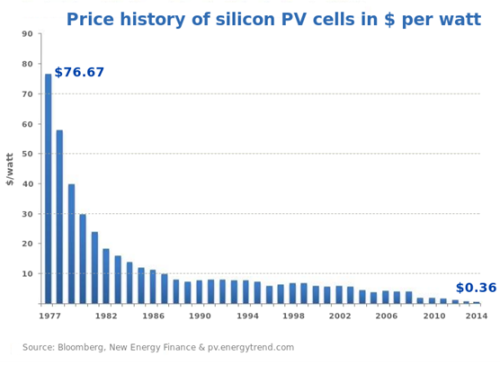

The cost of one watt of solar energy from PV went from $76.67/watt of 1977 to $0.36/watt of 2014, that is a 99% reduction of the cost in 30 years!

This makes solar power the cheapest source of energy you can buy, especially in the sunniest parts of the world.

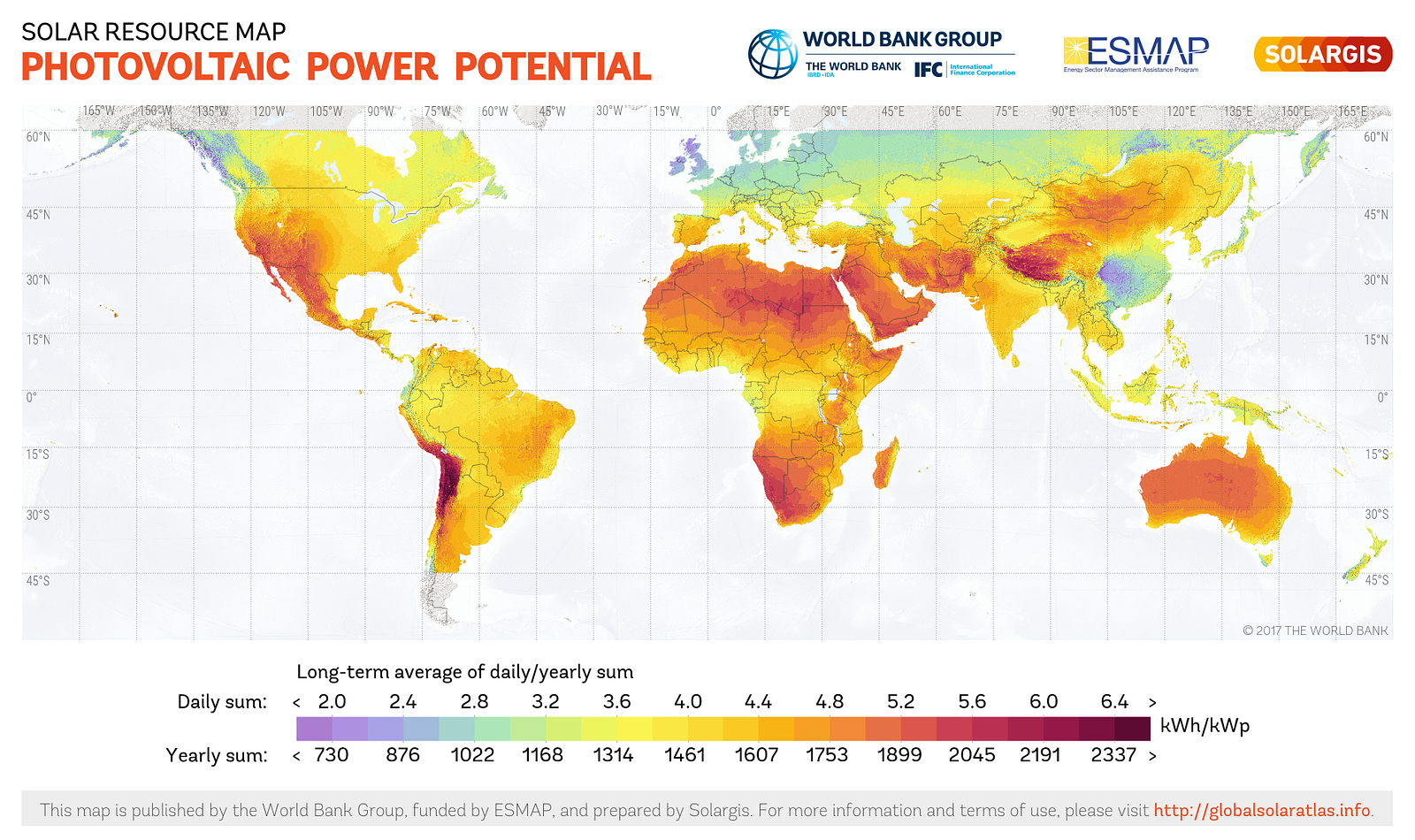

Here is the chart of the photovoltaic electricity potential. As you can see, in a big portion of the world (red/orange) solar will simply be cheaper, it is already cheaper now.

Solar growth has expanded by a factor of 50 in the last decade, showing an exponential growth pattern.

This is disruptive, a new technology that came on the market and went from almost zero to more than 400 GW of power installed in less than 30 years, and that is only a fraction of what is possible today and a smaller fraction of tomorrow potential given the exponential innovation trend.

Conclusions

New forms of energy are long term assets that take years to be developed and be adopted but they are here to stay and transform our approach with energy generation and consumption. Like in the first years of cars, the adoption was slow but as the products improved and the environment became suitable for a wide adoption, they exploded. With renewable energies is kind of the same thing, the only difference is that this time the rate of change is exponential.

As renewables become cheaper and more convenient, coal and gas plants will become non competitive. The CEO of NextEra Energy, a giant US utility company, predicted that by the early 2020s, it will be cheaper to build new renewables plants than continue running existing coal and nuclear plants. That’s something crazy and that is disruption, hundreds of of millions of assets that are no longer economically viable in a matter of three decades.

Renewable energies are becoming the cheapest power we can buy, even in the least sunny places the cost of solar is dropping below the cost of coal and gas energy.

By putting together solar and wind and creating a mix, we could easily be getting most of our electricity from these sources by building continent grids that integrate those.

Disruption in energy generation adds to revolutions in other technologies like storage, electric vehicles and transports. They all show an exponential trend in their development.

Technological progress is really powerful and changes aren’t just a matter of costs, the most intriguing part is about the creation of new business models, that are heading all of us to a really exciting future.