based education platform for elder financial abuse prevention.

1. IDENTIFYING THE AUDIENCE

Some of our initial assumptions surrounding the problem included:

- Most violations are from strangers and scams

- Elder users are resistant to learning new technologies

- Most elders don’t realize it’s happening until it’s too late

In addition, there were unanswered questions that demanded our attention:

- Is the law the same in every state?

- What data exists on the most vulnerable demographics?

- Do financial institutions have protocol for education and prevention?

In order to increase our understanding of the problem, we sought out a number of perspectives on the issue including:

community members / abuse victims / the loved ones of vulnerable elders / and two specialists.

Survey and Street Interviews

Our initial approach was to talk to real people as fast as possible. We sent out surveys to local senior centers and family members, as well as conducted in-person street interviews. Our goal was to gain as much insight as possible into what people know about the issue, and what people’s experiences were.

The data revealed that though many people have heard of financial abuse, they mostly believed it to be a result of phone and email scams. They were also unaware of what could be done to prevent the problem, or what could be done to report it when it did happen. Most people believed that calling their bank or credit union was the fastest course of resolve.

Contextual Inquiry

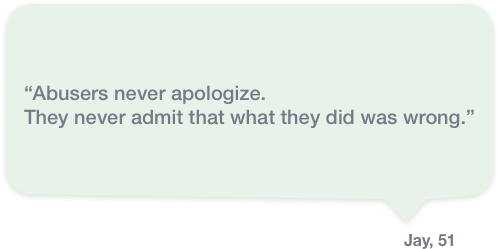

One of the most enlightening interviews we conducted was with a man whose mother had been exploited by his two sisters. This interview revealed valuable insight into the emotional context of financial abuse, the process of reporting, and the less-than-satisfying opportunities for legal support and resolution. Our key takeaways included:

- When parents are victimized by their children, there is often too much shame and guilt for the victim to be willing to admit the problem to themselves, much less to their friends or authorities

- The absence of early and sound financial plans for things like retirement, property management, and Power of Attorney are huge risk facts

- The absence of boundaries in family relationships provides easy access to abusers

Expert Interviews

Our team had the unique opportunity to interview two experts in the field: the Utah Adult Protective Services (APS) Information Specialist for elder financial abuse, and the Utah APS Auditor. These interviews revealed even more data to consider in our solution:

- Legislation differs from state-to-state and only certain areas give specialized attention to exploitation as a form of elder abuse

- The biggest risk factors for the elderly are:

isolation (emotional and physical) / the abuse of Power of Attorney / and generational beliefs that value trust above data

- Most direct reports come from banks

- The elderly are more likely to report scam exploitation than loved-one exploitation, though the latter is much more common

- Large percentages of the reporting come from concerned family members and are often tied up in family feuds

2. DEFINING THE USER’S NEEDS AND GOALS

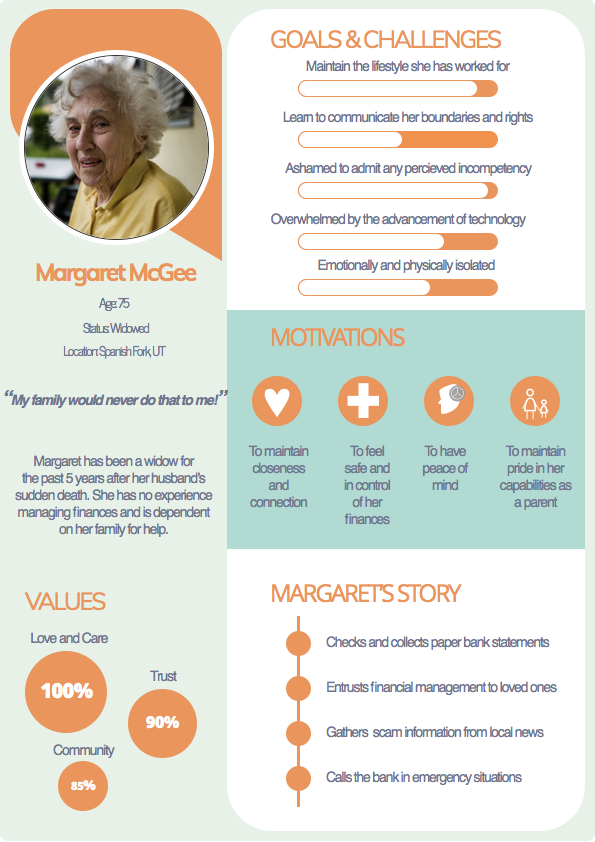

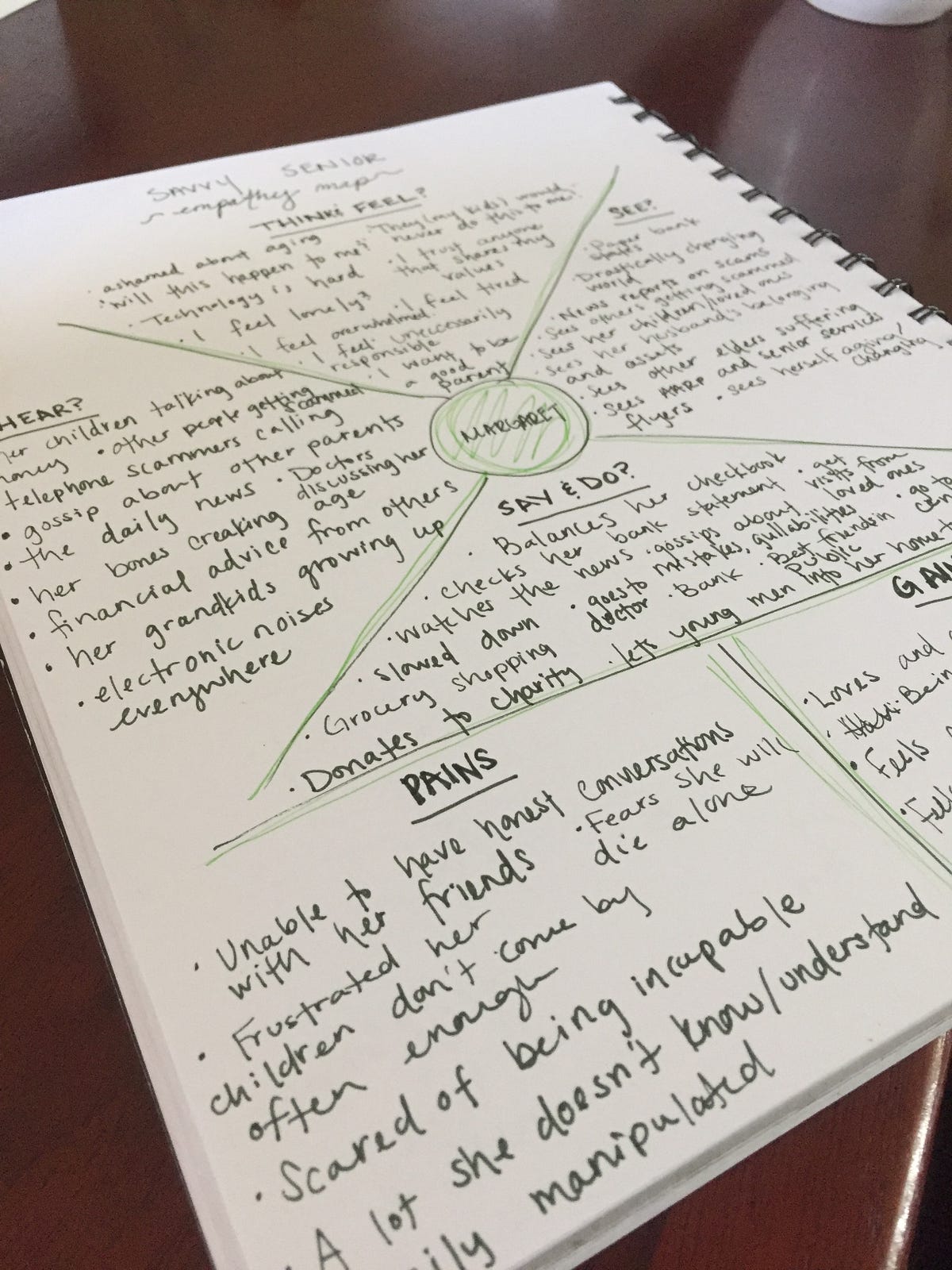

Meet Margaret

These findings helped us create a Primary Persona that aided us in making the best decisions throughout the project. Margaret represents the collective data from all of our interviews. When we were uncertain of the best course of action, we referred to Margaret’s goals and motivations to the most informed decision possible.

Through the evaluation of user data, the team was able to successfully identify the largest pain points for Margaret:

the overwhelming advancement of technology /

her own perceived incompetency /

loneliness /

and fear of being taken advantage of.

The next step was to decide how to meet these goals within the scope of our project.